By Odunewu Segun

As a result of the implementation of the new automotive policy, new car imports have dropped from the 45,618 recorded in 2014 to about 15,031 by December, 2015.

While speaking at a media parley with motoring correspondents to mark the end of the year, Mr. Andrew Ajuyah, Marketing Manager of Toyota Nigeria Limited revealed these statistics.

Ajuyah said that the Nigerian auto industry was most hit in 2015 with the downturn in the economy occasioned by the consistent reduction the prices of crude oil.

According to him, some major auto dealers imported more vehicles in 2013 to beat the window of opportunity given by the new automotive policy before tariffs on imported fully built cars were hiked.

Under the new regime, vehicle importers who hitherto paid 20 percent duty will henceforth pay 70 percent duty. The tariff, which is an offshoot of the new automotive policy, clearly explains that fully built cars (ready to drive) now attract duty of 35 percent and levy of another 35 percent of the cost of the vehicle bringing the total tariff to 70 percent.

The new policy also puts the age ceiling for private vehicles at 10 and commercial ones at 15.

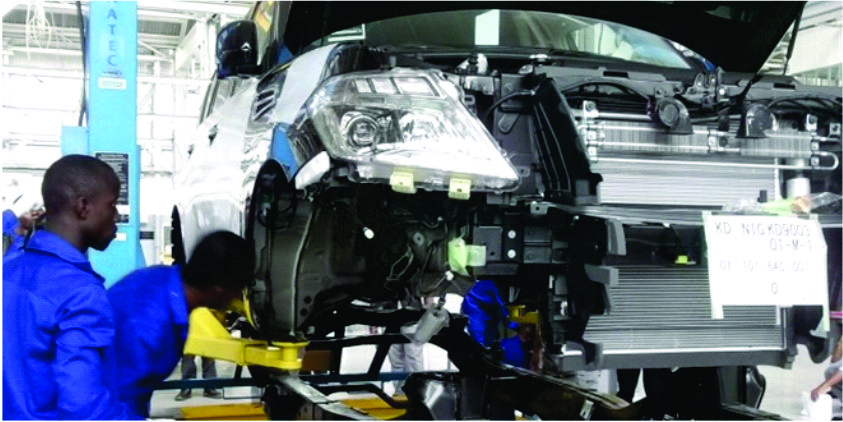

Ajuyah said out of the 15,031 vehicles imported so far in 2015, Toyota alone accounted for 7,000. Speaking further, he said Toyota Nigeria Limited has already got a commitment for the establishment of a local assembly plant in Nigeria from Toyota Motor Corporation, and that plans were already in top gear to build an international standard plant.

With the President Muhammadu Buhari-led government taking a relatively long time to actually layout its policy direction, operators and other stakeholders in the nation’s economy are left to make their plans based on hunches and hearsay.

The outgone Jonathan administration in an attempt to revamp the auto industry rejigged the policy framework for the sector, which involved adjusting the tariff structure for the importation of used and new cars into the country, while also extending some attractive incentives to operators interested in setting up auto plants to assemble cars locally in the country.

Amid some criticism, mostly from people with stakes in the importation and sales of fully assembled vehicles, the government went ahead to implement the policy and in a short period, the policy has begun to show signs of success.

According to the policy, the tariff for FBU imports outside NAIDP is 35 % duty plus 35% levy for cars and 35% duty for commercial vehicles, import tariff for investors within NAIDP range from 0 to 10% for CKD and SKD assembly operations while concessionary FBU imports within NAIDP would be at 35% duty for cars and 20% duty for commercial vehicles.

Football1 day ago

Football1 day ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Education1 week ago

Education1 week ago

Crime1 week ago

Crime1 week ago

Covid-191 week ago

Covid-191 week ago

Latest5 days ago

Latest5 days ago

Business1 week ago

Business1 week ago