In spite of the COVID-19 lockdown in 2020 which almost crippled some businesses across the world, CEOs of 11 commercial banks out of the 13 listed on the Nigerian Exchange limited as well as those of two unlisted banks earned N1.7bn between them in executive pay.

According to a report by Premium Times, this was one per cent less than the N1.74 billion earnings for 2019, implying that a majority of the bank heads maintained the same compensation packages of the previous year, while some took higher pay even when the CEOS probably worked for limited hours by reason of coronavirus lockdowns.

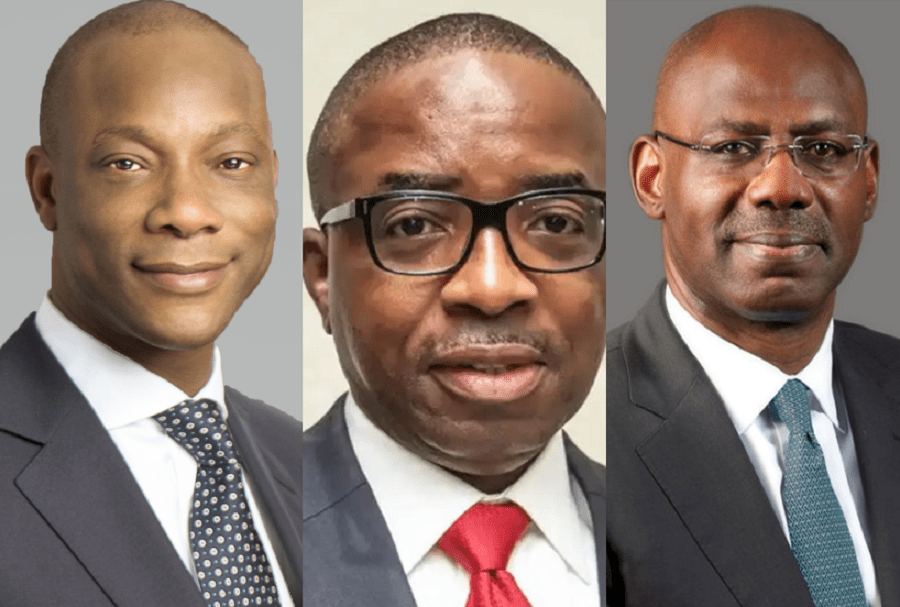

GTB’s Segun Agbaje maintained the top spot, his N400 million earnings almost two times those of his closest rival. Oluwatomi Somefun of Unity Bank earned the least pay.

Zenith’s Ebenezer Onyeagwu took a pay rise of more than four per cent bringing his remuneration to N230 million, while his FBN Holdings counterpart, U.K Eke, received N122 million, about 2 per cent higher than his earnings for 2019.

READ ALSO: GTbank MD, Agbaje, earned more than other bank CEOs in 2020

On the contrary, Innocent C. Ike of Polaris took N65 million, N19 million lower than his 2019 pay, just as Union Bank Managing Director Emeka Emuwa received almost 5 per cent less. Both CEOs opted for a pay cut even when their banks posted increases in profit. The emoluments of the rest 8 CEOs were unchanged.

Generally, the emoluments of bank directors in Nigeria were little impacted by the 2020 global economic crisis, given a modest increase in their pay and entitlements for the year, relative to those of 2019.

Only one (FirstBank) of the Big 5 banks, commonly called FUGAZ, reported an increase in directors’ remuneration; the rest four recorded a drop. In some ways, it reflects the efficiency of frugality as a winning factor in the time of austerity. Even when some lenders had grounds like bigger revenues and profits to up the pay of directors, they chose to lower them and took the longer view by laying up more earnings for future operations.

Fidelity, Polaris and Sterling all upped the emoluments of board members (excluding CEOs) despite reporting a slide in revenue, with Fidelity increasing its by as much as 78 per cent. Wema retained the remuneration of its top rank at the same level as 2019.

Cutting its directors pay by almost one third, Zenith Bank adopted the most prudent approach in compensating its directors of the 14 banks.

It was also gathered that while the banks did well amid COVID-19 in terms of profits, this didn’t stop them from cutting jobs and pay of some staff.

Figures from the National Bureau of Statistics show that the total number of staff in commercial banks fell by 9.03 per cent to 95,026 from 103, 610 in 2019. Not all who left the sector were dismissed. Some resigned and others retired.

The bulk of those who lost their jobs were contract staff. The number of contract workers dropped from 45,350 in 2019 to 39,798 while the total number of junior staff declined from 39, 896 to 37,590.

Interestingly, the commercial banks increased their sizes of their executive staff from 184 to 257, a 39.67 per cent rise, that pushed total personnel cost by 3.37 per cent to N552 billion.

Entertainment1 week ago

Entertainment1 week ago

Entertainment4 days ago

Entertainment4 days ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Business1 week ago

Business1 week ago

Health6 days ago

Health6 days ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Football6 days ago

Football6 days ago