Comments and Issues

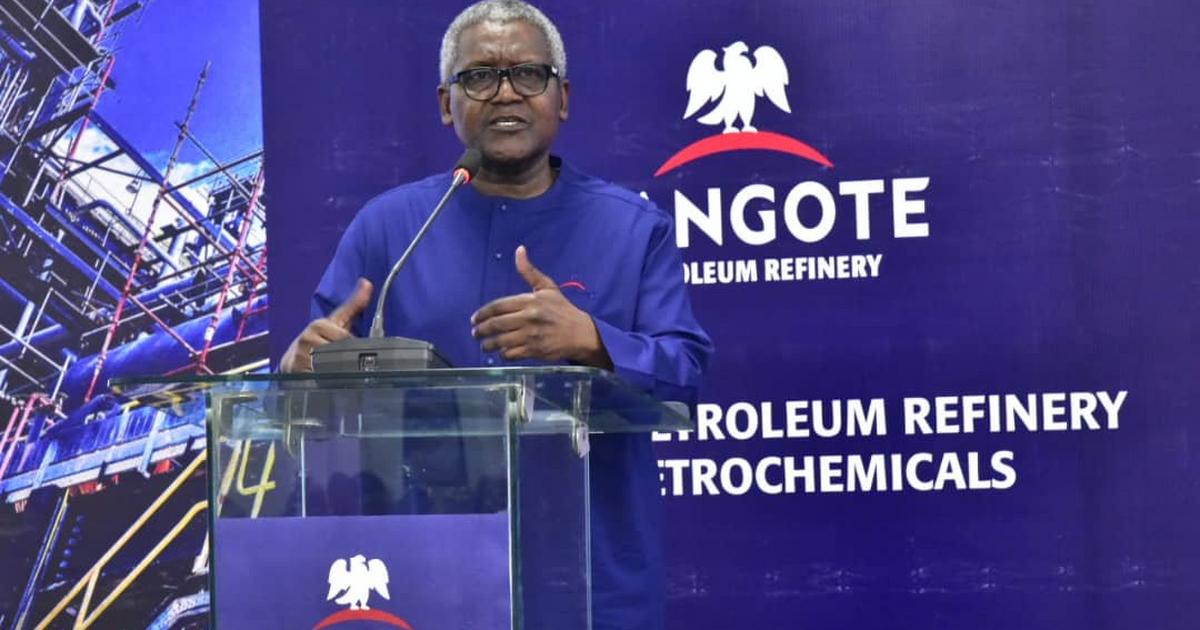

Fuel Price Conspiracy: Is Dangote still the Messiah?

Published

1 year agoon

By

Matthew Ma

“The notion of Aliko Dangote, Africa’s wealthiest individual, being seen as a “savior” who could single-handedly resolve Nigeria’s fuel crisis was likely an oversimplification from the outset. Although his 650,000 barrels per day refinery in Lagos is undeniably pivotal in reducing Nigeria’s reliance on imported fuel, it is not a panacea. The interplay of volatile global oil prices, government policies such as subsidy removal, and the potential monopolistic influence of the refinery complicates the narrative.”

In the past week, Nigerians faced heightened tension and anxiety as two significant entities, the Nigerian National Petroleum Company Limited (NNPCL) and Dangote Refinery, clashed over pricing and marketing rights for a single product—Premium Motor Spirit, commonly known as petrol. Before these events, the country experienced severe scarcity, leading to long queues at filling stations, congested roads, and some vehicle owners having to spend the night at petrol stations. Initially, NNPCL claimed it owed money to marketers abroad, but when this explanation proved insufficient, it attributed the scarcity to adverse weather conditions and other factors. The oil company’s inefficiency was evident, particularly when Dangote Refinery accused NNPCL of withholding crude oil sales to hinder the refinery’s production. Before this, NNPCL had employed coercive tactics, alleging that the products from the new refinery were of inferior quality compared to the imported ones to discredit and cast a negative light on the new refinery. The question now arises: who is speaking the truth in this situation?

I had refrained from commenting on the escalating petrol prices in Nigeria. I made this choice because conversations about the rising prices often evoked emotional sentiments from individuals with vested interests. However, given the war of words, tension, and anxiety surrounding the petroleum product pricing between the two prominent figures in the oil industry, I feel compelled to express my thoughts on the alleged conspiracy between these two influential gladiators. The ongoing cycle of blame, accusations, and counter-accusations between the Dangote Refinery and the Nigerian National Petroleum Company Limited (NNPCL) has compelled me to revisit this issue. The completion of the Dangote Refinery, which was expected to significantly lower petrol prices in Nigeria, has been plagued by delays and challenges. As a result, there is widespread disappointment among the public as the initial hopes for relief from high fuel costs have not been realized. The Nigerian National Petroleum Company Limited (NNPCL) has been embroiled in disputes and finger-pointing with the Dangote Refinery over the delays and their impact on petrol prices. This ongoing conflict has shed light on the complexities and challenges within the Nigerian fuel industry, prompting a reassessment of the situation.

