- CBN forex intervention to hit $4.6bn

By Odunewu Segun

There is uncertainty over direction of cost of funds in the interbank money market this week as short term cost of funds crashed to 4.0 per cent due to inflow of N533 billion comprising N480.0 billion from maturing FGN bonds and N53.0 billion from matured OMO treasury bills which hit the market last week.

As a result, market liquidly rose from minus N151 billion at the beginning of the week to N2447 billion at the close of the week. Reflecting the impact of the inflow interest rate of Colateralised (Open Buy Back, OBB) and overnight lending dropped to 4.0 and 4.75 per cent on Friday from 27.5 per cent and 29.7 per cent the previous week.

This week the market is expected to experience inflow of about N450 billion, comprising N150 billion from matured treasury bills and over N300 billion from statutory allocation fund. Analysts were however divided on how these inflows will impact cost of funds.

According to analysts at Cowry Assets Management Plc, a Lagos based investment firm: “With the net inflow from maturing treasury bills and Federation Accounts Allocation Committee ( FAAC) inflows expected to settle in this week, we expect downward pressure on the interbank rates. Afrinvest analysts however stated: “In the week ahead, we expect debits from successful bids at FX whole sale intervention auctions as well as OMO auctions to drag liquidity.

ALSO SEE: Wema Bank records 68% profit growth, to launch digital banking in May

The CBN will also be conducting a T-bills auction of net N150.6bn but its impact on liquidity is expected to be taped by a scheduled maturity of the same amount. Accordingly, we expect money market lending rates to trend northward from current levels,” they stated.

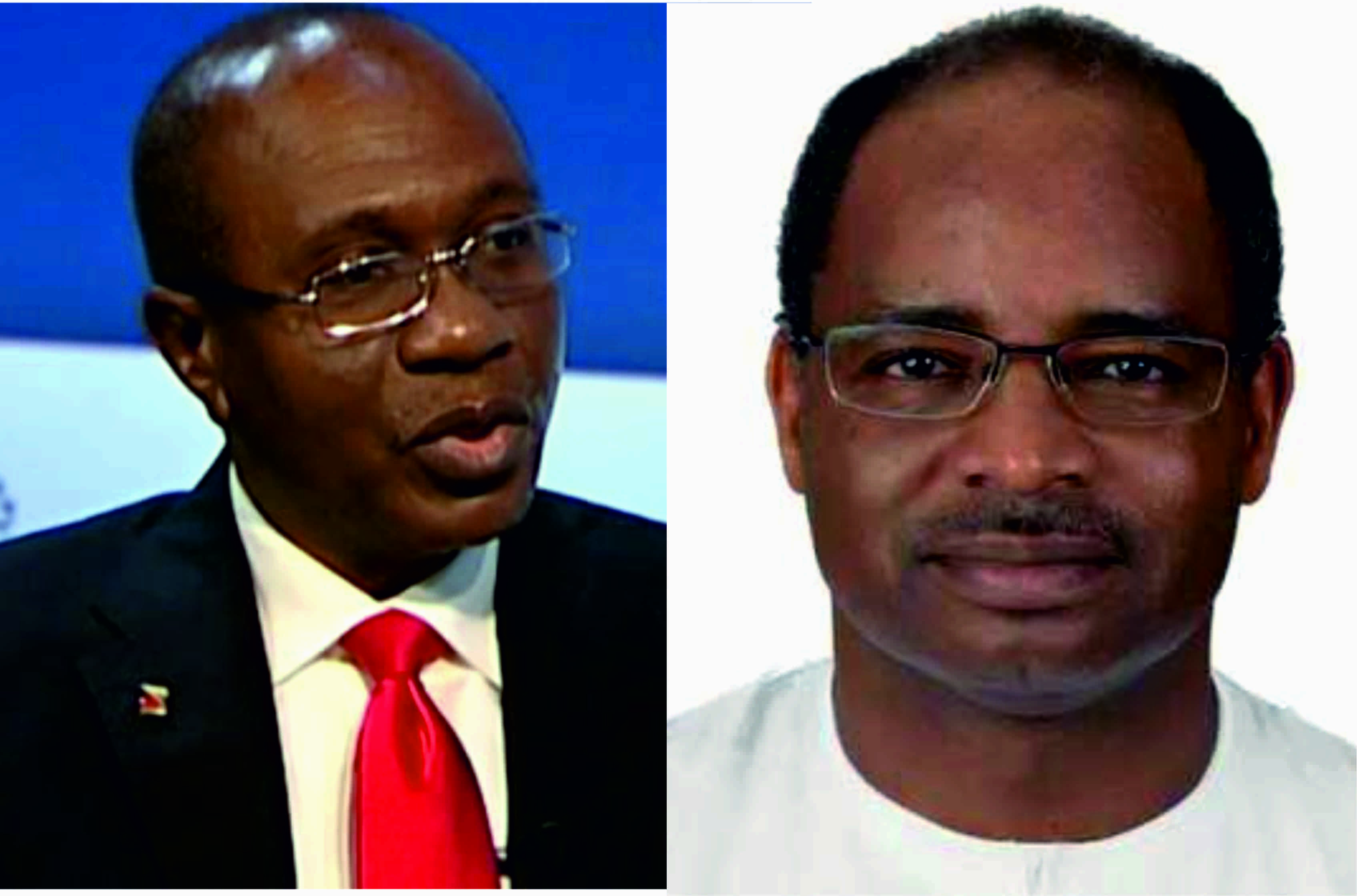

Meanwhile, the intervention of the Central Bank of Nigeria (CBN) in the foreign exchange market will this week rise to $4.6 billion. Since February 22, the CBN had intervened 22 times and sold $4.44bn, translating to an average of $202 billion for each intervention. This trend is expected to continue this week hence increasing the dollar sales to $4.6 billion.

Dealers have clearly noted that price-discovery is indeed happening in the window, with naira offer rate from foreign portfolio investors (FPI) looking to invest in Naira assets trending downward from initial N420 to N410 range at the start of the week to a range of N375 to N395 at Friday close of trade.

Football7 days ago

Football7 days ago

Health & Fitness21 hours ago

Health & Fitness21 hours ago

Aviation1 week ago

Aviation1 week ago

Featured5 days ago

Featured5 days ago

Education6 days ago

Education6 days ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Business6 days ago

Business6 days ago

Education1 week ago

Education1 week ago