Aviation

Naira crash: Foreign airlines now demand dollars for tickets

Published

8 years agoon

By

Olu Emmanuel

…as passengers lament fare hikes

By ISAAC TERSOO AGBER

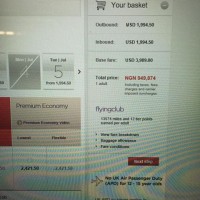

AS the naira goes crashing against the dollar in forex, foreign airlines have decided that all tickets for foreign flights must be sold in dollars, a situation that has caused unreasonable hikes in air fares. Reports have shown that an economy class on a British Airways flight to London now costs between N600,000 and N700,000 against the former rates of N350,000 and N400,000 a year ago. This represents a huge increase of over 120 per cent.

Investigation has shown that airfares for international routes are now increased by 100 per cent while some foreign airlines like Delta, United and others, do not accept the naira as passengers, both inbound and outbound, are made to pay with a dollar-paying debit card or the ticket will not be processed.

National Daily also gathered from investigation on major Nigerian routes flown by foreign airlines in the country that the cost of return tickets had been increased by between 80 per cent and 120 per cent against the previous fares, depending on the carrier, time of booking and the season.

The routes examined in the course of investigation were Nigeria-North America, Nigeria-South Africa and Nigeria-Europe routes. Also, airfares on the Lagos-London, Abuja-London, Lagos-New York, Lagos-Atlanta, Lagos-Houston, and Lagos-Johannesburg routes were equally examined.

Findings have indicated that an economic ticket on Air France for the Lagos/Abuja-London routes now goes for over N600,000, while Lufthansa charges little above N680,000. These represent an increase of 80 per cent and 90 per cent, respectively, when compared with an average fare of N300,000 on the routes a year ago.

Findings have indicated that an economic ticket on Air France for the Lagos/Abuja-London routes now goes for over N600,000, while Lufthansa charges little above N680,000. These represent an increase of 80 per cent and 90 per cent, respectively, when compared with an average fare of N300,000 on the routes a year ago.

Meanwhile, a business class ticket now goes for as high as N3m as against the N1.5m a year ago on the Lagos-London route.

ALSO SEE: MMA2 gets the nod of aviation ministry for regional operations

On the Lagos-Atlanta and Lagos-Houston routes, Delta Airlines and United Airlines, which used to fly Economy Class passengers for between N270,000 and N330,000 some 12 months ago, now render the same service at an average fare of N600,000, depending on the time of booking. This represents an increase of about 100 per cent.

South Africa Airways and Arik Air, which used to fly the Lagos-Johannesburg routes for between N100,000 and N120,000 for the economy class, now fly the route for between N180,000 and N220,000, depending on the time of booking and the season.

The Lagos-Paris route, which used to go for N180,000 on the average, now goes for around N400,000. This represents an increase of 120 per cent.

Operators link the increment in fares to the scarcity of foreign exchange to attend to the operational needs of the carriers and the erosion in the value of the ticket sales proceeds, which are now stuck in banks due to lack of forex to repatriate the funds.

Late last year, the new administration of President Muhammadu Buhari had unveiled a fiscal policy, through the Central Bank of Nigeria, restricting access to foreign exchange and funds transfer out of the country.

While this has had advantages on some sectors of the economy, foreign airline operators have complained of their inability to repatriate revenue to their operational bases as a result of the new policy.

An official of one the airlines told National Daily that the carrier had close to N90bn as accumulated earnings in banks, which it had been unable to repatriate. He said that the airline industry relied heavily on cash to meet its commitments, adding that it was sad that the government was not seeing things this way.

With huge airline revenue in the vaults of the banks, some of the operators are nursing fears of being exposed to risks should the pressure on the naira lead to the devaluation of the currency, which could erode the value of the funds by about 35 per cent to 45 per cent.

Following the difficulty in repatriating earnings from Nigeria, some of the airlines initially began restricting cheap fares on the Nigerian routes in the last quarter of 2015, leading to an indirect hike in fares.

At the time, the effect was felt more on second tier routes from Lagos-London-Atlanta, Lagos-London-New York, Lagos-London-Miami, Lagos-London-São Paulo, Lagos-London-Houston; or Lagos-Frankfurt-New York, Lagos-Frankfurt-Chicago, Lagos-Frankfurt-Los Angeles, and Lagos-Frankfurt-Shanghai.

Citing Nigeria’s slowing economy amid forex scarcity, some international airlines are now contemplating reducing flights to the country or operating smaller capacity aircraft as a short-term measure.

