Financial experts have forecasted a significant changes in the dynamics of the Nigerian capital market in the second quarter of 2024, driven by the imminent takeoff of a banking recapitalization exercise

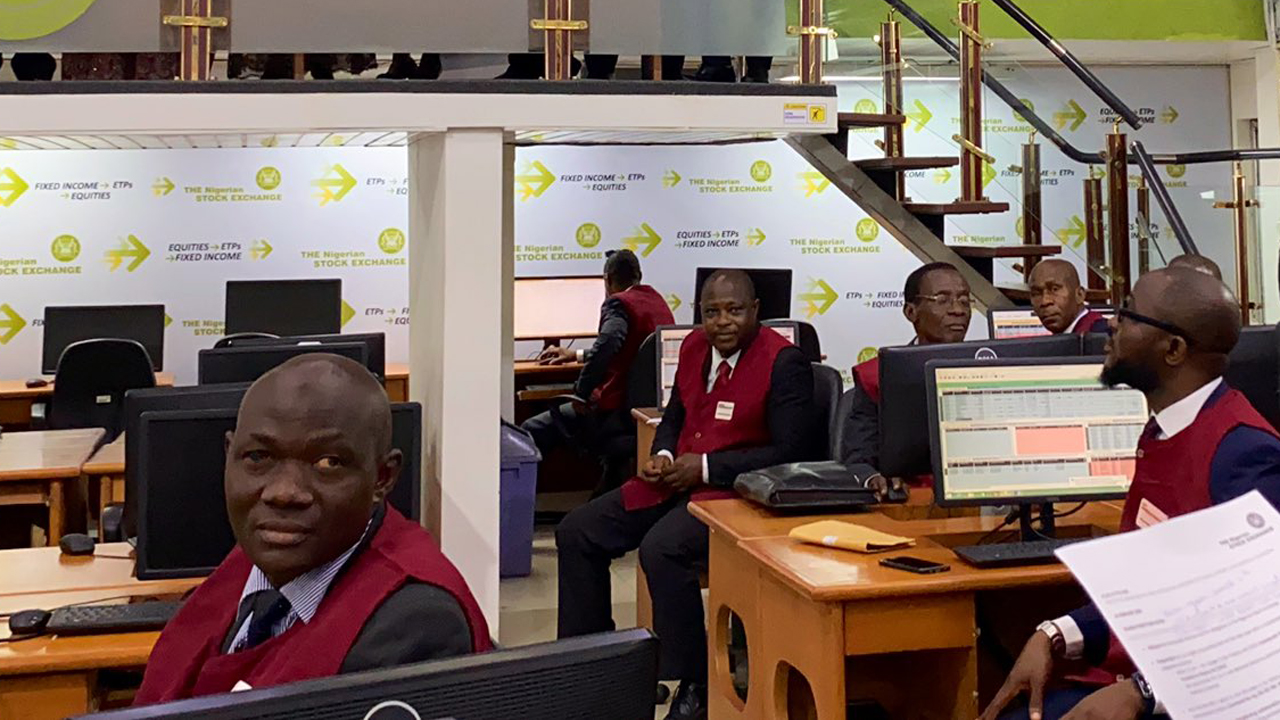

The Nigerian Exchange Limited (NGX) closed the first quarter of 2024 on a high note, fueled by renewed investor confidence in listed companies.

This prevailing optimism has translated into discernible changes in purchasing patterns, resulting in the All-Share Index achieving a remarkable closure at 104,562.06 index points at the quarter’s conclusion.

The market operators predicted that the primary market for equities may take center stage in the second quarter of 2024 driven by the imminent takeoff of a banking recapitalization exercise.

Mr.David Adonri, Managing Director of Highcap Securities Limited, said due to the takeoff of the banking recapitalization exercise, the Nigerian Capital Market is expected to shift to the primary market in the second quarter of 2024.

“We predict a redirection of focus towards the primary market as a result of the impending banking recapitalization exercise,” he said.

Adonri also expressed doubt regarding the sustainability of the prolonged rally observed in the secondary market for equities.

“I do not foresee the continuation of the bullish trend in the secondary market for equities into the second quarter of 2024.” he said.

READ ALSO: NGX: Equities market dips further as investors lose N62bn

Similarly, analyst and Head of Research at FSL Securities Limited, Mr. Victor Chiazor outlined his projections for the equities market, focusing on the influence of corporate actions surrounding the first quarter of 2024 earnings and dividend payments for FY’23 results, which are slated to be announced and disbursed in the second quarter of 2024.

According to Chiazor, companies boasting impressive first quarter of 2024 results and offering attractive dividend yields for FY ’23 are poised to draw heightened investor interest, potentially driving up investment in their shares.

“The equities market would be largely driven by corporate action around first quarter earnings and dividend payments for FY ’23 results which will be announced and paid in the second quarter of 2024.

“Companies with impressive first quarter results and decent dividend yields for FY’23 are expected to attract higher investments towards their shares compared to those with weak earnings and lower dividend yields especially given the high-interest rate environment,” he said.

An Investment Banker and Stockbroker, Mr. Tajudeen Olayinka noted that that first quarter showcased a commendable performance, particularly during the months of January and February, where significant gains were realized.

READ ALSO: NGX ends bullish run, crashes by 1.4% to hit 82,024.38 points

However, he noted that March 2024, while still positive for the index, was marked by socio-economic disruptions and profit-taking activities.

According to him, investors grappled with challenges stemming from high inflation and negative real returns in the fixed-income market, prompting the Debt Management Office (DMO) to issue Treasury Bills with yields exceeding 20 per cent for one-year maturities.

“The market is likely to witness a robust performance in the second quarter of 2024, as CBN continues to stabilize the exchange rate of the Naira with inflows from foreign portfolio investors and Diaspora remittances,” he said.

Entertainment1 week ago

Entertainment1 week ago

Entertainment5 days ago

Entertainment5 days ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Business1 week ago

Business1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Health6 days ago

Health6 days ago

Football6 days ago

Football6 days ago