Business

Before CBN Dabbles into Agric Murky Waters Again…

Published

2 years agoon

By

Marcel Okeke

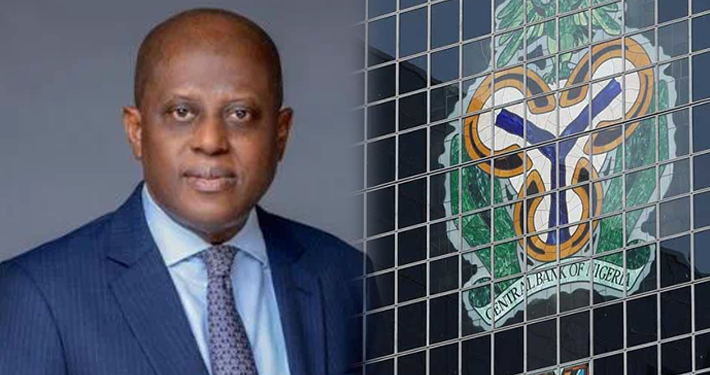

In what could be seen as an outright volte-face, the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, on Wednesday, March 13, 2024, doled out a whooping N100 billion (worth of fertilizer) to the Federal Ministry of Agriculture and Food Security (FMAFS) “to boost food production across the country.” Over the years, the apex bank had been muddied in its efforts at trying to improve agricultural productivity across the country through a variety of (funding) interventions. Till date, huge sums are yet to be retrieved by the CBN from numerous beneficiaries of those intervention (concessionary) facilities. Indeed, the outstanding repayment is yet in trillions of Naira.

While making the latest donation to the FMAFS at Abuja, Cardoso explained that while the CBN had been implementing several initiatives to curb inflation in the short term, the inflationary pressure had remained predominantly driven by escalating food prices. Cardoso pointed out that while transient inflationary pressure might persist, the government anticipates substantial alleviation by the third quarter of 2024. “This is precisely why we convene today to strengthen our collaboration with the Ministry of Agriculture with a shared objective of mitigating the surge in food prices,” Cardoso said.

Further explaining his food-inflation-fighting gambit, the CBN boss said “in alignment with our strategic shift towards focusing on our fundamental mandate, the CBN has veered away from direct quasi-fiscal interventions, and transitioned towards leveraging conventional monetary policy tools for executing monetary policies.” Truly, the apex bank has had its fingers burnt in spreading its attention and resources too thinly across practically all sectors of the Nigerian economy. In November 2023, during the Bankers’ Dinner organized by the Chartered Institute of Bankers of Nigeria (CIBN), Cardoso had thoroughly excoriated the erstwhile leadership of the apex bank for this ‘adventure.’

Cardoso said at the Dinner “Hitherto, the CBN had strayed from its core mandates and was engaged in quasi-fiscal activities that pumped over 10 trillion naira in the economy through almost different initiatives in sectors ranging from agriculture, aviation, power, youth and many others.” These initiatives, he said “clearly distracted the Bank from achieving its own objectives and took it into areas where it clearly had limited expertise.” It therefore looked odd and cause for worry, when the CBN boss, Cardoso, had to once again, veer off track (as it were) to hand over the sum of N100 billion to the FMAFS—in a manner reminiscent of the activities of the CBN of recent years.

Today, Nigeria’s agricultural sector is facing a daunting challenge as farmers and agricultural firms grapple with repaying a staggering sum of N380.97 billion in loans provided by the CBN under motely intervention programs. The due amount comprises both unpaid principal and accumulated interest, according to reports from the apex bank. This outstanding indebtedness amply show the hurdles being encountered by the CBN in recovering funds it disbursed to stimulate agricultural productivity and enhance food security. The apex bank had injected an estimated N2.07 trillion into agricultural development through eight targeted loan programs, with a huge chunk of this sum yet unrepaid, raising concerns about the sustainability of these interventions in bolstering the nation’s economy.

