The Central Bank of Nigeria (CBN) has insisted that there will be no extension for the January 31, 2023 deadline for the return of old Naira notes still in circulation as they ceased to be legal tender on the expiration of the deadline.

CBN’s Director of Currency, Rasheed Adams who disclosed this at a post press briefing of the Monetary Policy Committee (MPC) meeting on Wednesday in Abuja, also added that about N165 billion has so far been deposited at the bank since the announcement of plans to redesign the Naira notes.

Recall that some lawmakers had called for a shift in the January 31, 2023 deadline for the old banknotes to be withdrawn from circulation to April 2023 to enable people offload the cash they had stockpiled for elections.

During the debate, lawmakers also questioned the impact of the redesign of the naira note on the economy and if it will help reduce the inflation rate and the dwindling value of the naira.

Reacting, Mr. Adams expressed concerns that in spite of some waivers by the CBN on deposits, just a few Nigerians have come forward, stressing that there will be no extension on the January 23rd, 2023 deadline.

READ ALSO: CBN to deploy strategic grains reserve to check food inflation

The apex bank had said the initiative, which would affect the highest denominations of N200, N500, and N1,000 notes, is to allow the bank to take control of the currency in circulation.

The CBN also noted that a total of N2.7 trillion is currently outside the banking system, while currency in circulation is put at N3.29 trillion, increasing by over N855 billion between January and October 2022.

Recall on October 26, the CBN governor, Godwin Emefiele, while announcing the planned redesign of the high denomination naira notes by December 15, 2022, said that the initiative will aid security agencies in tackling illicit financial flow among others.

Emefiele said there was significant hoarding of naira notes by members of the public, with statistics showing that over 80 per cent of the currency in circulation was outside the vaults of the commercial banks.

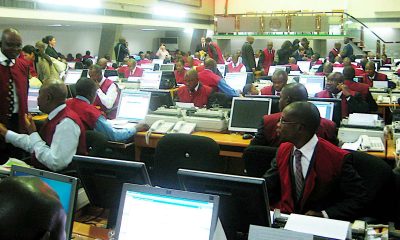

Meanwhile, commercial banks have begun adjusting operating hours and days to help Nigerians deposit their old Naira notes.

Before, Banks across the country operated between 8.00 am and 4.00 pm every working day, but have now shifted working hours to between 8:00 am and 6:00 pm.

READ ALSO: Why CBN monetary policy is not working – Economist

In a notice issued to its customers, Fidelity bank said all its branches would open by 8.00 am and close by 6.00pm on weekdays and the same time for Saturdays, specifically for cash deposits.

The move complies with the Central Bank of Nigeria (CBN) instructions for banks to operate more than the regular hours to ease depositing old Naira notes.

Access bank message to its customers reads: “In order to beat the new Naira notes deadline of January 31, 2022, our branches will be open for longer hours during the week for your convenience, and they will also be open on Saturdays from 10 a.m. – 2 p.m. to receive cash deposits.”

Ecobank also has a similar message: “You can now deposit your old banknotes ahead of the January 31st, 2022 deadline. We will be open from 10am to 3pm”

The United Bank for Africa (UBA) equally sent a message to its customers saying it would begin operations on Saturdays for cash deposits.

Latest1 week ago

Latest1 week ago

Business1 week ago

Business1 week ago

Latest1 week ago

Latest1 week ago

Latest1 week ago

Latest1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Football1 week ago

Football1 week ago

Business1 week ago

Business1 week ago