The notion of Aliko Dangote being celebrated as the savior of Nigeria’s fuel crisis, mainly due to the establishment of his Refinery, was initially based on high hopes that the Refinery, once completed, would address many of the country’s enduring fuel importation and price volatility challenges. There was a belief that the Refinery’s production capacity of 650,000 barrels per day would substantially lessen the need for fuel imports, stabilize prices, and cultivate a more self-reliant energy market in Nigeria. This early optimism set a lofty standard for the project. However, as the project unfolds within the current global economic climate, the reality of the situation is proving to be more complex. The completion of the Refinery, anticipated as a pivotal moment, has been clouded by controversy. Amidst soaring fuel prices, concerns about market dynamics and potential monopolistic practices have intensified, exposing the current challenges. These obstacles have dimmed the initial optimism, prompting questions about whether Dangote and his Refinery can still be the guiding light in Nigeria’s fuel crisis.

Nigeria, a prominent oil-producing nation, has grappled with the paradox of heavily relying on imported refined petroleum products. This heavy dependence has led to fluctuating fuel prices and shortages, posing significant challenges to the country’s economy and stability. The construction of the Dangote Refinery, set to be the largest in Africa, aimed to reduce or eliminate Nigeria’s reliance on imported refined petroleum products by domestically refining crude oil. This ambitious project had the potential to lessen the impact of external factors on Nigeria’s fuel supply and revolutionize the country’s energy landscape. The government pledged to minimize or eliminate controversial fuel subsidies by investing in local petroleum refining infrastructure, thereby reducing the costs of importing refined petroleum products. This initiative was expected to spur the establishment of new refineries and the modernization of existing ones, reducing the country’s dependency on imported fuel. As a result, the need for government subsidies on fuel prices was anticipated to decrease, contributing to a more sustainable and self-sufficient energy sector. Additionally, this move was projected to create job opportunities in the domestic refining industry and enhance the nation’s energy independence. The refinery was not only perceived as a significant economic driver but was also expected to generate thousands of direct and indirect jobs, offering employment opportunities for engineers, technicians, and support staff. Beyond stimulating growth in local industries, the refinery was anticipated to contribute to skill development and technology transfer in Nigeria’s petroleum sector. Furthermore, bolstering its export potential, the refinery was poised to play a crucial role in enhancing Nigeria’s position in the global refined petroleum market, potentially leading to increased revenue.

The anticipated benefits of the refinery have not translated into lower fuel prices in Nigeria. Following the government’s removal of fuel subsidies, fuel prices have surged to record levels in 2023-2024, casting doubts on the promised cost reductions by the Dangote Refinery. The sharp increase in fuel prices has raised concerns among consumers, businesses, and policymakers, especially considering that the Dangote Refinery was expected to lower fuel prices through its significant production capacity and potential to reduce reliance on fuel imports. Various factors, including infrastructure challenges, fluctuations in global oil prices, and the complexities of the Nigerian fuel market, have contributed to this disparity. The dominant position of Dangote in the Nigerian market has prompted worries about potential monopolistic practices. With its substantial presence in the cement, sugar, salt, and flour industries, the Dangote Group’s influence extends beyond just the petroleum industry. This has led to concerns about the impact on competition, consumer choice, and the overall market dynamics in Nigeria, particularly if alternative refineries remain weak or non-competitive.

The recent government decision to remove fuel subsidies to promote economic reform has led to a significant rise in fuel prices at the pump. This move was intended to accurately reflect the costs of refining and transporting fuel and the fluctuating global oil prices. However, it has placed a burden on consumers in the short term. While constructing Dangote’s refinery was expected to reduce the country’s dependence on fuel imports and potentially stabilize fuel prices, it has not mitigated the broad economic impacts of subsidy removal. Another pressing issue is Nigeria’s need for more competitive refining capacity. Presently, the country heavily relies on imported refined petroleum products, posing a significant economic challenge. Dangote’s refinery has the potential to address this importation issue due to its impressive capacity. However, it could become a de facto monopoly without other large-scale refineries operating at similar capacities. This raises concerns about market dominance and the potential for price manipulation, as there may not be sufficient competition to keep prices in check. Therefore, Nigeria must encourage the revival of government-owned refineries to promote a more balanced and competitive market for refined petroleum products, paving the way for a more promising future in Nigeria’s energy sector. Initially seen as a potential savior for addressing the country’s fuel challenges, Dangote’s reputation is shifting as fuel prices continue to climb and Nigerians face daily living cost struggles. Questions arise about whether Dangote’s promises of affordable fuel are realistic or unattainable under current economic conditions.

