The Central Bank of Nigeria has signed a bilateral currency swap agreement with China worth Renminbi (RMB) 16 billion (about $2.5bn).

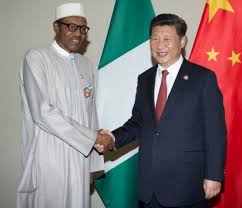

The deal, which has taken two years of negotiation was signed by Godwin Emefiele, the CBN governor, and Yi Gang, Peoples Bank of China (PBoC) governor.

With the agreement, Nigerians doing business with China will no longer have to worry too much about sourcing for dollars as it will provide the Chinese and Nigerian currencies directly to industrialists and other businesses from both countries.

This will reduce the difficulties encountered in the search for third currencies, according to Isaac Okorafor, the CBN spokesman, in a statement shared with National Daily.

“Among other benefits, this agreement will provide naira liquidity to Chinese businesses and provide RMB liquidity to Nigerian businesses respectively, thereby improving the speed, convenience and volume of transactions between the two countries,” he said.

“It will also assist both countries in their foreign exchange reserves management, enhance financial stability and promote broader economic cooperation between the two countries.

He said it will be easier for most Nigerian manufacturers, especially SMEs and cottage industries in manufacturing and export businesses, to import raw materials, spare-parts and simple machinery to undertake their businesses by taking advantage of available RMB liquidity from Nigerian banks without being exposed to the difficulties of seeking other scare foreign currencies.

Okorafor added: “The deal, which is purely an exchange of currencies, will also make it easier for Chinese manufacturers seeking to buy raw materials from Nigeria to obtain enough naira from banks in China to pay for their imports from Nigeria. Indeed, the deal will protect Nigerian business people from the harsh effects of third currency fluctuations.”

Nigeria is the third African country to have such an agreement in place with China.

Football5 days ago

Football5 days ago

Aviation7 days ago

Aviation7 days ago

Aviation6 days ago

Aviation6 days ago

Featured3 days ago

Featured3 days ago

Comments and Issues5 days ago

Comments and Issues5 days ago

Education4 days ago

Education4 days ago

Business4 days ago

Business4 days ago

Featured1 week ago

Featured1 week ago