Fintech is boosting financial inclusion across Africa, according to Ecobank, a pioneer in Africa’s digital transformation and the main sponsor of the 2018 Africa Tech summit starting on the 14th of February, 2018 in Kigali, Rwanda.

Although over 80% of Africans have mobile phones, only around one quarter (28%) of them have bank account. But mobile banking and e-wallets are helping to break the banking logjam, offering a range of alternative payment methods as well as lending and savings services. This has boosted the overall financial inclusion rate to 34%, and it is growing each day.

However, there are many barriers to wider use of new technology where a step change is needed in attitudes and approaches towards innovation. Ecobank’s work with e-commerce, small business, and consumers – through their mobile banking app and other e-products – is helping organisations and individuals to overcome these barriers and stimulate wider usage.

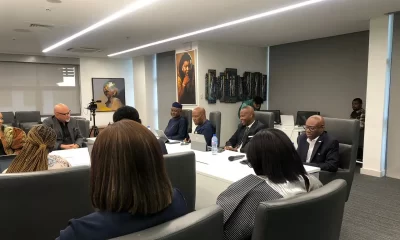

Head of the UK representative office of Ecobank and Group Research, Dr. Edward George, is expected give a keynote address at the opening of the summit where he will look at the acceleration of disruptive technology in Africa – technological innovations that are causing a step change in the way we do business and transact – and describe some of the latest banking & tech innovations that are helping individuals and businesses to meet the challenges.

“Nearly all the growth in financial inclusion since 2011 has been due to mobile banking services,” said Dr. George. “With around 100 million users of e-wallets, Africans account for around half (57.6%) of all mobile wallets in the world.”

“However, people are often stuck in their ways – whether a market trader or top executive – and the challenge is to change the mindset and open them up to the opportunities of digital.

“Disruptive technology is about recognising these challenges and seeing technology as an enabler, not a panacea, and by adapting innovations to the reality on the ground. That is what we are doing at Ecobank to help businesses and individuals take the digital leapfrog.”

Other speakers at the summit include Alice Kilonzo Zulu, Managing Director of Ecobank Rwanda, who talked about Ecobank e-commerce and how cashless innovations are spurring SME growth, and Nshuti Mbabazi, Vice President, Push Payments at Ecobank, who looked at how Ecobank’s digital strategy is helping deliver the cashless society in Africa.

Entertainment1 week ago

Entertainment1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Football1 week ago

Football1 week ago

Entertainment1 week ago

Entertainment1 week ago

Entertainment6 days ago

Entertainment6 days ago

Latest1 week ago

Latest1 week ago

Latest1 week ago

Latest1 week ago