Analysis of the market activity in the week ended December 31, 2015 technically revealed a sustained optimism with a corresponding surge in bargain activities as investors actively rallied towards cheap blue chip, big capped and value stocks considerably.

It was also gathered that an active and overwhelming accumulation pattern as investors displayed healthy demand appetite. The active accumulation was observed in key sectors, particularly in financial services, services, Conglomerates and consumer Goods sectors.

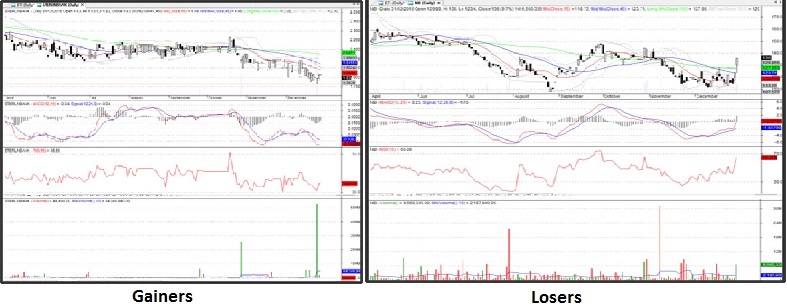

Also, volume analysis revealed bargain tendency towards WEMABANK, FBNH, STERLNBANK, UPL and UNITYBNK while investors displayed sell sentiments towards DIAMONDBNK, CADBURY, ZENITHBANK and GUARANTY.

In addition, investors displayed sustained and growing bargain tendency in some active sectors, particularly in Agriculture, Industrial Goods and Consumer Goods. However, we observed fresh sell tendency in Construction/Real Estate and ICT

In a nutshell, the bulls rule the week, strengthening the key benchmark index by 1,771.01 points against 333.88 gain recorded in the previous week to close at 28,642.25- ASI remains depressed and battered below its key resistance level at 41,957.50 In addition, the All Share Index traded within the range of 28,642.25 (week-high) and 26,763.24 (week-low) to settle at 28,642.25, above previous week’s low (26,918.22) by 1,724.03 points- This indicates improved bargain tendency when compared with previous posture. The outlook reveals growing bargain tendency.

In the week just ended, market breadth closed positive at 6.14 xs against 1.47 xs recorded in the previous week on the back of improved bargain sentiments.

STERLNBANK experienced moderate bargain tendency to close with positive sentiments in the week. The stock recorded 1.70% gain in the week against -2.70% loss recorded in the previous week.

The outlook in the week revealed a price recovery pattern on the improved bargain, after 11weeks fall of -19.73% to hit 36Months low experienced from October 20th to December 29th 2015.

In addition, technical indicator (MACD) revealed waning sell tendency towards the stock as RSI revealed improved price momentum. The stock closed bearish in both short-term mid-long term periods as revealed by its price moving averages- this indicates sustained presence of the bears towards the stock during the week.

Health5 days ago

Health5 days ago

Entertainment6 days ago

Entertainment6 days ago

Crime5 days ago

Crime5 days ago

Education7 days ago

Education7 days ago

Health7 days ago

Health7 days ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Football6 days ago

Football6 days ago

Latest6 days ago

Latest6 days ago