Business

Nigerian Economy 2025: Forlorn Hope and Uncertain Terrain

Published

1 year agoon

By

Marcel Okeke

The latest damning report of the Economist Intelligence Unit (EIU) which says that Nigeria’s business environment will remain among the most difficult in the world over the next five years, is both insightful and ominous. The report truly signposts the dreary outlook of the Nigerian economy in 2025 and the next few years.

The EIU is the research and analysis division of the highly influential The Economist Group—the sister company of The Economist of London. In its ‘Country Analysis’ on Nigeria released on Tuesday, December 3, 2024, the EIU cited several factors contributing to the bleak assessment, including high inflation, a collapse in the US dollar market size, an overstretched fiscal position and sluggish output.

“International oil prices are expected to be high enough to lubricate the system and prevent a recession, but Nigeria will not return to the high rates of economic growth that it achieved in the first decade of the 21st century,” the report said.

Furthermore, the EIU said, “the size of the bureaucracy will, if anything, increase. Structurally, institutions are sclerotic and dysfunctional on multiple levels, with corruption, politicization of judiciary, rampant instability and wide infrastructure gaps—all drawbacks to the business environment.”

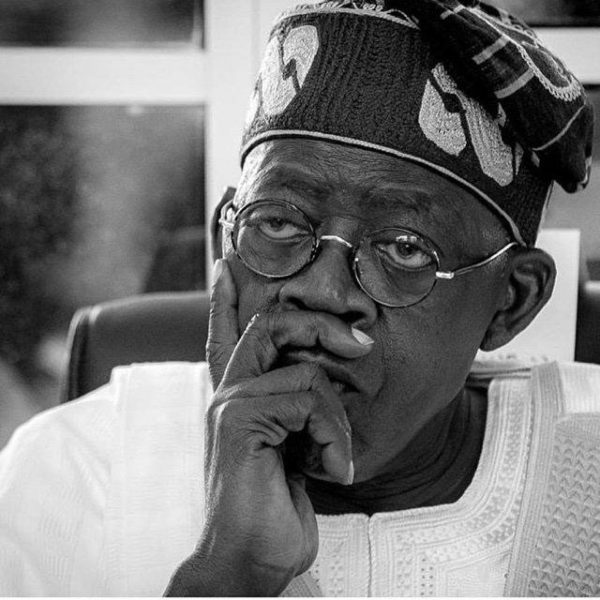

The motley challenges of the Nigeria polity as pointed out by the EIU are rooted in the outcomes of the reform initiatives of the President Bola Ahmed Tinubu-led administration in the past 18 months. Inflation rate that has maintained a runaway trend, rose from 22.40% in May 2023 to 33.88% in October 2024—a jump of almost 12%.

This trend was, without a doubt, triggered mainly by the fuel subsidy removal policy at end-May 2023 by the President Tinubu administration. From below N200 per liter, the price of Premium Motor Spirit (PMS) spiked to around N700 per liter; it is now at over N1000 per liter across the country.

This sudden spike in the prices of PMS had quickly resulted into outlandishly rising cost of transportation, as well as soaring prices of all goods and services. This has in turn translated into a hyper-inflationary trend that has thoroughly weakened the purchasing power of the citizenry.

In trying to assuage the pains, poverty and suffering unleashed on Nigerians by the outcomes of the policy initiatives, the President Tinubu administration disingenuously came up with the concept and practice of palliatives. However, for a year-and-six-months now, rather than alleviating the plight of the populace, the palliatives packages have proven to be mere crumbs. It has rather caused more hunger and anger in the land.

ALSO READ: Naira strengthens against Euro amid FX reforms, European political instability

With the basic needs such as food, accommodation, transportation, healthcare getting out of the reach of most Nigerians, the economic condition has literally become an existential threat. The deteriorating condition seems being sustained by the persisting shortage of PMS, leading to its ever rising prices.

Surprisingly, rather than addressing the problem of total dependence on imported refined petroleum products since the fuel subsidy removal, Government has been licensing more importers of the products. This reality hugely accounts for the gulping of a large chunk of the scarce foreign exchange (FX) by the PMS import spree.

This demand by PMS importers has been a major pressure on the FX market—leading to the endless fall of the Naira against the dollar. The full floatation of the local currency in June 2023 has provided the backdrop for its continuing depreciation, as ‘market forces’ were allowed to determine the exchange rate in the FX market.

By end-May 2023, the Naira exchanged at about N500/$; at a point, the rate almost hit N2000/$. Today, the naira exchanges at N1720 to dollar at the parallel market, and about N1663 to dollar at the official window. In the face of this level of exchange rate, the assumption of N1400/$ in the Mid-Term Expenditure Framework (MTEF) for the 2025 Appropriation Bill is obviously off the mark. It is unrealistic!

