A deputy governor and two directors with the Central Bank of Nigeria have been suspended over what a source described as ‘sophisticated plot’ to defraud the apex bank of huge amounts, finding by National Daily have revealed.

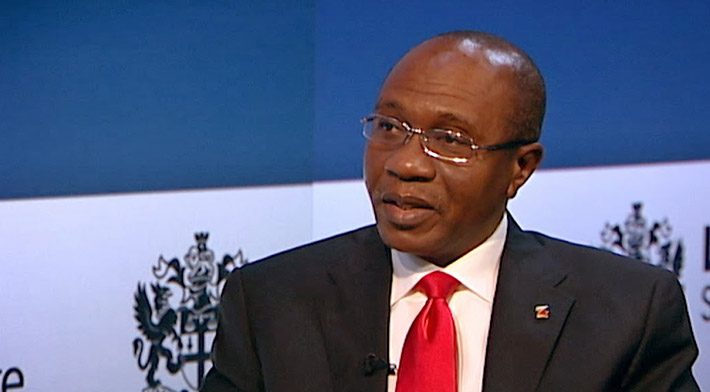

According to the National Daily source, who is highly placed in the CBN, Governor of the CBN, Godwin Emefiele had ordered the suspension after an investigation revealed the complicity of the affected top officials.

Although no names were mentioned, the bank said in a statement signed by the Acting Director, Corporate Communications, Isaac Okoroafor, that while preliminary investigations had not revealed any accomplices within the bank, some personnel within the CBN had been placed on suspension.

The statement read, “A highly sophisticated plot to defraud the CBN by some criminally minded elements has been uncovered and aborted by the bank.

ALSO SEE: GTB, First Bank lead others in forex allocation

“Although preliminary investigations so far have not revealed any accomplices within the CBN, the management has decided to place all key personnel involved in the transaction on suspension.

The CBN in the statement assured stakeholders in the banking sector that the security within the central bank remains intact and had not been breached.

Speaking on the development, a financial expert and CEO of Highcap Securities, Mr. David Adonri said the CBN as a regulator was being saddled with responsibilities that were related to that of commercial banking and, as such, made its system prone to corruption.

“The CBN is a banker to the Federal Government; it is also in charge of the foreign exchange market; it is also in charge of regulating the banks. In some countries, those functions are separated. The CBN is allocating forex to banks. There have been lots of cries that some are favourerd while others are not favoured. This is something that can breed corruption,” he explained.

He also said, “With the implementation of the Treasury Single Account, the CBN is now more of a banker than a regulator. That is another thing that can breed corruption. The CBN is being saddled with more responsibilities that have to do with banking rather than being a regulator.

ALSO SEE: Diamond Bank issues profit warning attributed to Impaired Loans in Energy, Commercial Business Sectors

A top ex-banker and Chief Executive Officer, Cowry Assets Management Limited, Mr. Johnson Chukwu, commended the CBN for having what he described as a robust internal control system to intercept the fraud.

He said, ‘The fraud attempt was unsuccessful, so it is a plus and indicates that the CBN has a robust internal control process. It shows the level of desperation of people to make money. This kind of thing usually happens in the financial services sector, but the key thing is to ensure there is robust system to intercept it.”

Entertainment1 week ago

Entertainment1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Football1 week ago

Football1 week ago

Entertainment1 week ago

Entertainment1 week ago

Entertainment6 days ago

Entertainment6 days ago

Latest1 week ago

Latest1 week ago

Latest1 week ago

Latest1 week ago