Virgin Atlantic and Iberia are already on the verge of pulling out of the country, giving reasons that the route is no longer benefitting them commercially.

However, following complaints by the airlines, representatives of the International Air Transport Association, reportedly, pleaded with the CBN Governor, Godwin Emefiele, to intervene in the matter and make dollars available to them. They also involved the Minister of Transport, Chibuike Amaechi, to exert his influence on the issue.

But the move hasn’t yielded any positive results yet. A spokesperson for one of the airlines noted that the difficulty in repatriating revenues was affecting aircraft leases and fuelling, stating that the earnings were partly being used for fuel and renewing aircraft leases.

ALSO SEE: FG determined to deal with safety, security issues in aviation – Sirika

While the situation persists, the effect on air travellers and other businesses that depend so much on air travel has been overwhelming. A manager with a transport and logistic company, Mr. Emmanuel Iruobe, was quoted recently saying the company had incurred more costs than were provided for in the execution of most contracts this year.

Iruobe urged the government to look into the situation with a view to resolving the situation in the interest of Nigerians and many other prospective investors eying Nigeria.

The situation also infuriated some stakeholders in the travel industry under the aegis of the National Association of Nigeria Travel Agencies (NANTA). They faulted the astronomical cost of air tickets by the airlines, especially the foreign carriers in their most recent chats with aviation correspondents, vehemently expressing their plight.

The group had petitioned the Federal Government, through the Ministry of Aviation, to caution the foreign airlines over the alleged sharp practices, describing the situation where taxes that go to the airlines are higher than base fares as unacceptable.

Meanwhile, spokesman of the Nigerian Civil Aviation Authority, Mr. Sam Adurogboye, told National Daily that some reports about airfare hikes have no basis to prompt any action against the airlines. He insisted that if the NCAA is privy to any credible information of distrust or actual evidence of hike against any airline, it would take it up without delay, adding that passengers were in position to report to the agency with valid information.

ALSO SEE: SAA to introduce all-inclusive travel package to passengers at cheap rates

In his words: “The stories have no basis to prompt any action from us; they are only popping up without verifiable facts. I also saw stories like that in some Nigerian dailies but when we confronted the airlines in question, they denied, saying it was a mere blackmail.

But if any passenger comes to us with convincing evidence of payment that they were made to suffer such experience, we will definitely take it up against the airline,” he said.

On why Virgin and Iberia are prepared to pull out of the country, Adurogboye said their pulling out is not motivated by diplomatic problems but commercial benefit, as the airlines are in business and wouldn’t want to operate at a loss.

“Virgin and Iberia pulled out sometime ago but came back to re-establish operations. The truth is that they can decide to pull out of any route anytime, especially when they are not making significant commercial value from it. So, I think their decision to pull out now largely depends on what favours them; you know they are in business so they can’t be operating at a loss. There is no diplomatic issue involved in their pulling out, it is basically for their benefit.

You may like

Naira drops at parallel market as forex scarcity persist

Moghalu tackles Buhari over forex directives to CBN

Police advises travelers against using credit card for air tickets

Naira depreciates more, loses N3 against dollar

Experts predict more fall for the naira as it drops to N382/$

Naira depreciates again over inadequate liquidity in forex market

1 Comment

Leave a Reply

Cancel reply

Leave a Reply

Trending

Football7 days ago

Football7 days agoGuardiola advised to take further action against De Bruyne and Haaland after both players ‘abandoned’ crucial game

Health & Fitness1 day ago

Health & Fitness1 day agoMalaria Vaccines in Africa: Pastor Chris Oyakhilome and the BBC Attack

Aviation1 week ago

Aviation1 week agoDubai international airport cancels flights as flood ravages runway, UAE

Featured5 days ago

Featured5 days agoPolice reportedly detain Yahaya Bello’s ADC, other security details

Education6 days ago

Education6 days agoEducation Commissioner monitors ongoing 2024 JAMB UTME in Oyo

Comments and Issues7 days ago

Comments and Issues7 days agoNigeria’s Dropping Oil Production and the Return of Subsidy

Business6 days ago

Business6 days agoMaida, university dons hail Ibietan’s book on cyber politics

Education1 week ago

Education1 week agoOsun NSCDC solicits cooperation towards national assets protection

Pingback: REPOSITIONING NIGERIA AS A GATEWAY FOR SUSTAINABLE INFRASTRUCTURE PROJECT FINANCE IN AFRICA. – Sterling Ellis Africa