It seems that there is a well-coordinated effort between the Dangote Refinery and the NNPCL to take advantage of Nigerians by imposing unreasonably high petrol prices. This behavior resembles what is commonly known as price gouging, which happens when businesses intentionally raise the prices of goods, services, or commodities to excessively high levels, especially during a crisis or emergency when demand increases and supply is limited. In the context of fuel, price gouging occurs when a company or companies significantly raise fuel prices in response to supply shortages. Although price gouging typically occurs during natural disasters, pandemics, or situations where essential goods become scarce, it can happen anytime. Essentially, it involves exploiting consumers’ vulnerabilities during critical times. I recently listened to VeryDarkMan (VDM) regarding the Dangote Refinery’s reported landing cost of petrol per liter. According to VDM, the price amounted to N119 in certain parts of northern Nigeria, N950 in some parts of western Nigeria, and N1000 in some parts of eastern and north-central Nigeria. While I have not independently verified this claim, the source’s credibility, VDM, adds weight to the information. The disparity in fuel prices across different regions raises concerns about Dangote Refinery’s adherence to its commitments in Nigeria. Additionally, conflicting reports have surfaced regarding the currency in which Dangote Oil acquired its crude Oil, despite the Nigerian government’s approval for the state oil company, NNPC Ltd, to sell crude in the local currency to the Dangote refinery to ease foreign exchange pressures. This discrepancy begs the question of who is presenting the truth about the differences between NNPCL and Dangote Refinery. The agreement between Dangote and NNPC on fuel prices in different locations is intriguing. The overarching question remains whether Dangote continues to uphold its status as Nigeria’s savior and what has become of the pledges made to Nigeria at the outset of the refinery project. The insistence of Dangote Oil on purchasing crude Oil in dollars and the conflicting statements from NNPC Ltd and Dangote Refinery have left us questioning the integrity of the information presented by both entities.

Amidst intense political maneuvering in Nigeria, the highly anticipated Dangote Refinery, initially hailed as a beacon of hope for the nation’s energy needs, is encountering substantial challenges that could impede its capacity to deliver on its commitments soon. The refinery, expected to play a pivotal role in addressing Nigeria’s energy demands, is now facing hurdles that raise concerns about its timely operationalization and impact on the country’s energy landscape. For example, recent revelations have raised doubts about the company’s capacity to offer affordable petrol to the market, leaving many frustrated and disappointed. Amidst many challenges and complexities, there have been persistent instances of rationalizations, coercion, and manipulation. In addition, strong nationalist sentiments have made it difficult for Nigerians to understand the unfolding events. The prevailing nationalist fervor may lead to the sidelining of adherence to regulations and due process during perceived national crises, mainly when influential figures are involved. Despite the passing of several months since the country was expected to make significant progress in domestic refining, uncertainty still looms over whom to trust between the Nigerian National Petroleum Company Limited and Dangote Refinery. Aliko Dangote had promised that the refinery’s products would be available by August 2023 during its inauguration on May 22, 2023. Nigerians are now questioning whether Dangote’s intentions were sincere or if he prioritized his own interests over those of the country. Concerns about the company’s apparent disregard for essential business fundamentals have also been raised. Aliko Dangote has revealed that his $20 billion conglomerate has only recently begun efforts to secure access to Nigerian crude to supply his 650,000-barrel refinery.

ALSO READ; Secret Investment: How much is NNPCL’s money in Dangote Refinery?

While the prospect of Dangote playing a pivotal role as “the messiah” in the Nigerian oil industry may appear somewhat optimistic, the government must take specific measures to enhance the Dangote refinery’s contribution to addressing Nigeria’s fuel challenges. These measures must prioritize the safety and well-being of Nigerian citizens, who ultimately bear the impact of these initiatives. The government should thoughtfully consider implementing a range of strategies to shield its citizens from potential hardships resulting from the activities of the Dangote refinery and NNPCL, which have been implicated in a conspiracy. This could involve the establishment of fuel price controls to prevent unjustified price hikes, ensuring that fuel costs remain stable and affordable for consumers. Additionally, subsidies could be introduced to ensure that essential goods and services remain accessible to the population, particularly those with lower incomes. Moreover, implementing import tariffs could safeguard local industries from unfair competition from foreign products, ultimately promoting the growth and sustainability of domestic businesses. It is crucial for regulatory bodies to actively enforce antitrust laws and regulations to ensure fair competition and prevent any single entity from dominating the market. Promoting competition is not just a choice but necessary to mitigate monopolistic practices that could harm consumers. This can involve rigorous monitoring of mergers and acquisitions to prevent the concentration of market power in the hands of a few dominant players. Additionally, creating incentives and supporting new entrants in the industry can foster a more diverse and competitive landscape, benefiting consumers through more excellent choices and fairer pricing. Furthermore, the government must establish strong partnerships with regulatory bodies to ensure fair and ethical business practices within the industry. This collaborative effort could involve continuously monitoring and rigorously enforcing industry standards. Working closely with industry stakeholders to develop and implement comprehensive codes of conduct that champion transparency, accountability, and consumer protection is crucial. Therefore, to uphold these standards, the government must regularly conduct audits and inspections to verify compliance with regulations and promptly address unethical practices.

