Business

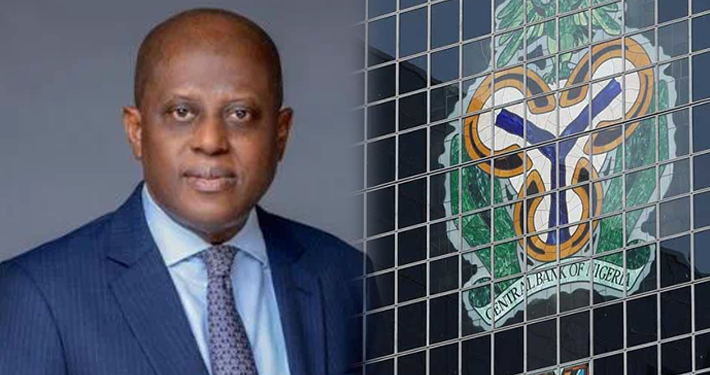

Nigeria: Are monetary policies ‘killing’ Banks?

Published

2 years agoon

By

Marcel Okeke

The news that deposit money banks (DMBs) and merchant banks in Nigeria borrowed a humongous sum of N8.7 trillion through the Standing Lending Facility (SLF) window of the central bank within the first two months in 2024, was nothing short of shocking. In fact, compared to the only N982 billion that the banks drew from the apex bank (via SLF) in the first two months of 2023, this is about 787 per cent increase (year-on-year). It means the banks found themselves in some more desperate situations to warrant resort to borrowing more from the Central Bank of Nigeria (CBN).

Commercial and merchant banks borrow from the CBN using SLF window and deposit cash with the apex bank using Deposit Facility window. The CBN Standing Lending Facility (SLF) is a short-term loan window (overnight advance) available to deposit money banks/discount houses—to access liquidity to run their business operations. Therefore, the rapidly increasing volume of SLF borrowing of the banks from the apex bank is an ample indication of the ‘gasping-for-liquidity’ condition of the banks. The more liquidity challenge the banks experience, the more they resort to/patronize the SLF—all things being equal.

Unsurprisingly, the CBN under its new leadership has redirected focus on the banks in its efforts at draining perceived excess liquidity from the Nigerian economy. This, the CBN has demonstrated in various ways in recent times—since the Olayemi Cardoso team came on board late last year. The CBN leadership erroneously believe that “too much money chasing few goods” is the main cause of the subsisting hyper-inflationary trend in the economy. Therefore, the policy decisions at the first Cardoso-led Monetary Policy Committee (MPC) were (in all intents and purposes) directed against the banks. For instance, raising of the Cash Reserve Ratio (CRR) from 32.5 per cent to 45 per cent, is obviously directed at sucking much cash away from the tills of the banks.

This is because, by definition, CRR is the percentage of money which a bank has to keep with the central bank in the form of cash from every amount it receives as deposit. The higher the percentage, the less the portion left for the bank for its operations—especially credit creation. And so, with the mindset to drain the banks of so much liquidity, the CBN had to raise the CRR from 32.5 per cent to 45 per cent—an increase of 12.5 per cent in one fell swoop. This means that for every one thousand Naira deposit a bank receives, 45 per cent (or four hundred and fifty naira) of it must be left with the apex bank.

Also, the retaining of the (Statutory) Liquidity Ratio (SLR) at 30 per cent by the MPC is not surprising because that level of liquidity will obviously constrain the ability of the banks to take some transactions. After all, the SLR is (another) obligatory reserve that commercial banks must maintain with the apex bank (in the form of approved securities per specific percentage of the net demand and time liabilities). In accounting terms, Liquidity ratios typically compare a company’s current assets to its current liabilities to measure what short-term assets it has available to pay for its short-term debts.

Even the MPR that was moved up by the MPC in an unprecedented quantum, by 400 basis points, would end up handicapping the banks. This is because in line with the hiked MPR the banks would be compelled to raise their own rates (especially the lending interest rates) to levels that would be beyond the reach of many of their potential and existing customers. Funds or funding would no longer be affordable and/or accessible to many businesses—especially real sector operators.

