The Presidential Committee on Tax Reforms and Fiscal Policy has proposed stripping the Nigeria Customs Service (NCS), Nigeria Ports Authority (NPA), Nigerian Postal Service (NIPOST) and 60 other Ministries, Department and Agencies from collecting revenue on behalf of the Federal Government.

If the proposal sails through, trillions in revenue generated or collected by the agencies will now be collected by the Federal Inland Revenue Service (FIRS).

According to the committee, the Nigeria Customs Service and 62 other Ministries, Departments and Agencies are not meant to collect revenue directly.

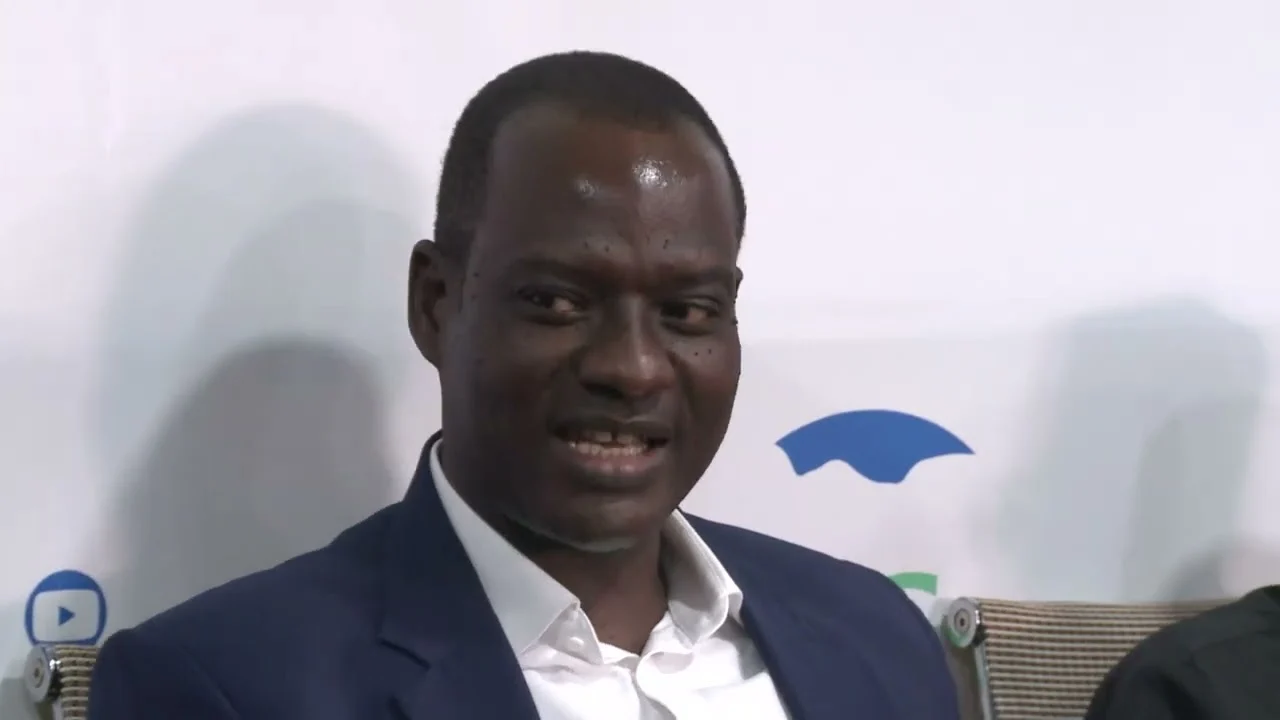

The Chairman of the committee, Taiwo Oyedele, said this on Channels Television’s Sunrise Daily breakfast programme on Wednesday, adding that the FIRS was best suited to collect revenue for the MDAs.

Oyedele, who is a former Fiscal Policy Partner and Africa Tax Leader at PriceWaterhouseCoopers, said that Nigeria’s revenue collection from taxes is one of the lowest in the world but the cost of collection is high.

READ ALSO: FRSC, Customs commences vehicle database integration

“Ironically, our cost of collection is one of the highest. And the reason for that is that we’ve got all manners of agencies. The Federal Government alone, we have 63 MDAs that were given revenue targets last year, no; actually in the 2023 budget.

“And two things that would come up from that: on one hand, these agencies are being distracted from doing their primary function which is to facilitate the economy. Number two, they were not set up to collect revenue, so, they won’t be able to collect revenue efficiently.

“So, move those revenue-collection functions to the FIRS. It has two advantages: the cost of collection and efficiency will improve, these guys will focus on their work, and the economy will benefit as a result”, Oyedele said.

Speaking further Oyedele said: “If you are Customs, focus on trade facilitation, border protection and if you are NCC (Nigerian Communications Commission), just regulate telecommunications. You are not set up to collect revenue.

“It can be your revenue and someone else can collect it for you. There will be more transparency because you can see what is being collected and is accounted for properly. It is also a way of holding ourselves to account as to how we spend the money we collect from the people.”

READ ALSO: Tinubu vows to end Nigeria’s over reliance on borrowing, sets 18% Tax to GDP target

He however noted that there would be pushback from stakeholders and others benefitting from the process but the committee’s sole objective is to not to take what belongs to anyone but what should come to the government.

The committee chairman also described the Treasury Single Account initiative as a step in the right direction but it has not been fully developed. He said the TSA would help his committee’s work but there are more to do to maximise the initiative.

Some of the agencies that would be affected include the Federal Airports Authority of Nigeria, Nigerian Ports Authority, Nigeria Deposit Insurance Corporation, Nigerian Meteorological Agency, National Agency for Food and Drug Administration and Control, Federal Road Safety Corps, Nigeria Customs Service, Standards Organisation of Nigeria and the Nigerian Airspace Management Agency

Others are Bank of Agriculture, Nigerian Bulk Electricity Trading, Tertiary Education Trust Fund, Federal Radio Corporation of Nigeria, Nigerian Railway Corporation, Federal Reporting Council of Nigeria, Nigerian Maritime Administration and Safety Agency, Corporate Affairs Commission, Nigeria Civil Aviation Authority, National Broadcasting Commission, Joint Admission Matriculation Board.

The Nigerian Port Authority, National Automotive Design and Development Council, Federal Mortgage Bank of Nigeria, Nigerian Upstream Petroleum Regulatory Commission, and the Nigerian Communications Commission will be affected too.

Entertainment5 days ago

Entertainment5 days ago

Health1 week ago

Health1 week ago

Health4 days ago

Health4 days ago

Football1 week ago

Football1 week ago

Football1 week ago

Football1 week ago

Crime4 days ago

Crime4 days ago

Crime1 week ago

Crime1 week ago

Education6 days ago

Education6 days ago