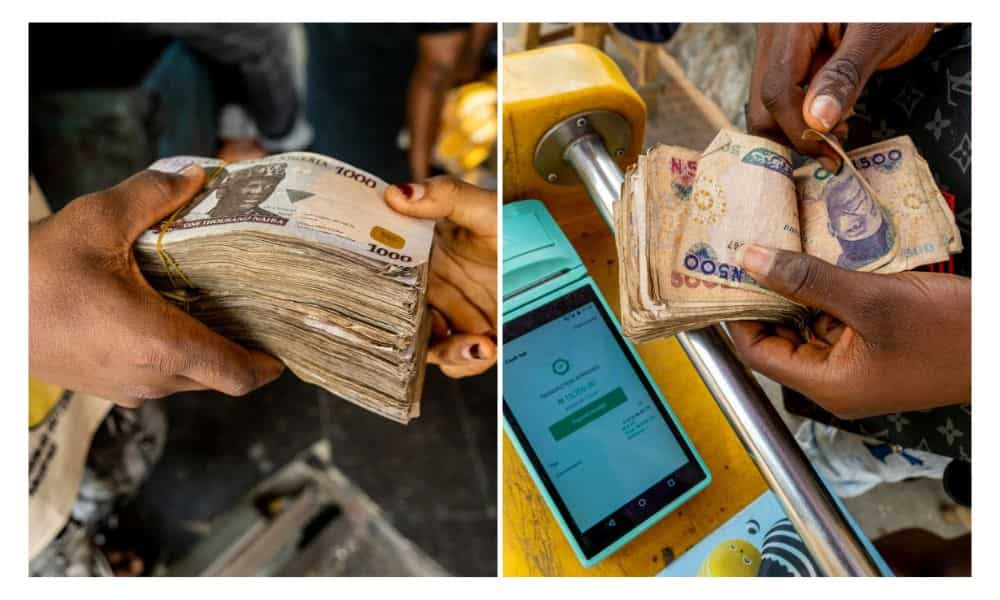

Several operators of PoS terminals in Lagos have resorted to buying Naira notes from unusual sources to remain in business following the scarcity of Naira in the country. Some PoS operators in the suburb of Ikeja metropolis, int6eracting with National Daily, explained the reason for the exorbitant charges on their customers who make withdrawals.

One of the PoS operators at Ogba told National Daily that the scarcity of Naira notes now forced them to buy Naira from petrol stations. He mentioned some of the petrol stations selling Naira notes to them to include Mobil, Oando, etc.

In the course of inquiry, National Daily found that some of the PoS operators charge N200 per N1,000 withdrawal. A customer was charged N1,000 cost for withdrawal of N5,000 which previously cost N100. For a withdrawal of N2,000, the customer pays N400 to the operator.

The Naira trading is also being done in old Naira notes, not the redesigned new notes.

A bank customer who went to his bank to withdraw N10,000 told National Daily that the bank could only give him N7,000 in N100 denomination. He said that the manager of the bank told him that they don’t have cash to dispense; meanwhile, he signed a cheque for N10,000, noting that N3,000 is still outstanding at the bank.

At a PoS terminal on Allen Avenue, Ikeja, a customer paid the operator N5,000 to withdraw N20,000, all in old notes.

The crisis of the Naira redesign and swapping of the old notes has caused unprecedented difficulties for many Nigerians, including businesses. Many PoS operators do not have cash to dispense and have, therefore, suspended businesses, except those who unlawfully buy from banks, petrol stations and other sources.

It is expected that the new directive of the Central Bank of Nigeria to banks to pay limited cash to customers on the counters, and other measures the government may be adopting henceforth, could bring relief to Nigerians.

Business1 week ago

Business1 week ago

Entertainment6 days ago

Entertainment6 days ago

Entertainment3 days ago

Entertainment3 days ago

Latest1 week ago

Latest1 week ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Business6 days ago

Business6 days ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Health1 week ago

Health1 week ago