Firms that secure funding (unavoidably) from the banks at the very high interest rates are very likely to factor such costs into their product pricing. The attempt to transfer the high cost through product pricing to the ultimate consumer would manifest as cost-push inflation. This vicious cycle would keep inflation going up, as long as the businesses procure loans from the DMBs.

Even as these scenarios are playing out in the larger economy, the CBN seems bent on enforcing its 45 per cent CRR ‘retroactively’, and vowed during a virtual meeting with prospective foreign portfolio investors that it was going to drain about N5 trillion from the tills of the banks. Mohammed Abdullahi, the CBN deputy governor (economic policy) confirmed the planned move of the apex bank during the meeting. Abdullahi noted that the banking system had a shortfall of N5trillion to meet the new 45 per cent CRR.

The upshot of all these is that the banks are now desperately resorting to the use of SLF widow to sustain their normal operations. Thus, the sharp rise in SLF borrowing by the banks in February could be attributable to the persisting high double-digit rate of inflation, foreign exchange shortages, and incessant liquidity mop-up by the CBN. Available data show that the banks through the SLF borrowed N2.75 trillion in January 2024, up 419.95 per cent (year-on-year) from only N528.2 billion they borrowed a year earlier in January 2023. In February 2024, the banks borrowed N5.97 trillion, up 1215 per cent (year-on-year) from N453.7 billion borrowed in February 2023.

If the scorching policy environment forced the banks to borrow N8.7 trillion just in two months (January and February 2024), they are most likely to borrow much more in the emerging tight monetary stance of the apex bank. But the import of this would be restrained or constrained lending capacity for the DMBs, and consequent stalled economic growth. In the current tight monetary stance also, loan-deposit-ratio (LDR) is no longer being emphasized, as was the case under the immediate past leadership of the CBN. The apex bank had in 2019 initiated a minimum LDR for banks of 60 per cent.

This policy (hiked LDR) and its strict enforcement by the erstwhile leadership of the CBN, without a doubt, led to some boost in credit to the real economy. The LDR policy strategically regulates the proportion of a bank’s deposits allocated to productive lending rather than being held in low-yield assets. The components of the LDR policy include mandatory lending quotas, obliging banks to maintain a specified minimum percentage of total deposits as loans to the real sector—fostering economic activities such as agriculture, manufacturing and SMEs.

The (LDR) policy is usually reinforced through a system of penalties and incentives, encouraging compliance and active participation by the banks in driving economic growth and development. The CBN initially mandated a minimum LDR of 60 per cent in July 2019, but subsequently raised it to 65 per cent in September 2019. Today, under the guise of fresh economic reforms (or monetary policy), the LDR and kindred policies (including T-200 non-oil export drive) have been jettisoned by the apex bank.

Rather, the banks are being swamped with circulars and memos directed at squeezing out alleged huge foreign exchange (FX) in their different vaults. The apex bank seems preoccupied with combing the banks to drain them of perceived “excess FX” hoarding rather than getting the DMBs to function effectively within the normal transmission mechanism. Only time shall tell what the banks turn out to be, as the “market forces” economy subsists. Only time!

- The author, Okeke, a practising Economist, Business Strategist, Sustainability expert and ex-Chief Economist of Zenith Bank Plc, lives in Lekki, Lagos. He can be reached via: [email protected]

Trending

Entertainment1 week ago

Entertainment1 week agoSinger Simi sparks debate after calling for death penalty for rapists

Business1 week ago

Business1 week agoNaira mixed across markets as official window dips, parallel market strengthens

Health1 week ago

Health1 week agoStudy suggests possible link between cell tower radiation and rising diabetes cases

Business1 week ago

Business1 week agoNaira hits N1,337 against Dollar amid positive market sentiment

Latest1 week ago

Latest1 week agoADC blasts APC over electoral act amendment, warns against ‘democratic backsliding’

Entertainment1 week ago

Entertainment1 week agoTems, Burna Boy set new African record with most entries on Billboard hot 100

Football1 week ago

Football1 week agoUCL Playoff: Gordon scores four as Newcastle thrash Qarabağ 6-1

Entertainment5 days ago

Entertainment5 days agoSinger Simi faces backlash after TikToker admits to false rape allegation