By Odunewu Segun

The personalities of the backers behind Sigma Golf-Riverbank Consortium, the firm that acquired Keystone Bank from the Asset Management Corporation of Nigeria (AMCON) is still shrouded in secrecy, even after the official handover by AMCON.

Checks by National Daily have shown that both Sigma Golf Nigeria Limited and Riverbank Investment Resources Limited the entities set up by local investors for the bidding process have no digital footprints.

As limited liability companies, they are not listed on the Nigerian Stock Exchange, and have no records on the Securities Exchange Commissions website.

It had been earlier speculated that the consortium is being run by some northern elites, who do not want to been seen as the key stakeholders in the multi-billion naira deal.

National Daily gathered had exclusively reported that the bank, which was valued at almost N4 billion, was sold to the Sigma Golf-Riverbank consortium for N25 billion ($81.5 million), while the reserve bidder offered N13 billion ($42.4 million).

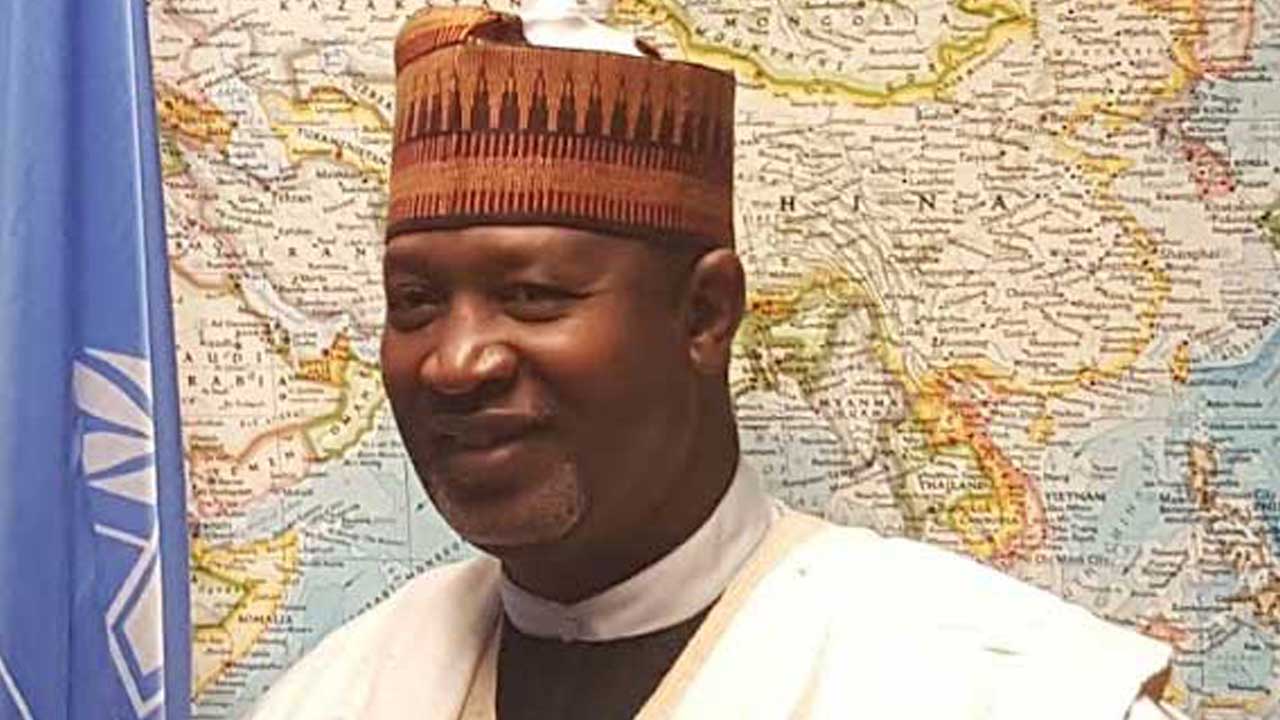

National Daily has identified one of the financiers as former Managing Director/CEO of Sigma Pensions Limited, Mr. Umar Hamidu Modibbo. Modibbo and his brother, Adamu Mu’azu Modibbo, a former governorship aspirant in Adamawa State, were the founders of Sigma Pensions, a pension fund administrator (PFA), until its sale to Actis LLP, a private equity investor in emerging markets, in November 2015.

The other investors have remained largely unknown.

A statement from the bank said the handover took place “last Friday after the completion board meeting to consummate the acquisition and pave way for the takeover was held the previous day (Thursday) with representatives of Sigma Golf-Riverbank Consortium (the Buyer), AMCON (the Seller), Board and Management of Keystone Bank as well as the advisers to the buyer (KPMG Professional Services, Boston Advisory Services, Giwa Osagie & Co., Pan-African Capital Limited) and the Seller (FBN Capital Limited, Citibank Nigeria Limited, Banwo & Ighodalo, CrosswrockLaw)”.

The completion meeting signified the effective hand-over of the bank to the buyer and the commencement of a transition process that will culminate in the reconstitution of the Board and Management of the bank to reflect the new ownership.

Keystone Bank, formerly Bank PHB, was taken over by AMCON in 2011 and has been managed by the AMCON-appointed board and management which stabilised the bank over the years to make it attractive as potential new investors, who emerged as preferred bidders after a very transparent and competitive bidding process.

Health1 week ago

Health1 week ago

Latest1 week ago

Latest1 week ago

Health7 days ago

Health7 days ago

Football7 days ago

Football7 days ago

News1 week ago

News1 week ago

Latest1 week ago

Latest1 week ago

News1 week ago

News1 week ago

Latest1 week ago

Latest1 week ago