Moniepoint Inc., a financial institution, on Tuesday, revealed that the online banker has secured $110 million in equity financing to expand its digital payments and banking solutions across the continent.

The Group Chief Executive Officer of Moniepoint, Tosin Eniolorunda, in a statement in Lagos on Tuesday, emphasised that the series C funding round was led by the Development Partners International’s African Development Partners III fund, with participation from Google’s Africa Investment Fund, Verod Capital, and existing investor Lightrock.

READ ALSO: Insecurity forces shutdown of over 20 schools, 13 clinics in Katsina-Ala

He said the funding would enable Moniepoint to accelerate its growth across Africa, building an all-in-one, seamlessly integrated platform for businesses of all sizes.

Eniolorunda added that the platform would offer services such as digital payments, banking, foreign exchange, credit, and business management tools.

“ The proceeds from this raise will speed up our efforts to drive financial inclusion and support Africa’s entrepreneurial potential.

“Our mission is to help our customers solve their challenges by making our platform more innovative, transparent, and secure.

“We are grateful for the support of our investors and look forward to working with them to expand our customer base,” Eniolorunda said.

READ ALSO: Reps vows to address Lawmaker’s assault of driver with utmost seriousness

According to him, Moniepoint’s financial inclusion efforts support initiatives by many African governments to widen access to the formal financial system and drive economic growth, a vital necessity given 83 per cent of employment across Africa is in the informal economy.

On the rationale for their investment, Adefolarin Ogunsanya, Partner at Development Partners International (DPI), said Moniepoint was well positioned to continue its impressive growth trajectory while driving financial inclusion for underserved businesses and individuals across Africa.

Ogunsanya said that DPI had a long-track record of supporting businesses like Moniepoint to achieve their next stage of scale.

He noted that the company’s combination of innovative technology, fast growth, and positive impact on the continent underpinned DPI’s conviction in its future success.

READ ALSO: Ghana proposes to import petroleum from Dangote Refinery

According to him, Moniepoint processes over 800 million transactions monthly, valued at $17 billion, and has experienced 2,000 per cent growth in personal finance customers over the past year.

“The company has also achieved 150 per cent Compound Annual Growth Rate revenue growth in recent years.

“We look forward to working closely with Eniolorunda and his talented team to expand Moniepoint’s customer base by providing businesses and individuals with first-class banking and payments services, ” Ogunsanya said.

NAN

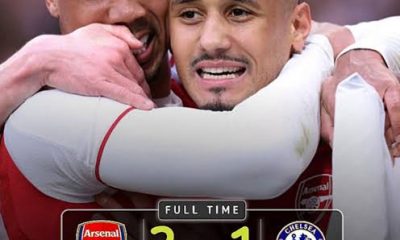

Football6 days ago

Football6 days ago

Crime5 days ago

Crime5 days ago

Health6 days ago

Health6 days ago

Latest1 week ago

Latest1 week ago

Health1 week ago

Health1 week ago

Entertainment1 week ago

Entertainment1 week ago

Crime1 week ago

Crime1 week ago

Football1 week ago

Football1 week ago