Business

Are foreign investors deserting Nigeria?

Published

3 years agoon

By

Marcel Okeke

It is sheer paradox that the more Nigeria tries to woo foreign investors, the more those investors flee in droves from the country. This trend reflects in the very poor shape of some of the key indicators of socio-economic progress in recent times. Without a doubt, inflow of foreign investment into an economy is, all things being equal, a strong vote of confidence on such a country’s investment climate and economic stability. But, for Nigeria, foreign investment (or foreign portfolio investment) through the Nigerian Exchange (NGX) Limited fell (year-on-year) by a whopping 40.5 per cent to N145.08 billion in the first half, 2023, from N243.49 billion in first half 2022.

The scenario was not any better in the first quarter 2023, as data from the National Bureau of Statistics (NBS) show total Foreign Direct Investment (FDI) into Nigeria was a mere US$48 million. This is as against US$84 million in the last quarter 2022; representing a decline of 43 per cent on a quarter-on-quarter basis. On a year-on-year comparison, this would show a substantial 69 per cent decrease, as FDI fell from US$155 million in first quarter 2022 to US$48 million in first quarter 2023.

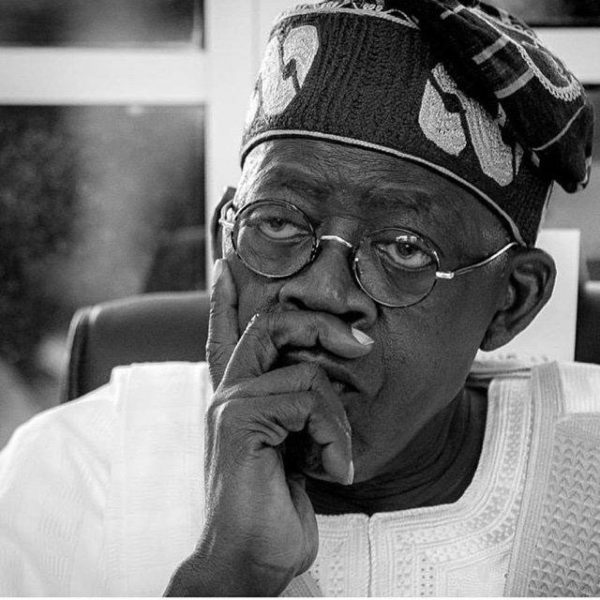

Unarguably, these dwindling investment inflows (both FPI and FDI) are manifesting at a time when the Nigerian Government has been implementing reforms obviously targeted at attracting more foreign investment. Not a few people believe that recent economic liberalization measures of the Bola Ahmed Tinubu administration (fuel subsidy removal and exchange rates unification) were aimed at attracting investments from within and outside the country. Unfortunately, as it were, the unintended consequences of those ‘reform’ policies have been practically ‘sinking’ the economy and unleashing interminable hardship on the citizenry.

Put differently, the declining investment inflow into the country reflects low investor-confidence in the Nigerian economy; mostly driven by prolonged foreign exchange (FX) scarcity as well as uncertainties caused by the build up to the 2023 general elections. The Naira redesign policy and its (un)intended consequences were truly scary to all economic agents—especially—the investors. The ‘show of power’ and ding-dong between the Presidency (then) and the judiciary (the Supreme Court) on the matter of availability and acceptability of certain Naira denominations negatively affected all (financial) market activities.

The Bretton woods institutions (The International Monetary Fund (IMF) and the World Bank) have never relented in urging and nudging the Nigerian Government to adopt full liberalization of the economy. To them, market forces should determine the prices all products and services, including public goods. This accounts for why, in its recent Country Report for Nigeria, the IMF blamed what it termed “Nigeria’s complex exchange rate policy and multiple exchange rates” as some of the factors impeding the inflow of FDI and FPI to the country.

Reflecting the impact of global geopolitics on capital flows, the IMF noted that “firms and policy makers are increasingly looking at strategies for moving production processes to trusted countries with aligned political preferences to make supply chains less vulnerable to geopolitical tensions.” In the face of this, the Fund advised that multilateral efforts aimed at preserving global integration are the best way to reduce the large and widespread economic cost of FDI fragmentation.

ALSO READ: How much really is Nigeria’s external reserve?

“Some countries could reduce their vulnerability by promoting private sector development, while others could take advantage of the diversion of investment flows to attract new FDI by undertaking structural reforms and improving infrastructure,” the IMF said. On its part, the World Bank said FDI in Nigeria remains low because of “limited forex availability, security concerns and other structural challenges”. According to the Bank, these challenges have also affected the net withdrawal of equity by foreign investors.

