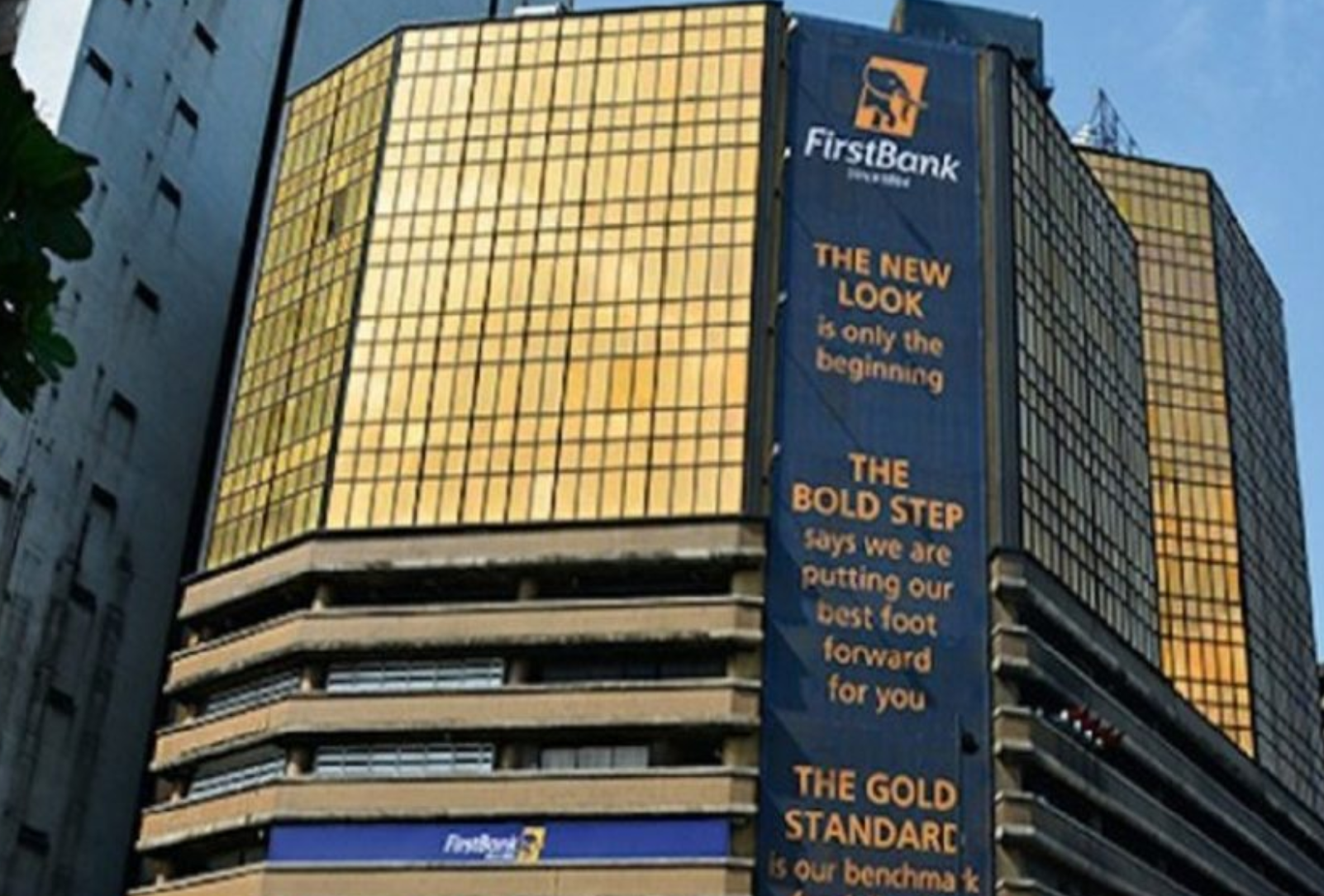

Nigeria’s oldest bank, FBN Holdings became the most capitalized bank in Nigeria at the close of trading on Monday 25th February 2024, overtaking GTCO which has held the position for a while now.

GTCO is now the second most capitalized bank on the exchange having just recently toppled Zenith Bank. GTCO has a market capitalization of N1.14 trillion after its share price closed at N39.05 per share

Zenith Bank shares closed at N35.3 with a market cap of N1.1 trillion closely behind GTCO. UBA is third with a market cap of N813.9 billion. Access Bank has a market cap of N12.6 billion.

FBNH’s share price closed trading at N34 per share, becoming the largest bank in the country by market capitalization. The stock opened trading at N31 per share and fell to as low as N30 per share before closing at N34 per share thus topping GTCO as the most capitalized stock.

FBNH’s share price has seen a remarkable increase in market value following the announcement of billionaire investor Femi Otedola as a majority shareholder of the bank last year.

READ ALSO: FBNH rejoins UBA, Dangote, Zenith, others as Nigeria’s most valuable listed companies

Since then, the share price has surged by 230 per cent, making it one of the best-performing banking stocks over the past year, remaining above this threshold in the early part of 2024, before dipping below a market capitalization of N900 billion two weeks ago.

However, the stock is experiencing a resurgence, coinciding with the bank’s recent accolade from Euromoney, being named the Best Corporate Bank in Nigeria for 2023.

Additionally, FBNH recently unveiled its unaudited results for the fiscal year 2023, which showed profits soaring by 127 per cent to N309.8 billion, marking the highest ever recorded by the bank.

FBNH’s rise to become the most capitalized stock likely didn’t come as a surprise to stock market investors familiar with the significant impact Femi Otedola’s involvement can have on a company’s fortunes.

For instance, his acquisition of shares in Transcorp Group catalyzed a sustained increase in the stock’s price, even long after his exit, culminating in Transcorp ending the year as one of the best-performing stocks.

Furthermore, following his recent announcement of purchasing shares in Dangote Cement, the stock has surged by as much as 139 per cent this year.

Otedola’s flagship investment, Geregu Power, has seen an exponential increase, up by ninefold in just over a year and a half since its debut at around N100 per share.

Entertainment5 days ago

Entertainment5 days ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Health7 days ago

Health7 days ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Health3 days ago

Health3 days ago

Football7 days ago

Football7 days ago

Football7 days ago

Football7 days ago