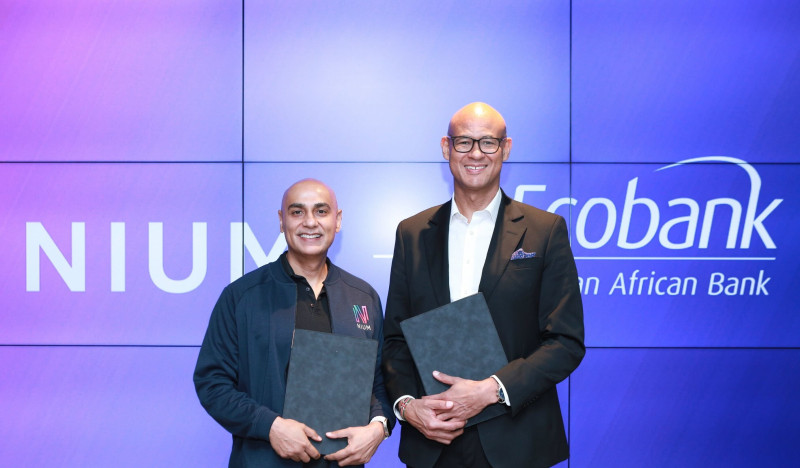

Nium, a global leader in payments technology, has announced a strategic partnership with Ecobank Transnational Incorporated to enhance cross-border payment services for over 32 million customers in 35 African countries.

This collaboration aims to modernize the region’s payment landscape by enabling faster, more efficient international transactions for both businesses and individual consumers.

Under this agreement, Nium will integrate its cutting-edge real-time payments infrastructure into Ecobank’s existing banking systems. This move is expected to significantly boost Ecobank’s service offerings, particularly for small and medium-sized enterprises (SMEs)—a critical segment of Africa’s economic framework.

The partnership will seamlessly link Ecobank’s current SWIFT workflows to Nium’s platform, ensuring real-time transfer capabilities and payment tracking without the complexities of additional API integrations.

Jeremy Awori, CEO of Ecobank Group, emphasized the transformative nature of the alliance. “Partnering with Nium allows us to enhance our service offerings and provide our customers with faster, more efficient cross-border payment solutions.

By leveraging our unique API-based payment platform, this collaboration is a significant step towards advancing financial inclusion and connectivity across Africa and enabling businesses to thrive in a global marketplace,” he stated.

READ ALSO: Lawyer criticizes CBN over dismissal of petition against Ecobank, demands retraction

Through this integration, Ecobank customers will experience greatly reduced waiting times for international payments, a significant improvement over traditional cross-border processes.

Businesses and consumers alike will benefit from faster payment clearances, real-time tracking, and streamlined settlements to over 220 markets, spanning more than 100 countries. This development is set to enhance the overall efficiency of financial transactions within the region.

Anupam Pahuja, General Manager and Executive Vice President for APAC, Middle East, and Africa at Nium, echoed this sentiment, noting the strategic value of the partnership.

“We are thrilled to partner with Ecobank and introduce Nium’s cutting-edge real-time payment capabilities to Africa. This collaboration represents an important step forward in expanding our global payments network, and we are proud to support Ecobank in delivering faster, more efficient payments for its customers across the region.”

The implications of this partnership are far-reaching, particularly for SMEs that often face delays and high costs in cross-border transactions.

By leveraging Nium’s robust payment technology and Ecobank’s extensive network, the partnership is expected to lower transaction costs, enhance liquidity, and foster greater economic integration both within Africa and on a global scale.

Dr. David Olaniran, a financial analyst specializing in African markets, called the partnership a pivotal moment for the continent’s financial ecosystem. “The integration of real-time payment systems into Africa’s banking infrastructure is long overdue.

This partnership will reduce transaction costs, enhance liquidity, and improve the competitiveness of SMEs, enabling them to access markets and resources previously out of reach. It’s a game-changer for the African business ecosystem,” he remarked.

This collaboration between Nium and Ecobank represents a significant leap forward in addressing the inefficiencies of cross-border payment systems in Africa.

By streamlining and expediting financial transactions, the partnership is poised to unlock new opportunities, drive economic growth, and strengthen Africa’s position in the global marketplace.

Latest1 week ago

Latest1 week ago

News1 week ago

News1 week ago

Business6 days ago

Business6 days ago

Business1 week ago

Business1 week ago

Latest1 week ago

Latest1 week ago

Education1 week ago

Education1 week ago

Business6 days ago

Business6 days ago

Football1 week ago

Football1 week ago