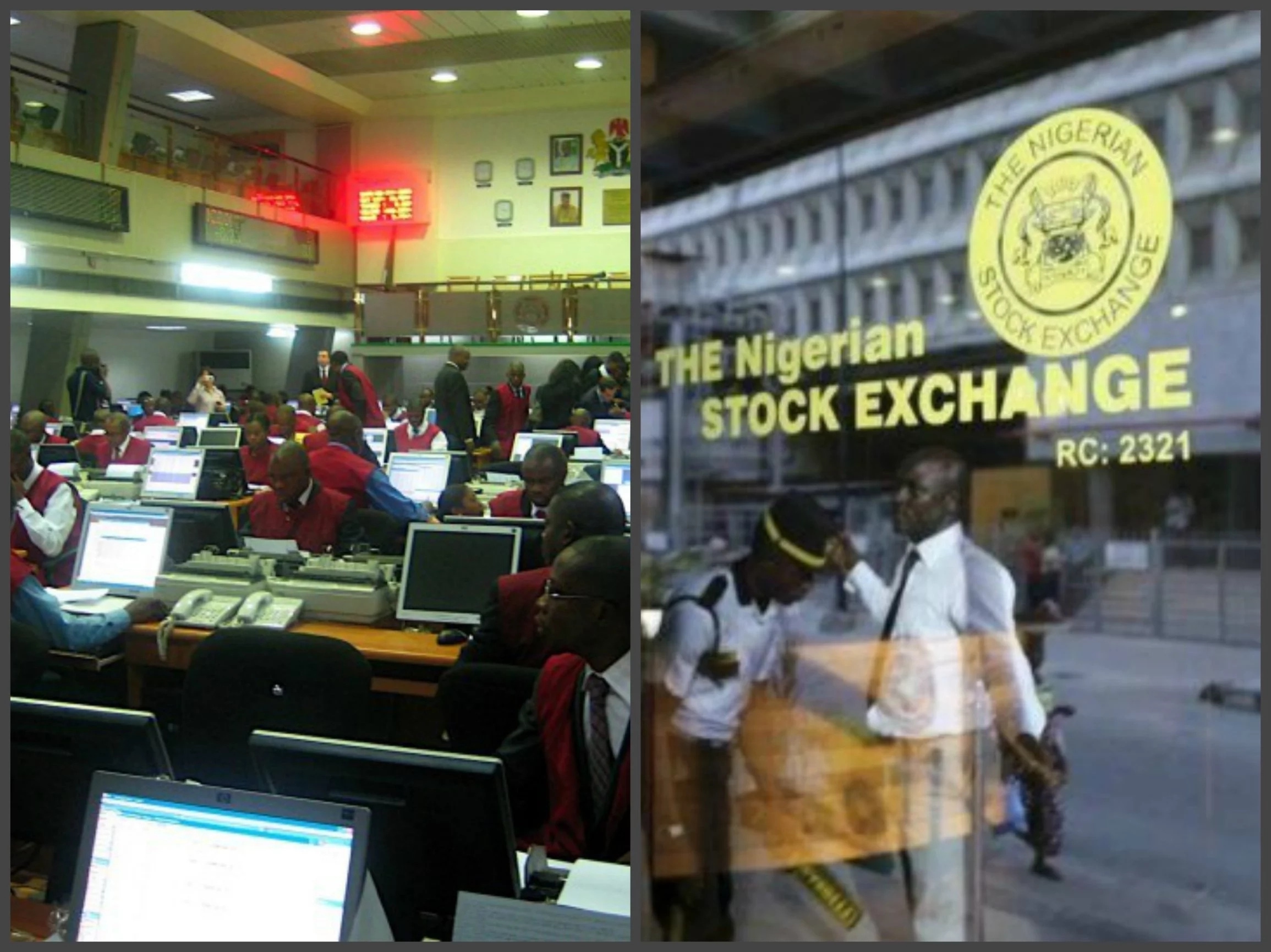

Investors in the Nigerian capital market lost N35.66 billion at the close of trading on Tuesday.

This followed the crash in equity capitalization from N30.39 trillion to N30.35 trillion after five hours of trading today.

Similarly, the All-Share Index dipped by 65.47 basis points to close at 55,722.9, down from 55,788.37 achieved by the bourse on Monday.

Investors traded 199.26 million shares valued at N2.81 billion in 3,898 deals on Tuesday.

This surpassed the 179.02 million shares worth N2.54 billion traded by shareholders in 4,296 deals the previous day.

READ ALSO: Nigerian stock market capitalization hits N28.68trn

Enamewa led the gainers’ list with a N1.55kobo rise in share price moving from N16.20kobo to N17.75kobo per share. FTN Cocoa’s share value was up by 7.69 percent to end trading at N0.28kobo from N0.26kobo per share.

Sterling Bank gained 3.42 percent to move from N1.46kobo to N1.51kobo per share.

UAC Nigeria gained N0.30kobo to close at N9.50kobo, above its opening price of N9.20kobo per share. NGX Group’s shares traded upward by N0.70kobo to rise from N26 to N26.70kobo per share.

Chams topped the losers’ table after shedding 8 percent to drop from N0.25kobo to N0.23kobo per share. Prestige’s share price dropped by 7.32 percent to end trading at N0.38kobo from N0.41kobo per share.

READ ALSO: Cash crisis: investors dump banking, insurance stocks amid fears

Linkage Assurance lost 6.82 percent to end trading with N0.41kobo from N0.44kobo per share. UPDC’s share price dropped from N1.03 to N0.96kobo per share after losing 6.80 percent during trading.

Wema Bank lost N0.26kobo to drop from N4.30kobo to N4.04 per share. Sterling Bank led the day’s trading with 31.09 million shares valued at N46.91 million.

Neimeth traded 20.17 million shares worth N31.67 million. Zenith Bank sold 16.51 million shares worth N412.51 million.

Entertainment1 week ago

Entertainment1 week ago

Entertainment4 days ago

Entertainment4 days ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Business1 week ago

Business1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Health6 days ago

Health6 days ago

Football6 days ago

Football6 days ago