By Odunewu Segun

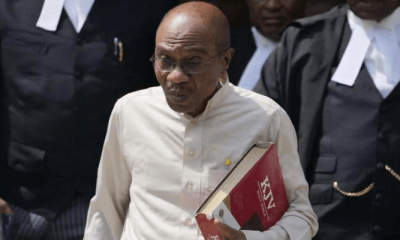

The Governor of the Central Bank of Nigeria, Godwin Emefiele has defended the apex bank’s forex policy, arguing that policies were made in the best interest of Nigerians.

Emefiele disclosed this recently at the Annual Media Trust Dialogue with the theme “Beyond Recession: Towards a Resilient Economy, in Abuja.

While reacting to comments from panelists at the dialogue, Emefiele said the forex policy was meant to stimulate the economy at a time of acute scarcity, adding that the country found itself in the present situation due to lack of appropriate commitment to economic diversification.

He counselled critics of the CBN and government policies that “priority will be given to Nigerian masses by managing the limited resources to provide for industrial raw materials, plants and equipment and agricultural inputs in order to create employment and generate wealth.

Adeosun lamented that the previous administrations missed the opportunity of investing massively on infrastructure, which she described as the bedrock of economic growth and development, when oil prices were very high.

According to her, with a daily oil production of 2.2 million barrels of oil per day (mbpd) for a population of about 180 million people, compared to Saudi Arabia’s 10 mbpd for a 30 million population, Nigeria cannot be described as an oil economy.

She noted that the present administration was desirous of navigating the country out of past mistakes and launch it into a sustainable economic growth, anchored on massive infrastructure.

At the parley were other prominent Nigerians, including the Speaker of House of Representatives, Hon. Yakubu Dogara; Minister of Finance, Mrs. Kemi Adeosun; a former minister of Petroleum Resources, Chief Philip Asiodu; and the Chairman, Standard/IBTC, Mr. Atedo Peterside, who all proffered solutions to the nation’s biting economic hardship.

Meanwhile, the Naira at the weekend remained indifferent to the sale of over 250 million dollars to licensed Bureau De Change (BDC) operators nationwide as it suffered another loss against the dollar.

The Naira inched against the dollar at the early hours of Thursday morning by 2 points but could not sustain the gain as it shed 3 points to close at N498 to a dollar at the open market.

The Pound Sterling and the Euro traded at N596 and N520, respectively, at the open market.

At the BDC window, the Naira exchanged at N399 to a dollar, CBN controlled rate, while the Pound Sterling and the Euro closed at N599 and N522, respectively.

Trading at the interbank market saw the Naira weakening further as it closed at N305.50, from the N305.25 it recorded on Wednesday.

The naira lost a third of its official value against the dollar in 2016 after the bank scrapped a peg in a bid to alleviate dollar shortages.

On the black market, the naira is worth about 40 per cent less than the official rate. It closed at N490 to the dollar.

Football2 days ago

Football2 days ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Education1 week ago

Education1 week ago

Crime1 week ago

Crime1 week ago

Covid-191 week ago

Covid-191 week ago

Latest6 days ago

Latest6 days ago

Business1 week ago

Business1 week ago