It is also more of a forlorn hope to couch the 2025 Federal budget on the assumption that Nigeria’s volume of crude oil production would stand at two million barrels per day (mbpd). Historical evidence shows that for a number of years, Nigeria has been producing far below its OPEC quota (about 1.8 mbpd); most times, at only about a million barrels per day. Although this has inched up to 1.35—1.50 million barrels per day, the industry is yet dogged by a myriad of challenges, including the oil theft phenomenon.

Indeed, according to OPEC’s monthly oil market report for November, Nigeria’s daily crude oil production increased from 1.39 million barrels per day (mbpd) to 1.43 mbpd in October 2024. With this level of oil production and poor outlook of the industry, it becomes a mere wishful thinking for the 2025 budget to be anchored on 2.06 mbpd oil production.

Note that this unfounded oil production optimism is in the face of the borrowing spree of the Federal Government—via Eurobonds and local monetary instruments. In point of fact, the MTEF approved by the Legislature has a proposed 2025 budget size of N47.9 trillion and new borrowing of N9.22 trillion, comprising both domestic and foreign loans. And debt servicing is to gulp N15.38 trillion!

The fearsome augury of these proposals is further exacerbated by the persisting runaway inflationary trend, the fight against which has seen the Central Bank of Nigeria (CBN) raise the indicative interest rate (Monetary Policy Rate, MPR) from 18% in May 2023 to 27.50% in November 2024. For the umpteenth time, the apex bank has posited its efforts at checkmating the high inflationary trend as reason for endless hike in MPR and other parameters.

Unfortunately, the policy mix of the Federal Government is such that encourages ‘cost push’ factors that drive the spiraling inflation. High ‘imported inflation’ arising from FX utilization for inputs and equipment—consistently feed into pricing for the ultimate consumer. This, added to the high cost of funds (high interest rate), high electricity tariff, and distribution, among others, push product prices through the roof.

Put together, all these make Nigeria’s 2025 economic outlook foggy and uncertain. This undesirable prospect aptly tallies with the EIU’s ranking of the country among the most challenging business environments for the next couple of years.

The unusual situation where, in early December, the Appropriation Bill for the succeeding year is yet to be formally presented to the National Assembly, as is the case today, is befuddling. Against the spirit and intendments of the Fiscal Responsibility Act (FRA) 2007, the 2025 Appropriation Bill is yet in the works—merely three weeks to end-2024. This further shrouds year 2025 in uncertainty!

Surprisingly, what rather features copiously in public debate today is the highly controversial tax reform bill. In a rare development, the National Economic Council (NEC) headed by the Vice President, has called for the withdrawal of the Bill from the National Assembly to make for “more consultations” among stakeholders.

Similarly, the Nigerian Governors’ Forum (NGF) has called for the retrieval of the Bill form the Legislature, for further deliberations. In the same vein, groups of states in various regions of the country have also strongly advocated for more consultations around the Bill by key stakeholders. On its part, the Presidency has not only insisted on expedited Legislative action on the Bill, but urges all to forward their “observations and reservations” for a holistic legislative deliberation.

All these, to say the least, have been heating up the polity; and perhaps, accounts for why the 2025 Federal Budget is literally in limbo. Again, this heightens uncertainty about the economy in 2025. How soon the tax bill imbroglio will be resolved remains indeterminate.

- The author, Okeke, a practicing Economist, Business Strategist, Sustainability expert and ex-Chief Economist of Zenith Bank Plc, lives in Lekki, Lagos. He can be reached via: [email protected] (08033075697) SMS only

Trending

Entertainment1 week ago

Entertainment1 week agoSinger Simi sparks debate after calling for death penalty for rapists

Business1 week ago

Business1 week agoNaira mixed across markets as official window dips, parallel market strengthens

Health1 week ago

Health1 week agoStudy suggests possible link between cell tower radiation and rising diabetes cases

Business1 week ago

Business1 week agoNaira hits N1,337 against Dollar amid positive market sentiment

Latest1 week ago

Latest1 week agoADC blasts APC over electoral act amendment, warns against ‘democratic backsliding’

Entertainment1 week ago

Entertainment1 week agoTems, Burna Boy set new African record with most entries on Billboard hot 100

Football1 week ago

Football1 week agoUCL Playoff: Gordon scores four as Newcastle thrash Qarabağ 6-1

Entertainment5 days ago

Entertainment5 days agoSinger Simi faces backlash after TikToker admits to false rape allegation