By DANLADI BATURE

THE recent currency swap agreement between the Central Bank of Nigeria (CBN) and Industrial and Commercial Bank of China (ICBC) may significantly ease the pressure on the dollars and consequently stabilize the ailing local currency, naira, experts say.

The expectation is that the swap will shift activities to the Yuan and creates a breather for the dollars which through which our major transaction of naira are carried out.

“The currency swap between the CBN and ICBC will facilitate direct trade. This entails trading without dollars, so there is less demand for dollars.

In addendum, the Nigerian importer from China would have eliminated two exchange rate risks following the swap.

Only two months back did the Reserve Bank of India (RBI) and Central Bank of the United Arab Emirates, sign a Memorandum of Understanding (MoU) of bilateral swapping of the Indian Rupee with the Dirham.

From a lowly $2 billion in 2002, the volume of bilateral trade between Nigeria and China grew to 14.9 billion dollars, and a currency swap between the countries will stabilise the naira in the short term, according to Ayodele.

Taiwo Ayodele, a partner and head of tax and regulatory services, PWC, says the currency swap will ease the pressure on the naira and will see it appreciate against the dollar.

ALSO SEE: Currency swap deal will ease pressure on Naira – Gwadebe

“80 percent of the $14.9 billion trade volume between Nigeria and China are imports from China, while 20 percent represent Nigeria’s exports. This implies that to import from China, Nigeria expends almost $12 billion.

“With the currency swap, we won’t need this amount of dollars anymore to import from China, because we can now use the Chinese currency. This will reduce the demand for the dollars and strengthen the naira in the short term,” Ayodele says.

However, he says, the benefits may be short-lived, as the challenge of dollar scarcity confronting the nation may soon be transferred to the yuan if policy makers in Africa’s largest economy fail to put policies in place to spur exports and balance trade deficits.

“The agreement we have with China will not solve our problem in the long run. The only solution for us is to start exporting.

We must increase our exports to China if we are to have a substantial amount of yuan in our reserves,” Ayodele added.

Muda Yusuf, director-general of the Lagos Chamber of Commerce and Institute, was apt to point out the inability of the agreement to stabilise the naira, even as he identified smoother trade activities between both parties as an up-side of the deal.

“I hear people say the currency swap will stabilise the naira and curb the demand for dollars. I don’t agree with this assertion. As long as we have capacity issues with forex, our currency will not stabilise.

The weakness in the naira is not only in relation to the dollar, but to other foreign currencies. Unless we address the fundamental issue of low exports, not much will change materially,” Yusuf says.

ALSO SEE: Bureau de change operator expresses optimism on currency swap with China

However, Bukar in his view says Government should not stop with China, but proceed with India, UAE, and other countries that have a healthy trade relationship with the nation.

“We shouldn’t stop with China; we should reach out to India. Look at Dubai as well; we have a lot of Nigerians importing from the Dubai.

We can have a currency swap with these countries and this will be a clever way of relieving the pressure on the dollar,” Bukar said.

A currency swap is an arrangement, between two friendly countries (in this case), which have regular, substantial or increasing trade, to basically involve in trading in their own local currencies, where both pay for import and export trade, at the pre-determined rates of exchange, without bringing in third country currency like the US Dollar.

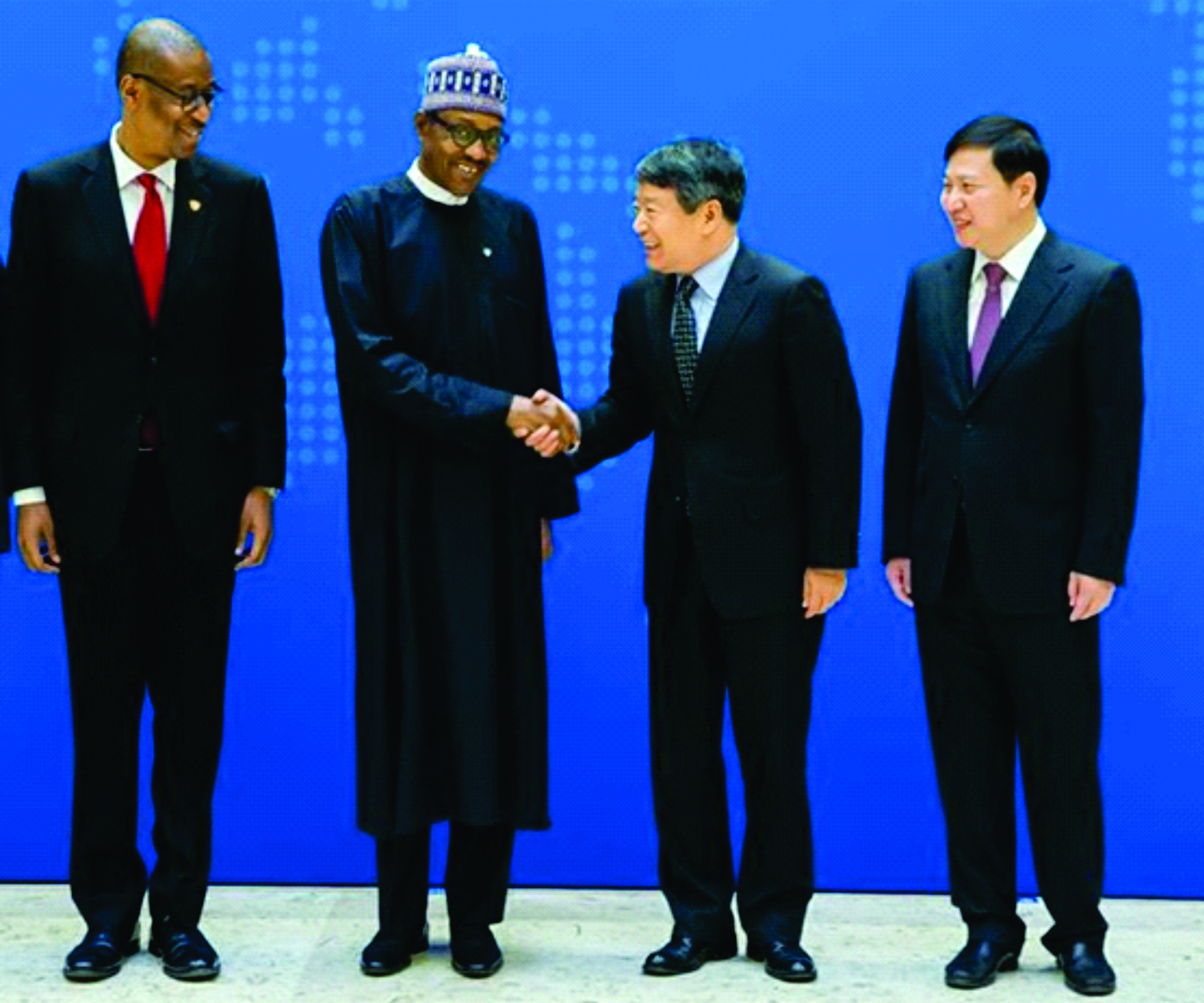

Nigeria’s Central Bank and the Industrial and Commercial Bank of China (ICBC) – the world’s biggest lender- last week, signed a currency swap agreement.

Entertainment5 days ago

Entertainment5 days ago

Health1 week ago

Health1 week ago

Health4 days ago

Health4 days ago

Football1 week ago

Football1 week ago

Football1 week ago

Football1 week ago

Crime4 days ago

Crime4 days ago

Crime1 week ago

Crime1 week ago

Education6 days ago

Education6 days ago