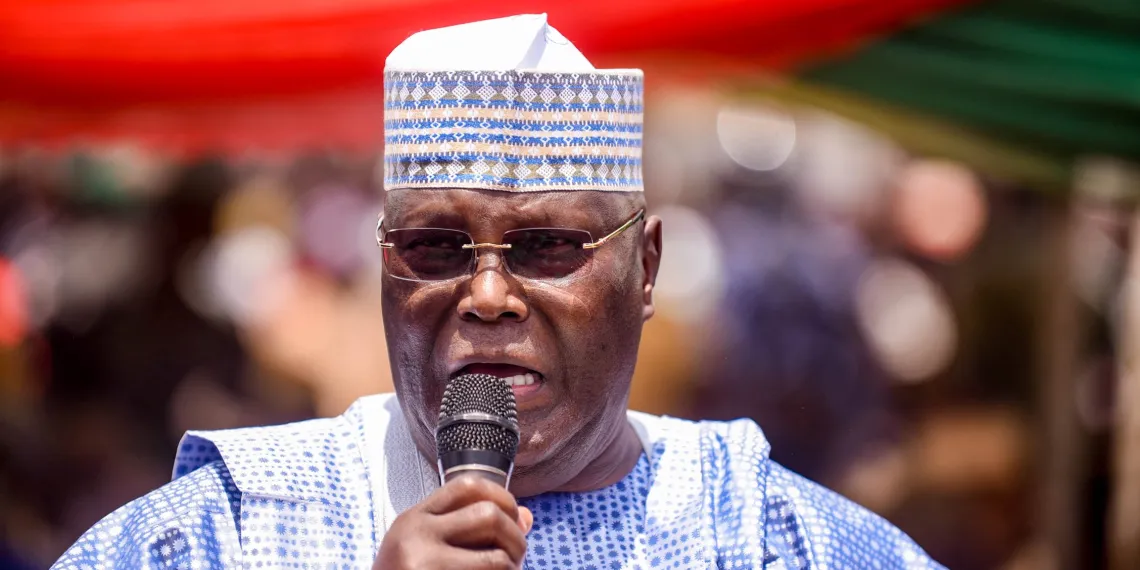

Former Vice President Atiku Abubakar has called for a fresh legislative consideration of the tax reform laws introduced by the administration of President Bola Ahmed Tinubu, warning that the current controversy surrounding the laws poses a serious constitutional challenge.

In a statement issued on Sunday night, Atiku said a new round of legislative action is the only lawful option following the Senate’s confirmation that the gazetted version of the Nigerian Tax Act does not fully reflect what was duly passed by the National Assembly.

His call comes amid plans by the Federal Government to commence the implementation of the remaining tax reform laws from January 1, 2026.

According to Atiku, the discrepancies between the versions passed by lawmakers and those gazetted cannot be resolved through administrative shortcuts or a hurried re-gazetting process.

He stressed that any law published in a form that was never approved by the National Assembly is legally invalid.

Citing Section 58 of the 1999 Constitution, Atiku explained that the lawmaking process requires passage by both chambers of the National Assembly, presidential assent, and only then gazetting.

He emphasised that gazetting is a purely administrative act and does not possess the power to amend, validate, or correct a defective law.

The former Vice President argued that any insertion, deletion, or modification made after passage without legislative approval amounts to forgery rather than a clerical error.

“The only lawful path is fresh legislative consideration, re-passage in identical form by both chambers, fresh presidential assent, and proper gazetting,” Atiku said.

READ ALSO: NBA, Atiku urge FG to halt tax reform laws amid allegations of post-passage alterations

He criticised reported attempts to fast-track a re-gazetting of the tax laws while investigations by the National Assembly into the alleged alterations are still ongoing.

According to him, such an approach undermines parliamentary oversight and sets a dangerous constitutional precedent.

Atiku further warned that illegality cannot be cured by speed or administrative directives from the leadership of the National Assembly.

He maintained that neither the Senate President, Godswill Akpabio, nor the Speaker of the House of Representatives, Tajudeen Abbas, has the authority to validate laws that were not properly passed by lawmakers.

The controversy erupted after members of the House of Representatives alleged that the gazetted versions of some tax reform laws differed from those approved by the National Assembly. The affected legislations include the Nigerian Tax Act and the Nigerian Tax Administration Act, both scheduled to take effect from January 1, 2026.

Following its own investigations, the Senate confirmed that discrepancies exist between what legislators approved and what was eventually gazetted, lending credibility to the concerns raised by the House.

The confirmation has since intensified calls for corrective legislative action.

The Tinubu administration’s tax reforms form a central pillar of its economic agenda, aimed at easing the tax burden on low-income earners and small businesses while boosting long-term government revenue through economic growth and improved compliance.

However, Atiku warned that unresolved constitutional flaws could expose the laws to legal challenges and delay their implementation.

He noted that undertaking fresh legislative consideration could help restore confidence in the reform process, protect the rule of law, and minimise the risk of protracted court battles—though it would likely require a postponement of the January 2026 implementation date.

So far, four tax reform laws have been enacted under the Tinubu administration. Two came into effect in June 2025, while the remaining two are scheduled to commence in January 2026.

Health5 days ago

Health5 days ago

Entertainment7 days ago

Entertainment7 days ago

Crime6 days ago

Crime6 days ago

Education1 week ago

Education1 week ago

Health1 week ago

Health1 week ago

Comments and Issues7 days ago

Comments and Issues7 days ago

Football7 days ago

Football7 days ago

Latest6 days ago

Latest6 days ago