Africa’s richest man, Aliko Dangote is reportedly considering counter-offers for PPC Group Ltd. that could signal a bidding contest for South Africa’s largest cement maker.

Dangote Cement Plc sees a bid for the Johannesburg-based company as a way to accelerate expansion outside its home market of Nigeria, said the people, who asked not to be named as the matter is private.

Although Spokespeople for Dangote, LafargeHolcim, HeidelbergCement, Titan, Fairfax and PPC declined to comment, PPC will consider any rival offers to the joint approach by Canada’s Fairfax Financial Holdings Ltd. and domestic rival AfriSam Group Pty Ltd. and present them to shareholders in early October, one of the people said.

The future ownership of PPC is up for grabs after merger talks with AfriSam failed for a second time last month following two-and-a-half years of on-off negotiations. Both companies have been struggling with high debt levels, which Fairfax offered to resolve with its unexpected entrance to the saga this week.

LafargeHolcim Ltd., the world’s biggest cement maker based in Jona, Switzerland, and Germany’s HeidelbergCement AG are also monitoring PPC’s situation, the people said. Titan Cement Co. SA of Greece is also looking at the South African company, according to one of the people.

The cement makers’ interest was sparked after Toronto-based Fairfax offered to buy 2 billion rand of PPC’s shares and support a merger with AfriSam earlier this week, the people said. The proposal “significantly undervalued” the business, PPC said at the time.

The Toronto-based company said it would recapitalize AfriSam, enabling it to settle outstanding loans, and buy 2 billion rand worth of PPC shares at 5.75 rand each.

The Public Investment Corp., the biggest shareholder in both PPC and AfriSam, would prefer a higher cash component of more than 6 rand a share, the people said, adding that Fairfax hasn’t ruled out increasing its offer.

ALSO SEE: FG to end gas flaring soon – Presidential aide

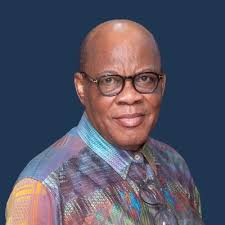

Aliko Dangote, who has interests in sugar, flour and packaged food businesses as well as cement, has a net worth of $11.4 billion, according to the Bloomberg Billionaires Index.

Dangote would be open to a sale of all or part of its cement operations in Pretoria-based Sephaku Holdings Ltd. unit to win regulatory approval for a takeover, two of the people said.

Separately, PPC said it had reduced capital expenditure targets for fiscal years 2018 and 2019. The company sees spending of as much as 900 million rand in year through March 2018, rising to as much as 1 billion rand the following year, PPC said in a presentation to investors on Friday. The cement maker also said debt would probably fall in the current year.

PPC shares jumped 2.9 per cent to 6.38 rand as of 3:30 p.m. in Johannesburg, on track for the highest on a closing basis since April 25. That values the company at 10.2 billion rand ($792 million).

Health5 days ago

Health5 days ago

Entertainment7 days ago

Entertainment7 days ago

Crime6 days ago

Crime6 days ago

Education1 week ago

Education1 week ago

Health1 week ago

Health1 week ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Football7 days ago

Football7 days ago

Latest6 days ago

Latest6 days ago