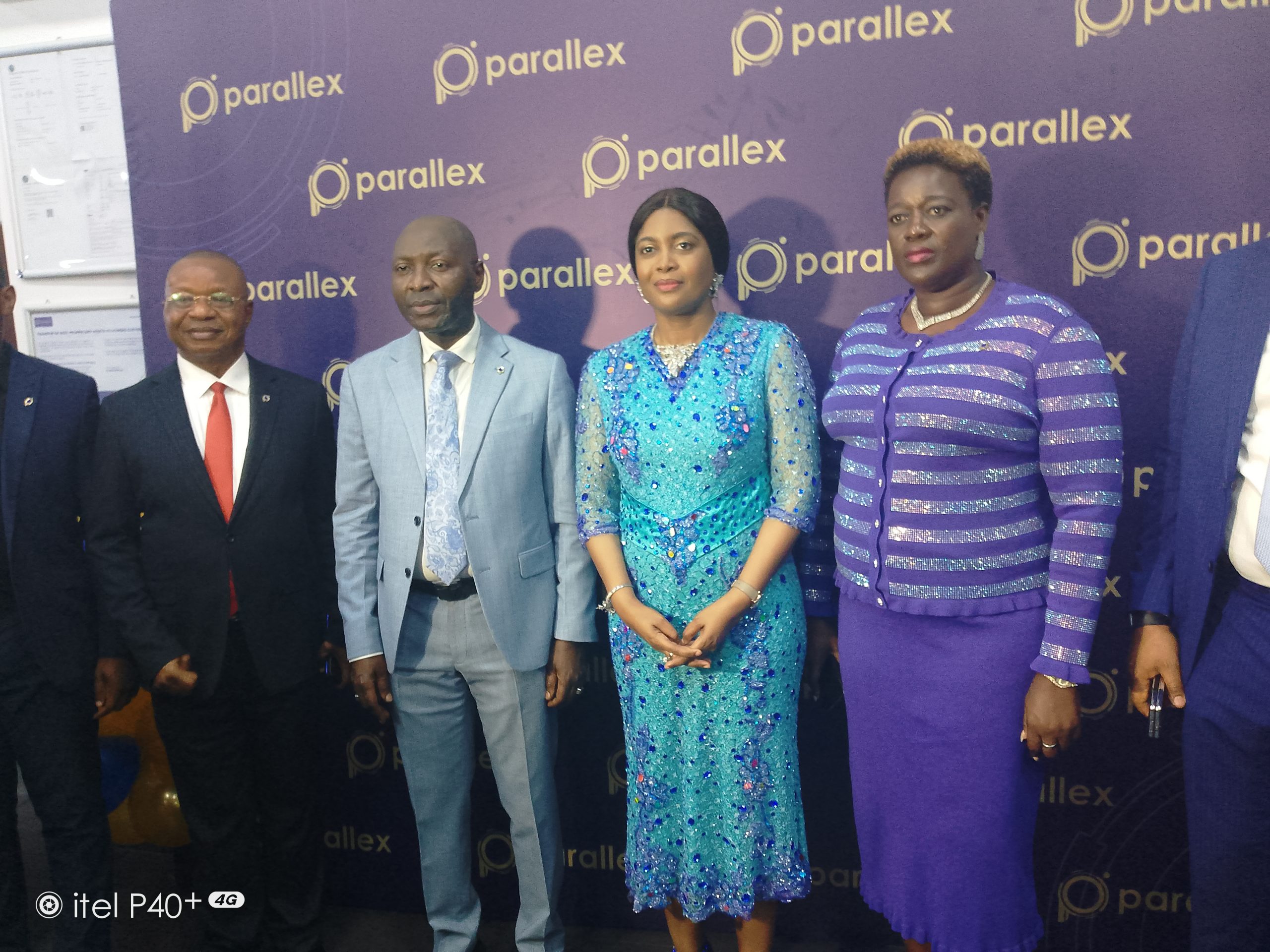

As part of its commitment at bringing limitless banking experience closer to businesses and individuals on Lagos Island, Parallex Bank on Wednesday September 20, 2023 unveiled a new branch at 37 Marina, Lagos Island.

In her remark before the unveiling, Chairman of the Bank, Dr. Adeola Phillips said the new Marina branch is just one of the 12 branches to be launched before the end of the year.

She said Parallex Bank has come a long way from being a Microfinance Bank to a National Commercial Bank, and has been getting the attention of customers because of its unique packages.

“Our journey to becoming the preferred financial solution provider is not just about numbers, we’re about creating equality, economic output, building trust and fostering lasting relationships and partnerships with our customers and communities.

READ ALSO: Parallex Bank nips National Daily Newspaper’s Regional Bank of the Year

“Our responsibility in our view extends beyond our balance sheets. We are dedicated to making a positive impact on the communities we serve through our corporate social responsibility initiatives.

Dr. Phillips reiterated that Parallex Bank is in business to enhance efficiency, strengthen risk management practices, expand product offering and deliver exceptional customer experiences to those who will embrace change with open arms.

“That is what brought us from the microfinance one to a commercial bank. We know what it is to adapt to change and embrace change and we can shape a brighter future not just for the money entrusted with us, but also for all our stakeholders.

“And together we are committed to foster a culture of inclusion and growth. And to continue to deliver value to our stakeholders. I want to assure you all our customers and friends and other board members that we will continue to work diligently to meet and exceed expectations.” She added.

READ ALSO: Customers rush to open Accounts with Parallex Bank

Earlier in his welcome address, Managing Director of the bank, Mr. Olufemi Bakre, said the vision of the bank is to be the preferred financial solution provider redefining customer experience through innovation.

He assured customers of excellent banking products and services, stating that the bank’s unique value propositions included ensuring convenience – via instant account openings and internet-enabled ‘contactless’ banking, service reliability, prompt resolution to complaints, both technically and practically, as well as fostering socio-impactful partnerships that will also improve the banking industry in Nigeria, as well as address the yearnings of Nigerians.

“Our value propositions to our customers are Instant account opening, convenience, reliability, prompt resolution to complaints and partnerships. This is how we plan to disrupt the market and delight our customers.”

Mr. Bakre revealed that the bank has over 100,000 customers who are currently enjoying the bank’s unique services, imploring other businesses and individuals to join the bank’s growing list of customers in order to enjoy these benefits.

The unveiling was attended by stakeholders in the business community, including market leaders on Broad Street as well as Alhaji Saheed Olanrewaju, Chairman of BOVAS oil.

The bank was first established as a Microfinance Bank in 2008 and obtained the licence to operate as a commercial bank in January 2021.

Health5 days ago

Health5 days ago

Entertainment6 days ago

Entertainment6 days ago

Crime5 days ago

Crime5 days ago

Education7 days ago

Education7 days ago

Health7 days ago

Health7 days ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Football6 days ago

Football6 days ago

Latest6 days ago

Latest6 days ago