All said, however, the barrage of policies or reforms by the President Bola Tinubu administration would seem to be escalating rather calming the volatility in the FX market. This has led to the non-stop crashing of the Naira against the dollar and other world currencies. In truth, the FX volatility, coupled with the inability of businesses to access foreign exchange (without hassles), is really stymying investment: both FDI and FPI. Without a doubt, investors are scared of the kind of environment where they would bring in millions of dollars, but end up having their earnings trapped or being allowed to repatriate a few thousands of dollar-revenue. Till date, not a few foreign investors (FDI) have their monies trapped in Nigeria because of acute scarcity of the greenback.

The scandalous case of many foreign airlines (operating in Nigeria) whose (earned) revenues running into close to a billion dollars got trapped in Nigeria, is ever fresh in the mind of investors. Truth be told: Nigeria, as a highly import-dependent economy experiences massive demand for dollar at all times—with static or dwindling supply of the currency in the FX market. This is why, since the liberalization of the FX market (or floatation of the Naira) by the current administration in Nigeria, the local currency has been on a free-fall against all other currencies. Some sort of equilibrium in the forex market got distorted: currency speculators, hoarders, round-trippers, racketeers, etc. got unleashed into the FX market.

Rather than sanity, the new policies in the FX market introduced insanity and confusion—even as the monetary authorities seem to have reached their wits end. In truth, the economic structure of Nigeria is not such that Naira flotation or devaluation would translate to improved exports (that is, rise in the demand for goods and services from Nigeria). Nor is the environment such that can attract local and foreign investors on the basis of weak local currency alone. The ‘ease of doing business’ in the country is nothing to write home about; the state of physical and social infrastructure remains appalling. Multifaceted insecurity has remained a feature of the country for several years now; the situation is life threatening.

The world has since become a global village; and investments flow to climes that guarantee not only high returns but also security of life and property. Investments go to places with low corruption perception indices, strict adherence to rule of law and high regard for good corporate governance and sustainability tenets. Nigeria, in truth, ranks very low on these indices or attractions for business. A country that cannot safeguard the mainstay of its economy—crude oil—from the ravages of ‘organized theft’, cannot be perceived as capable of guaranteeing safety of business entities.

More than anything else, this could be why many International Oil Companies (IOCs) have quit the shores of Nigeria in recent years. Clutching onto ‘energy conversion’ fad, most of the IOCs fled Nigeria, claiming to be migrating to places where ‘renewable energies’ are in vogue. The IOCs practically waited for eons to see and be guided by the country’s oil industry roadmap, but got frustrated when the Petroleum Industry Bill (PIB) had to spend indeterminate number of years on the Federal legislative shelves. Owing to this, major new investments in oil sector got stalled (or deferred) or diverted to other jurisdictions.

Today, Nigeria, a country that used to enjoy the place of pride as the number one oil producer and exporter on the African continent, ranks fourth; producing crude oil far below its OPEC allotted quota of 1.8 million barrels per day. Insecurity around oil facilities across the Niger Delta is equally a major deterrent to existing and prospective investors. All these sum up to a clarion call on the Tinubu administration to quickly begin to address the multifaceted challenges of the country, if foreign investment must begin to flow into Nigeria, going forward. At present, the business environment appears too hostile and unattractive.

- The author, Okeke, a practising Economist, Business Strategist, Sustainability expert and ex-Chief Economist of Zenith Bank Plc, lives in Lekki, Lagos. He can be reached via: [email protected]

Trending

Health6 days ago

Health6 days agoDeclassified CIA memo explored concealing mind-control drugs in vaccines

Entertainment1 week ago

Entertainment1 week agoSimi addresses resurfaced 2012 tweets amid online backlash

Crime6 days ago

Crime6 days agoSenior police officers faces retirement after Disu’s appointment as acting IGP

Education1 week ago

Education1 week agoPeter Obi urges JAMB to address registration challenges ahead of exams

Health1 week ago

Health1 week agoNAFDAC issues alert on suspected revalidated SMA Gold infant formula

Comments and Issues7 days ago

Comments and Issues7 days ago20 Critical Fixes to Save Nigeria’s Democracy from Electoral Fraud

Latest7 days ago

Latest7 days agoICPC yet to respond to El-Rufai’s bail request as arraignment date looms

Football1 week ago

Football1 week agoMartínez ruled out of Everton clash with calf injury