By Odunewu Segun

MTN, which makes a third of its revenue in Nigeria, said it expects a headline loss, and will issue a further trading statement on the likely range within which its headline loss is expected.

National Daily gathered that the South Africa-based MTN Group expects to report a full-year loss due to a $1 billion regulatory fine in Nigeria and underperformance there and at home, sending its shares to a two-month low.

Eight analysts polled by Reuters had expected the company to post a 39 percent fall in headline earnings per share to 455 cents.

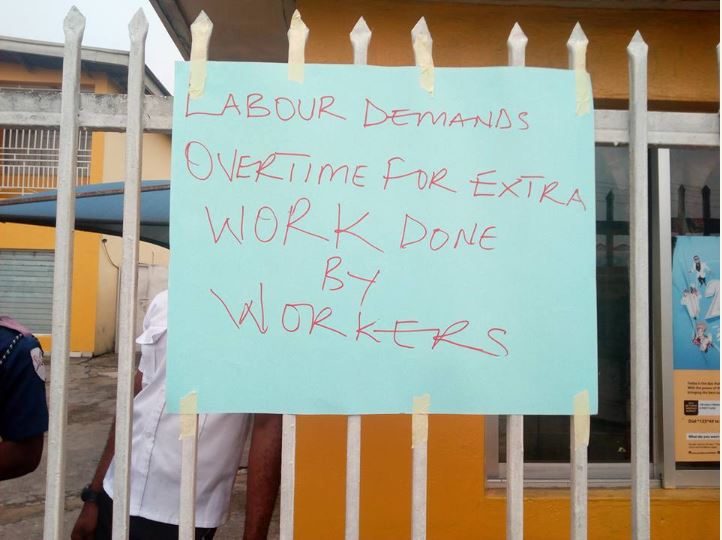

MTN agreed in June to pay Nigeria a 330 billion naira ($1.05 billion at the time) fine for missing a deadline to cut off unregistered SIM cards from its network.

The fine, which was originally set at $5.2 billion, shaved off 474 cents per share from headline earnings per share, a primary profit gauge that strips out certain one-off items.

In the mix of paying the fine, MTN is being investigated by Nigerian lawmakers for illegally repatriating $14 billion between 2006 and 2016, the second major dispute analysts have said exposes the inherent risk of investing in frontier markets.

Shares in MTN, which fell more than 4 percent at market open, were 2.18 percent lower at 115.16 rand at 1043 GMT, the lowest level since December.

Underlying operational results for full-year 2016 were also affected by fees incurred for a planned listing in Nigeria and under performance of its unit there and in South Africa in the first half of 2016.

MTN has said it aims to list its Nigerian operations on the local bourse during 2017, subject to market conditions. However, the unit has been battered by the weak economy, depreciation of the naira and the disconnection of l4.5 million subscribers in February last year.

The appointment of banker Rob Shuter, who starts next month, as chief executive is expected to bring operational strength and step up Africa’s biggest telecoms company’s hunt for returns, possibly in financial services.

“We hope that this new CEO with a stability mentality will be able to stabilize MTN and not venture into all these risky operations,” said Momentum SP Reid analyst Sibonginkosi Nyanga.

Health1 week ago

Health1 week ago

Latest2 days ago

Latest2 days ago

Trends3 days ago

Trends3 days ago

Crime1 week ago

Crime1 week ago

Energy7 days ago

Energy7 days ago

Latest1 week ago

Latest1 week ago

Aviation1 week ago

Aviation1 week ago

Latest1 week ago

Latest1 week ago