News

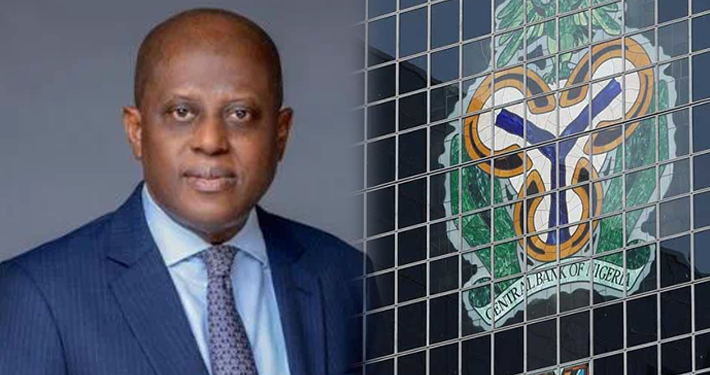

HURIWA demands DSS, EFCC to investigate CBN over Naira scarcity

Published

4 months agoon

A civil rights group, HUMAN RIGHTS WRITERS ASSOCIATION OF NIGERIA (HURIWA), has urged President Bola Ahmed Tinubu to order a joint covert operations between the Department of State Services (DSS) and the Economic and Financial Crimes Commission (EFCC) to investigate the Central Bank of Nigeria (CBN) over suspected economic sabotage, leading to the prolonged artificial scarcity of the Naira notes which has adversely affected businesses all around the Country.

HURIWA said since scarcity of the National currency resurfaced around the last quarter of 2023, the CBN has failed to resolve this absurdity, even when it is statutorily responsible for the smooth circulation of the naira notes by virtue of her legal functions to issue legal tender currency in Nigeria; maintain external reserves to safeguard the international value of the legal tender currency; promote a sound financial system in Nigeria; and. act as Banker and provide economic and financial advice to the Federal Government.

HURIWA recalled that as cash scarcity occasioned by the redesign of three naira notes continued to bite Nigerians about a year after the implementation of the policy, the Central Bank of Nigeria (CBN) had in December 2023 warned against collusion between Deposit Money Banks (DMBs) and Point-Of- Sale (PoS) operators.

HURIWA noteds that the CBN, in a statement by its spokesperson, Sidi Ali, Hakama, emphasised that such collusion was affecting the availability of cash and the seamless circulation of the naira in the country.

The CBN said it was investigating reported cases of collusion between banks and PoS operators “capable of undermining the smooth running of the economy”.

READ ALSO: Saraki celebrates Dino Melaye @ 50

“The CBN frowns at such inappropriate actions by certain individuals and is investigating the reported cases capable of undermining the smooth running of the economy,” the statement partly read.

“The CBN has, therefore, warned banks and PoS operators to desist from such activities as relevant sanctions shall be meted out to those found wanting.”

The apex bank encouraged members of the public to use alternative payment channels as well as report any case of unauthorised activities, such as capping and hoarding, by banks or PoS agents to the CBN branch in their locations, HURIWA recalled.

HURIWA in a statement by the National Coordinator, Emmanuel Onwubiko, regretted that the CBN has become a toothless bulldog and allowed forces known to the hierarchy of the CBN to continue to sabotage the national economy of the Country by manipulating the circulation of insufficient volumes of the Naira in the Country and thereby frustrating the economic activities of a broad spectrum of Nigerians. The Rights group pointed to the fact that since the CBN had since identified the sources of the scarcity as contained in the aforementioned press statement, it is shocking that over a month after the public statement, the CBN lacks the political will to crush those it identified as conspirators in the scarcity of the Naira. HURIWA said if this hierarchy of CBN can’t save the value of the Naira from nosediving, why has the CBN also failed to ensure seamless circulation of the National legal tender the Naira?

HURIWA said the overwhelming opinions of those who should know are of the fact that the solution of cash scarcity can’t happen without the central bank of Nigeria implementing far-reaching measures in line with her mandate to boost the volumes of cash in circulation in Nigeria and thereby conclusively resolve the lingering scarcity of Naira in the Country.

The Rights group quoted an economic expert interviewed by the press, David Adonri, Executive Vice Chairman, Highcap Securities, as suggesting that the commercial banks may not be behind the resurgence of cash scarcity, said that the informal sector, which supports the economy is already feeling the bite. He, David Adonri told the media thus: “I don’t think the banks are behind the resurgence of cash scarcity. They may be acting on instructions beyond their control.

READ ALSO: HURIWA urges Nigerians to demand government’s accountability on terrorists attacks

“Scarcity of cash in a cash economy, like Nigeria’s economy, is not something to condone. Its negative consequences are too numerous to mention. The informal sector which dominates the economy is feeling the heat seriously. Petty transactions that sustain petty traders and common people are getting eroded.

“As a matter of urgency, CBN should intervene by adequately supplying, especially, N50, N100 and N200 denominations,” Adonri said.

Also HURIWA quoted the media as interviewing another financial expert Tajudeen Olayinka, Analyst and CEO, of Wyoming Capital and Partners, said: “Since it is not a programmed cash scarcity, the solution lies in CBN looking into the cause of the problem and dealing with it accordingly. I suspect the scarcity might be due to insufficient cash in circulation, arising from previous withdrawal of old notes and burning. It’s possible that some people decided to hoard cash ahead of the previous December 31st Deadline. I believe we will get out of it in due course.”

HURIWA declared: “We are by this press statement calling on President Bola Ahmed Tinubu to order that the EFCC and the DSS carry out combined but covert operations within the CBN to ascertain the exact reason for the scarcity and to arrest and prosecute any official found wanting in the prolongation of the biting scarcity of the Naira in the country. It is such a very pathetic commentary to say that even after the erstwhile governor of the CBN Godwin Emefiele was dismissed, arrested and has been undergoing prosecution in different courts relating to issues around alleged official indiscretion and fraud, the new management headed by the new CBN governor have failed so far to bring to an end the widening spectres of artificial scarcity of the Naira in the country. What is happening with the scarcity of the Naira is purely issues around economic sabotage of a well coordinated fashion and this must be confronted frontally by the law enforcement bodies set up to prevent economic sabotage and to crush economic saboteurs.”

You may like

Trending

Health & Fitness3 days ago

Health & Fitness3 days agoMalaria Vaccines in Africa: Pastor Chris Oyakhilome and the BBC Attack

Featured7 days ago

Featured7 days agoPolice reportedly detain Yahaya Bello’s ADC, other security details

Education1 week ago

Education1 week agoEducation Commissioner monitors ongoing 2024 JAMB UTME in Oyo

Aviation5 days ago

Aviation5 days agoWhy some airlines are avoiding Nigeria’s airspace–NAMA

Business1 week ago

Business1 week agoMaida, university dons hail Ibietan’s book on cyber politics

Business7 days ago

Business7 days agoDebt servicing gulps 56% of Nigeria’s tax revenue, says IMF

Crime1 week ago

Crime1 week agoPolice take over APC secretariat in Benue

Aviation4 days ago

Aviation4 days agoJust in: Dana airline crash lands in Lagos