A US data group on Monday exposed how China infused debt trap and harsh conditions on loan requests by Uganda for the country’s airport project. A US-based research lab AidData on Monday revealed that a top Chinese lender infused “aggressive” repayment terms on a $200 million loan to expand Uganda’s international airport. The US data group berated the Chinese bank for forcing the government to repay its debt before funding public services.

AidData on Monday stated that under the loan contract from China’s Exim Bank for the modernization of the Entebbe Airport, the Ugandan government is required to deposit all revenue from the only international airport in the country to a joint account with the lender.

The Chinese bank conditioned the Ugandan government to disburse part of the revenue to repay the loan each year before it can invest in public services.

According to Bradley Parks, Executive Director at AidData, “These are more aggressive terms than what we have seen earlier.”

He noted that the contract “limits the fiscal autonomy of the government”.

It was highlighted that the State-owned China Communications Construction Company commenced repairs of runways and building new airport hangars in Entebbe in 2016; with contract terms to complete the work this year.

It was noted that Chinese creditors, contrary to the practice by other loan givers in developed nations, require governments to deposit some earnings from big infrastructure projects in bank accounts they control to serve as collateral.

AidData Executive Director emphasized that the contract for the Ugandan airport was taken to deeper conditions, observing that: “The lender is asking not just for revenues from the new projects they are funding, but also from the underlying asset, or the airport, that already exists.”

Parks, citing data from the government, highlighted that the airport was built in 1951 and was generating about $68 million annual revenue before the expansion project. The money, he said, was used to fund public services.

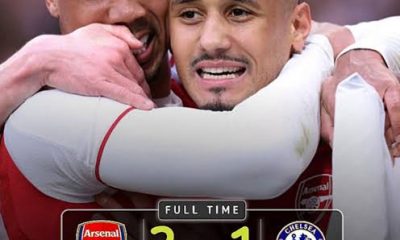

Football6 days ago

Football6 days ago

Crime5 days ago

Crime5 days ago

Health6 days ago

Health6 days ago

Latest1 week ago

Latest1 week ago

Health1 week ago

Health1 week ago

Entertainment1 week ago

Entertainment1 week ago

Crime1 week ago

Crime1 week ago

Football1 week ago

Football1 week ago