Business

Seplat announces US$59m dividend payout to shareholders

Published

6 years agoon

By

Olu Emmanuel

The Board of Seplat Petroleum Development Company Plc has announced a dividend distribution for shareholders with US$59 million paid out in the 2019 financial year, thus, amounting to 10 cents per share.

National Daily gathered from the company on Sunday.

The announcement was made while addressing shareholders and other stakeholders during the company’s 7th Annual General Meeting (AGM) held in Lagos on Thursday.

According to Dr. Orjiako, amidst the current headwinds occasioned by the prevailing global coronavirus pandemic and low oil prices, Seplat will continue to maintain strict financial discipline over investment decisions, while also embedding high standards of corporate governance and transparency; strong commitment sustainable business; and effective management of risks with a strong HSE culture.

“I believe that Seplat has an important role to play throughout the energy transition that is set to occur in the years and decades ahead, not least through the impact we can have by scaling up our domestic gas supply business and displacing imported diesel fuels that are being burned for power generation and helping Nigeria benefit from the social and economic multiplier effects that reliable and affordable power availability can bring,” he said.

Against this backdrop, Dr. Orjiako said Seplat plans to position itself for an ambitious next phase of growth which would see the expansion of its footprint in terms of energy business activities, a plan to pursue offshore assets acquisition, as well as opportunity driven entry into different geographies.

He added: “Looking forward, one of the main challenges facing the independent E&P sector is to remain relevant as the world makes the transition to a lower carbon future. The oil and gas industry face considerable challenges given that oil in particular plays such a significant part in today’s energy supply mix, with demand for the commodity still growing. A key part of my role as Chairman of the Board is to steer the Company through these transitions.

“The Board believes that such a corporate transition would require a different kind of organisational structure, people skills set and mentality to compete well in the expanded space. In view of this, over the course of 2020 we will be reviewing the current organisational and systems structure.”

The Seplat Chairman assured that the fundamentals of the company’s core business remain strong and through the effective integration of the Eland acquisition, the combined business will have greater scale and value creation opportunities to capture.

“I believe the investment case for Seplat remains compelling,” adding that: “As we look ahead to 2020 and beyond, I would like to take this opportunity to thank all Seplat employees and wider stakeholders for their efforts and continuing support and I look forward to updating all of our stakeholders on our progress throughout the year ahead.”

Also addressing shareholders at the 7th AGM, the Chief Executive Officer, Seplat, Mr. Austin Avuru, described 2019 as a solid year in which the robust fundamentals of the business once again kept the company on an extremely solid footing. “The strong cash generation we realised from our low-cost production base meant that our capital expenditures, debt service obligation and dividend distributions to shareholders were more than covered by cash generated from operations by a comfortable margin.”

From a strategic perspective, Mr. Avuru said 2019 will prove to be an inflection point in the company’s history, as it took a final investment decision (FID) for the 300 MMscfd ANOH midstream gas processing project in March.

“Once completed, the plant will process gas produced at the upstream unitised gas fields in OML 53, where Seplat has a 40 percent working interest, and Shell’s OML 21. Now that we have gone live, so to speak, with the project in partnership with government, we have set a clear trajectory that will see us become the largest supplier of processed gas to the domestic market once it becomes operational,” the Seplat CEO hinted.

On the outlook or 2020, Mr. Avuru said Seplat faces the same challenges as the rest of industry in terms of managing oil price volatility and other macro risks, adding that the emergence of the COVID-19 pandemic has thrown in another variable that has impacted the global economy. “As these factors are not in our control we can only make sure that we have plans in place that can mitigate and de-sensitise the business to these risks as far as is possible.

Commenting on the company’s planned transition, Mr. Avuru said: “I am extremely honoured to have led Seplat for the past ten years, and I am proud of the role it has played in promoting indigenous participation in the Nigerian oil and gas space. My ultimate goal in the transition of the CEO role is for Seplat to achieve even greater things in the next decade, creating a blueprint for others to follow.”

Also commenting, the company’s Chief Financial Officer (CFO), Mr. Roger Brown, said a position of financial strength has enabled Seplat to capitalise on significant growth opportunities during the 2019 financial year.

Mr. Brown said: “Our growth strategy is underpinned by a clear financial strategy that aims to maintain a strong well-funded balance sheet with sustainable operational cash flow. Investments made during the year have significantly progressed our ambitious growth strategy for both oil and gas production; of which our core business remains highly cash generative.”

The Seplat CFO further stressed that: “The business is hedged against low oil prices and a significant proportion of our revenues now come from gas, which offers further protection from oil price volatility.

The company has low production costs and can remain profitable even at lower oil prices. We have significant cash resources available and will manage our finances prudently in 2020, expecting now to invest just US$100 million of capital expenditure (US$50 million spent in Q1 2020), with a target of three new wells across our portfolio.

“We will also continue to focus on our investments in gas and the completion of the ANOH project remains a major priority.”

According to Orjiako, Seplat, a leading Nigerian independent oil and gas company listed on both the Nigerian Stock Exchange (NSE) and the London Stock Exchange (LSE), remains a resilient business that generates significant free cash flow from a low cost production base; has a balanced portfolio split evenly between oil and gas (which is de-linked to oil price); and is focused on delivering shareholder returns through regular dividend distributions and capital growth.

Trending

Latest1 week ago

Latest1 week agoTwo more Rivers lawmakers call for halt to Fubara impeachment

News1 week ago

News1 week agoJakande Estate residents allege illegal demolition, tasks Sanwo-Olu

Business7 days ago

Business7 days agoRising fuel costs, policy push signal EV boom in Nigeria as industry predicts 2026 takeoff

Business1 week ago

Business1 week agoNCC engages PwC to conduct comprehensive competition review of Nigeria’s telecoms sector

Latest1 week ago

Latest1 week agoKwankwaso tells NNPP members to discreetly sign defection forms amid Kano APC shift

Education1 week ago

Education1 week agoFG, ASUU sign landmark agreement to stabilize Nigerian university system

Business6 days ago

Business6 days agoNigeria misses OPEC quota for fifth month as crude output dips in December

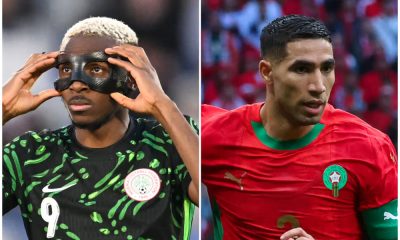

Football1 week ago

Football1 week agoAFCON 2025: Nigeria, Morocco clash in high-stakes semi-final as title race intensifies