Minister of finance, Mrs. Kemi Adeosun has urged to make sure it meets the over N4.957 trillion tax revenue for 2016.

Adeosun gave the advice during the 2016 Annual Corporate Strategy Retreat of the FIRS. “There is really no room for failure. The nation will depend on FIRS to fund the budget. We need the money to stabilise the economy.

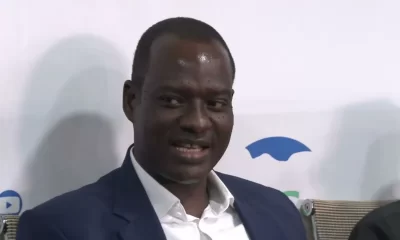

She acknowledged the strides the FIRS made in the past and the successes it had attained since its new Chairman, Tunde Fowler resumed, she said, “I know your chairman as an achiever. He did very well in Lagos. Work with him. He will do well here. He is one person who has the welfare of staff on his mind.”

Total E&P urge Port Harcourt chamber of commerce to invest in Egi clay project

When the retreat opened on Tuesday, FIRS Executive Chairman, Tunde Fowler announced FIRS 2016 target of N4.957 trillion. He said the tax agency hopes to earn N3.87 trillion from Value Added Tax, VAT and Companies Income Tax, CITS this year.

The N3.87 trillion from VAT and CIT will be 78.42 per cent of the N4.957 trillion tax revenue targeted for 2016.

“The above target is clearly unacceptable and not a reflection of our capacity. I am particularly not pleased with the very poor VAT collection, which based on my previous experience at the state level in the administration of a tax similar to VAT, should be a high yield and easy to collect tax.

FIRS, he said, was collaborating with State Governments, tax consultants, major audit firms, stakeholders in the federal system, including the National Assembly.

He said the tax agency was undertaking a nationwide Value Added Tax and Witholding Tax Monitoring exercise and nationwide taxpayer registration exercise anchored by the FIRS Federal Engagement and Enlightenment Tax Teams, (FEETT).

At Tuesday’s event, Minister of Budget and National Planning, Mr Udoma Udo Udoma, Minister of the Federal Capital Territory, FCT, Muhammed Musa Bello, Accountant General of the Federation, Ahmed Idris, Chairman Senate Committee on Finance, Senator John Owan Enoh and Deputy House Committee on Finance Hon. Austin Chukwurah emphasised the primal role FIRS will play in providing revenue towards realising Federal Governments’ plan for 2016.

Representatives of key accounting and tax audit firms: KPMG, Ernest Young, Akintola Williams and Delloite, PEDABO, FITC Consulting, PriceWaterHouse Cooper suggested how FIRS could be innovative, increase tax yield, expand tax base and encourage taxpayers to pay their taxes happily.

Health5 days ago

Health5 days ago

Entertainment7 days ago

Entertainment7 days ago

Crime6 days ago

Crime6 days ago

Education1 week ago

Education1 week ago

Health1 week ago

Health1 week ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Football7 days ago

Football7 days ago

Latest6 days ago

Latest6 days ago