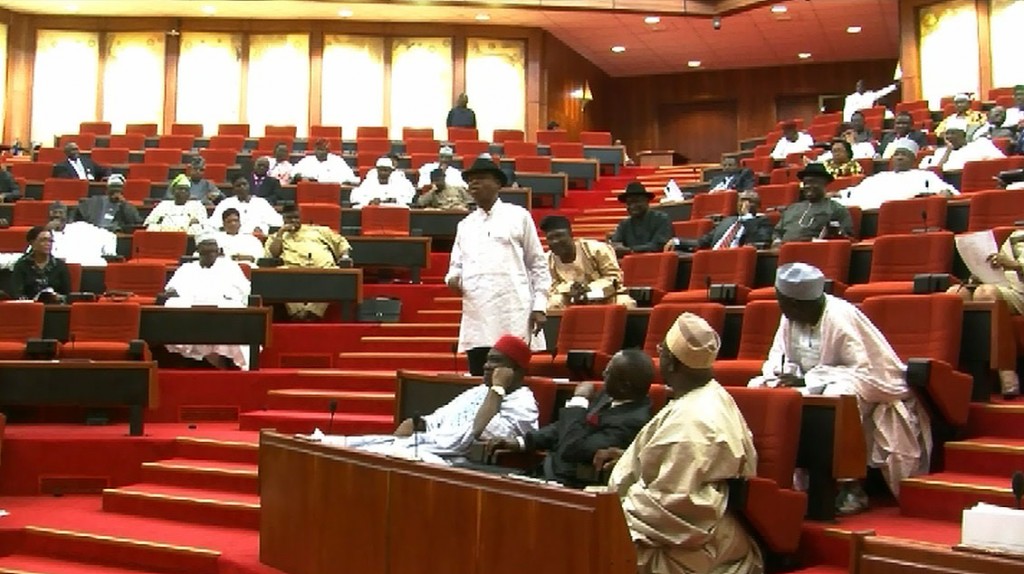

Parliament has finally passed the 2016 budget after passing the third reading at the Senate earlier today.

The budget is based on an oil price of $38 a barrel and crude production of 2.2 million barrels a day, in line with current output. ($1 = 199.0000 naira)

President Muhammadu Buhari presented a record $30 billion budget in December but asked for its withdrawal a month later to make changes after a further drop in oil prices.

The total budget has not changed but the deficit has risen to 3 trillion naira ($15 billion) from 2.2 trillion. “The bill is hereby read the third time and passed. Now it’s the point of the executive to faithfully implement it,” Senate President Bukola Saraki told the assembly.

Funding of the budget remains unclear as oil revenues, which make up about 70 percent of Nigeria’s income, have slumped, whacking its currency and drying up development projects.

In January, Finance Minister Kemi Adeosun Nigeria said Nigeria planned to borrow up to $5 billion from multiple sources, including the Eurobond market, but officials have provided no update since then.

In another development, Monetary Policy Committee (MPC) of the Central Bank of Nigeria yesterday announced a tightening of monetary policy stance by increasing the monetary policy rate by 100 bases point from 11 per cent to 12 per cent.

The Governor, Central Bank of Nigeria (CBN), Godwin Emefiele made this known on Tuesday, while addressing newsmen on the outcome of the two-day MPC meeting held at the apex bank headquarters in Abuja.

He said the decision was made following the committee’s concern that the excess liquidity in the banking system was contributing to the current pressure in the foreign exchange market.

ALSO SEE: Budget deficit: FG plans to raise N1.884 trillion

“The Committee, in its assessment of relevant internal and external indices, came to the conclusion that the balance of risks is tilted against price stability.

“The MPC therefore, voted to tighten the stance of monetary policy. One member voted to retain the CRR at 20 per cent while another member voted to retain the current width of the asymmetric corridor.

“The MPC voted to raise MPR by 100 basis points from 11.00 per cent to 12.00 per cent; raise CRR by 250 basis points from 20 to 22.50 per cent.

“The Liquidity Ratio was retained at 30 per cent; and the asymmetric corridor was narrowed from +200 and -700 basis points to +200 and -500 basis points.”

Emefiele said MPR was the anchor rate at which the CBN, in performing its role as lender of last resort, lends to Deposit Money Banks to boost liquidity in the banking system.

Health5 days ago

Health5 days ago

Entertainment6 days ago

Entertainment6 days ago

Crime5 days ago

Crime5 days ago

Education7 days ago

Education7 days ago

Health7 days ago

Health7 days ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Football6 days ago

Football6 days ago

Latest6 days ago

Latest6 days ago