In addition, the government can take proactive measures and initiatives to enhance transparency, equity, and the protection of public interests. These measures may include increased oversight, policy reforms, greater public engagement, and implementation of economic safeguards. The government’s crucial role in enforcing antitrust laws is fundamental to our regulatory system, ensuring fair competition and preventing monopolistic practices in the market. As a significant player in the oil refining industry, the refinery must refrain from exploiting its position to raise prices, restrict supply, or engage in predatory pricing to stifle competition unfairly. This is vital for maintaining a level playing field, fostering innovation, and protecting consumer interests by ensuring access to various choices at fair prices. The government should meticulously review fuel subsidy policies and revamp them to shield consumers from the impact of artificially inflated fuel costs. Establishing fair and transparent pricing systems that account for global oil prices, transportation expenses, and government taxes is crucial. Furthermore, the restructuring of fuel subsidy policies should prioritize providing subsidies to those in need while minimizing potential adverse effects on the environment and the overall economy.

The government can significantly reduce our reliance on finite fossil fuels by diversifying our energy sources and investing in various renewable energy options such as solar, wind, hydroelectric, and geothermal. This transition to renewable energy is crucial not only for mitigating the impacts of climate change but also for contributing to economic growth. Diversifying our energy sources has multiple benefits. It reduces our vulnerability to supply disruptions from a single source, decreasing the potential for monopolistic practices to manipulate energy prices. Furthermore, investing in renewable energy creates new job opportunities, fosters technological innovation, and brings about environmental benefits such as reduced greenhouse gas emissions and improved air quality. These positive impacts on both the economy and the environment can significantly enhance the overall quality of life for the population. In Nigeria, this shift to renewable energy could also address the ongoing issue of fuel hikes and the monopoly held by certain marketers. By diversifying energy sources and investing in renewable energy, the government can not only alleviate the reliance on finite fossil fuels but also create a more competitive and sustainable energy market for the benefit of the entire population.

The notion of Aliko Dangote, Africa’s wealthiest individual, being seen as a “savior” who could single-handedly resolve Nigeria’s fuel crisis was likely an oversimplification from the outset. Although his 650,000 barrels per day refinery in Lagos is undeniably pivotal in reducing Nigeria’s reliance on imported fuel, it is not a panacea. The interplay of volatile global oil prices, government policies such as subsidy removal, and the potential monopolistic influence of the refinery complicates the narrative. Rather than portraying Dangote as a “savior,” it is more pragmatic to consider the refinery as part of a comprehensive suite of economic and structural reforms required to stabilize Nigeria’s energy market. Transparency in the energy sector and fostering healthy competition are not mere catchphrases but essential components that will ensure the equity and efficiency of Nigeria’s energy market. Robust regulatory oversight and economic diversification are crucial for a sustainable resolution to the country’s fuel price challenges. Furthermore, investments in infrastructure, such as pipelines and storage facilities, as well as policies promoting renewable energy sources, can further contribute to Nigeria’s comprehensive and resilient energy market.

Rev. Ma, S.J., is a Jesuit Catholic priest of the North West Africa Province of the Society of Jesus. He writes from Abuja, FCT.

Trending

Entertainment1 week ago

Entertainment1 week agoSinger Simi sparks debate after calling for death penalty for rapists

Business7 days ago

Business7 days agoNaira mixed across markets as official window dips, parallel market strengthens

Football1 week ago

Football1 week agoGalatasaray thrash Juventus 5–2 to hand Spalletti first champions League defeat

Business1 week ago

Business1 week agoNaira hits N1,337 against Dollar amid positive market sentiment

Health1 week ago

Health1 week agoStudy suggests possible link between cell tower radiation and rising diabetes cases

Latest1 week ago

Latest1 week agoADC blasts APC over electoral act amendment, warns against ‘democratic backsliding’

Entertainment1 week ago

Entertainment1 week agoTems, Burna Boy set new African record with most entries on Billboard hot 100

Football7 days ago

Football7 days agoUCL Playoff: Gordon scores four as Newcastle thrash Qarabağ 6-1