Labour

School fees, corporate accounts, compliance records take centre stage in Yahaya Bello trial

Published

3 weeks agoon

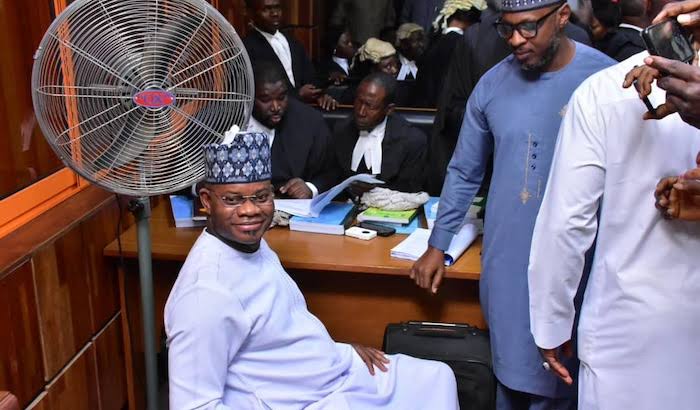

The ongoing trial of former Kogi State Governor, Yahaya Adoza Bello, took a significant turn on Thursday, February 5, 2026, as fresh testimony revealed detailed financial transactions, including multimillion-naira payments to educational institutions, further intensifying scrutiny of alleged money laundering activities tied to the former governor.

The proceedings, held before Justice Emeka Nwite of the Federal High Court in Maitama, Abuja, featured extensive testimony from the Economic and Financial Crimes Commission’s (EFCC) eighth prosecution witness, Gabriel Ochoche, a compliance officer with First City Monument Bank (FCMB). \

Bello is standing trial on a 19-count charge bordering on alleged money laundering amounting to N80,246,470,088.88.

Ochoche, who appeared in court pursuant to a subpoena, provided detailed insight into transactions linked to Kunfayakun Global Limited, an account reportedly under investigation.

Led in evidence by EFCC counsel, Olukayode Enitan, SAN, the subpoena served on the witness was admitted by the court as Exhibit 36 without objection from the defence team.

During his testimony, Ochoche disclosed that several payments were traced to educational institutions, including transfers totaling N46,505,400 to the American International School.

He specifically identified a N30 million transfer executed on November 1, 2021, to American International School/Abdul Bashir, alongside another transfer of N16,505,400 made to the same institution.

The witness further tendered the statement of account, certificate of compliance, and account opening documents for Kunfayakun Global Limited, Account Number 7819613011. The documents, covering transactions between June 1, 2021, and August 31, 2022, were admitted into evidence as Exhibit 37 without objection.

When questioned about the period covered by the financial records, Ochoche clarified that the transactions spanned June 29, 2021, to December 31, 2024.

Providing technical clarity on the structure of the account statement, Ochoche explained that the financial records were organized into seven columns: date, reference, description, value date, deposit, withdrawal, and balance.

He highlighted several high-value transactions linked to the account. Among them was a N700 million NIP transfer from Keyless Nature Limited dated December 15, 2021, followed two days later by a N400 million RTGS inflow from Access Bank on the instruction of the same company. Ochoche explained that Real-Time Gross Settlement (RTGS) transfers involve transactions processed by one bank on behalf of a customer.

Further financial movements were traced to November 2, 2021, when multiple inflows from Gadonkaya Global Concept—N10 million, N10 million, and N8.96 million—were credited into the Kunfayakun account. On the same day, an outflow totaling N34,506,600 was reportedly made to American School and China Payment/Abdul Bashir.

The witness also testified that on February 18, 2022, the account received six separate NIP transfers of N100 million each from Ejadams Essence Limited, amounting to N600 million. He further confirmed a subsequent RTGS inflow of N325 million from Access Bank, processed on behalf of Ejadams, with a value date matching the earlier transfers.

“Yes, my lord, I confirm that ₦600 million was received from Ejadams Essence Limited,” the witness stated while responding to questions from the prosecution.

Earlier in the proceedings, Prosecution Witness Seven, Olomotane Egoro, a compliance officer with Access Bank, continued his testimony under cross-examination, shedding further light on transaction monitoring practices within the banking sector.

Egoro confirmed an entry dated June 22, 2022, in Exhibit 33(8), indicating an outflow of ₦20 million described as payment for educational materials. He clarified that the transaction was not a cash withdrawal and noted that he could not determine the beneficiary from the available documentation.

The witness also acknowledged multiple cash withdrawals conducted by one Yakubu Siyaka between January 9, 2019, and December 30, 2022, totaling over N552 million.

Addressing banking regulatory responsibilities, Egoro explained that while customers have the right to access their funds freely, banks are legally mandated to flag and report transactions that appear inconsistent with customer profiles or fall within money laundering indicators.

“The customer can use his money as he likes; however, the bank has a reporting obligation where transactions do not fit the customer’s profile or fall under money laundering typologies,” he told the court.

The courtroom also witnessed a legal dispute when defence counsel J.B. Daudu, SAN, attempted to question the witness regarding the contents of a Suspicious Transaction Report (STR) submitted by Access Bank to the Nigerian Financial Intelligence Unit (NFIU).

Prosecution counsel, Kemi Pinheiro, SAN, objected to the line of questioning, arguing that it contravened provisions of the Administration of Criminal Justice Act (ACJA) since the document was not before the court.

Justice Nwite upheld the objection, ruling that defence counsel could not interrogate the contents of a

The court also admitted several additional documentary exhibits, including the Certified True Copy of proceedings from Justice Obiora Egwuatu’s court dated May 12, 2025, which was marked as Exhibit 35(D2).

Other documents admitted included the Kogi State Government House account opening package (Exhibit 34(1)), the Kogi State Government House Administration account (Exhibit 34(2)), and the account opening package and statement of account for E-Traders International Limited (Exhibit 33(6)).

The case has continued to attract widespread public and legal attention, given the scale of the alleged financial infractions and the involvement of key financial institutions.

As the trial progresses, testimonies from compliance officers and documentary evidence remain central to the prosecution’s efforts to establish transaction patterns and financial accountability in one of Nigeria’s most closely watched corruption cases.

Trending

Business1 week ago

Business1 week agoNaira mixed across markets as official window dips, parallel market strengthens

Football1 week ago

Football1 week agoUCL Playoff: Gordon scores four as Newcastle thrash Qarabağ 6-1

Entertainment6 days ago

Entertainment6 days agoSinger Simi faces backlash after TikToker admits to false rape allegation

Entertainment3 days ago

Entertainment3 days agoSimi addresses resurfaced 2012 tweets amid online backlash

Business1 week ago

Business1 week agoThree Crowns Milk launches nationwide Ramadan campaign to promote heart-healthy nourishment

Latest1 week ago

Latest1 week agoTinubu defends electoral reform, downplays mandatory real-time upload

Comments and Issues6 days ago

Comments and Issues6 days agoNigeria’s Declining Oil Output and Soaring Foreign Portfolio Investment Inflow

Business6 days ago

Business6 days agoPENGASSAN warns Tinubu’s executive order on oil revenues could jeopardise 4,000 jobs