In the agricultural sector alone, among the eight intervention schemes of CBN were the Accelerated Agricultural Development Scheme (AADS), Anchor Borrowers’ Program (ABP), Commercial Agricultural Credit Scheme (CACS), Maize Aggregation Scheme (MAS), National Food Security Program (NFSP), Paddy Aggregation Scheme (PAS) and Rice Distribution Facility (RDF). In all these, while almost all have had substantial disbursements and some repayments, most are facing considerable outstanding balances and repayment arrears.

Specifically, the ABP with a disbursement reportedly exceeding N1.12 trillion is yet harboring an outstanding principal balance of N581.87 billion and due repayments totaling N367.06 billion. Similarly, the CACS is said to still have an outstanding principal of N115.26 billion, while the NFSP has an outstanding principal of N32.27 billion. In the face of all these, Mr. Cardoso while doling out the N100 billion (or the fertilizer equivalent), claimed he was (indirectly) fighting the runaway inflationary pressure that has seen the Consumer Price Index (CPI) standing at 31.70 per cent in February 2024.

It becomes apposite, however, to ask: what is the overarching agricultural development blueprint of the FMAFS that the apex bank is keying into through the ‘fertilizer donation?’ Even if the ‘fertilizer donation’ is an agenda of the erstwhile leadership of the CBN, must it be carried through in the current circumstances? Has the apex bank not been ‘over exposed’ by virtue of its countless interventions in recent years in the Nigerian economy? Indeed, there is little or no nexus between ‘fertilizer donation’ to the FMAFS and the quest to tame soaring inflation.

In point of fact, the CBN under the leadership of Olayemi Cardoso had either cancelled and/or adapted a number of programs and initiatives it inherited from their predecessors. Therefore, the excuse is lame that the ‘fertilizer donation’ is a carryover from the past regime; it is by no means compulsory for the CBN to keep engaging in frivolous donations or quasi-fiscal engagements that add no value to national life.

Without any known agriculture plan of the FMAFS, who and where are the farmers that stand to benefit from the CBN’s dole? It is on record that a large number of the beneficiaries of the ABP, for instance, have been chased out of their farms in their hamlets and villages. Today, most of them live in the internally displaced persons (IDPs) camps across the country. This situation is more widespread in the states and regions normally referred as the ‘food basket’ of the country. The ever worsening spate of banditry, kidnapping for ransom, insurgency, Boko Haram invasion, among other social upheavals are existential threats to farming and farmers across the land. In recent years, not a few farmers have paid the supreme price for venturing to be in their farms.

All these tend to put a serious question mark over the CBN’s support to largely unknown plan of the FMAFS for improved food production in Nigeria. Truly, for the apex bank, it is a very circuitous and windy process of ‘fighting inflation.’ It is like the CBN has come to its wits end, by practically licking its vomit to now keep committing resources to things that ‘distract’ it.

As it, the CBN should have cancelled the N100 billion (or fertilizer equivalent) support to the FMAFS, an obligation it claimed to have inherited. By its seeming volte-face in making the donation, the CBN could unwittingly be creating the perception that it is still tied to the ‘ugly past.’ It should be better focused in tackling Nigeria’s subsisting economic challenges and do everything possible to avoid dabbling, once again, into the murky waters of (in)direct agriculture financing.

- The author, Okeke, a practising Economist, Business Strategist, Sustainability expert and ex-Chief Economist of Zenith Bank Plc, lives in Lekki, Lagos. He can be reached via: [email protected]

Trending

Health5 days ago

Health5 days agoDeclassified CIA memo explored concealing mind-control drugs in vaccines

Entertainment7 days ago

Entertainment7 days agoSimi addresses resurfaced 2012 tweets amid online backlash

Crime6 days ago

Crime6 days agoSenior police officers faces retirement after Disu’s appointment as acting IGP

Education1 week ago

Education1 week agoPeter Obi urges JAMB to address registration challenges ahead of exams

Health1 week ago

Health1 week agoNAFDAC issues alert on suspected revalidated SMA Gold infant formula

Comments and Issues6 days ago

Comments and Issues6 days ago20 Critical Fixes to Save Nigeria’s Democracy from Electoral Fraud

Football7 days ago

Football7 days agoMartínez ruled out of Everton clash with calf injury

Latest6 days ago

Latest6 days agoICPC yet to respond to El-Rufai’s bail request as arraignment date looms