By Odunewu Segun

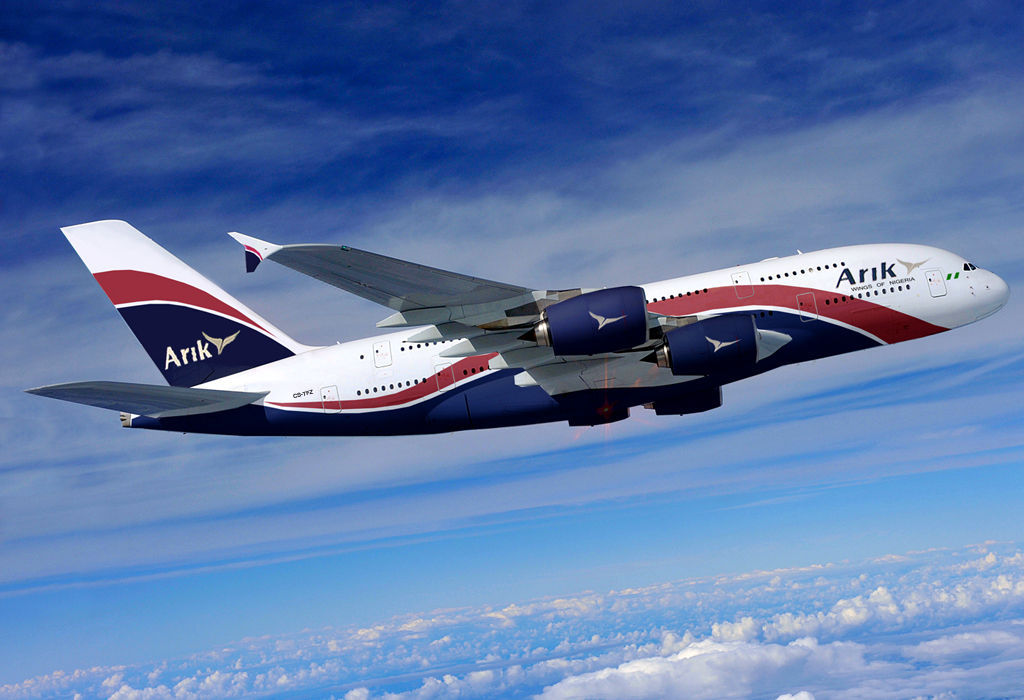

Embattled Arik Air has been described as a disaster waiting to open if the Asset Management Corporation of Nigeria (AMCON) had not intervened and took over the management of the airline, National Daily has gathered

Spokesman of AMCON, Jude Nwazor who interacted with aviation correspondent on Wednesday, April 12 disclosed that as at the time AMCON intervened in Arik, the company had no single tyre in its store whereas they used to utilize 48 tyres every month.

“This means Arik Air has been toying with the lives of Nigerians. If AMCON had given Arik Air 25 years, it would not be able to pay up the debt,” he said, adding that contrary to claim, the former management does not have assets that could cover its indebtedness.

He said, “AMCON took over Arik to underscore government’s decision to instill sanity in the nation’s aviation sector and prevent a major catastrophe that protected and preserved Arik.

“The takeover would among other objectives enhance the value of Arik, improve customer experience, and sustain the safety, reliable and secure operational history of the airline.

“Arik was in a precarious situation largely attributable to its heavy financial debt burden, bad corporate governance, erratic operational challenges and other issues, that required immediate intervention in order to guarantee the continued survival of the Airline.”

Also in an affidavit deposed to on April 11 before the Federal High Court in Lagos by the Receiver Manager of the airline, Oluseye Opasanya, Arik owed almost N387 billion.

ALSO SEE: Arik Air crumbles under huge debt burden – AMCON

This amount comprises N375bn local debt; €31million being owed Lufthansa Technik Group which manages Arik Air planes and $6.5m being indebtedness on the west coast. The foreign component of the indebtedness is estimated to about N12bn.

The breakdown of the debts, according to the court document showed that the former shareholders of Arik Air owe various creditors huge sums of money in services rendered and loan obtained at one time or the other.

Among those being owed are Federal Airports Authority of Nigeria (FAAN) with a claim of N11.2bn; unremitted pension fund of N4.5bn; Insurance premium, N418.8m; N337.5m claim from Pan African Capital Limited for financial advisory services allegedly rendered to the former management; and N277.4 being judgement debt allegedly due to Nigerian Aviation Handling Company.

Others are N203.8m claims for aviation insurance cover; N60.7m claim from Babington Ashaye & Co for tax consulting services; N40.1m claim from Wakanow.com for alleged incentive payout; N22.2m being alleged refund settlement for unused tickets to some 275 passengers; N19.08m being owed 21st Century Technologies Limited; N6.1m for alleged tax liability to the Kwara State Government, among others.

Entertainment1 week ago

Entertainment1 week ago

Business1 week ago

Business1 week ago

Health1 week ago

Health1 week ago

Business1 week ago

Business1 week ago

Latest1 week ago

Latest1 week ago

Football1 week ago

Football1 week ago

Entertainment1 week ago

Entertainment1 week ago

Entertainment6 days ago

Entertainment6 days ago