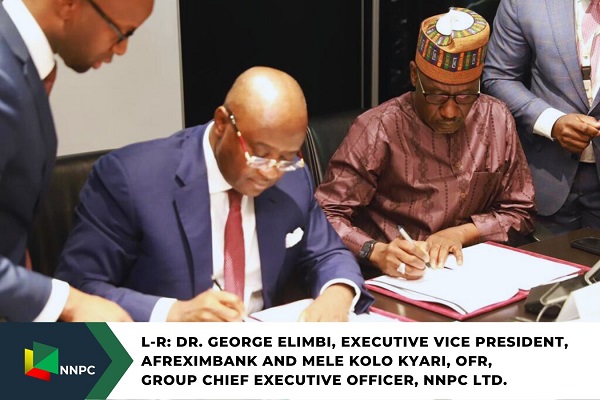

News broke on Wednesday that Nigeria’s national oil company, the Nigeria National Petroleum Company Limited (NNPCL) signed a loan agreement to the tune of $3 billion in what is dubbed Emergency Crude Repayment Loan with African Export-Import Bank (Afreximbank).

In a short statement disclosing the deal, the NNPC said the commitment letter, which was signed at AFREXIM Bank’s headquarters in Cairo, Egypt on Wednesday, will enable it to support the Federal Government in its ongoing fiscal and monetary policy reforms aimed at stabilising the exchange rate market.

Here is what you need to know about the loan deal and how it will impact Nigeria’s economy and the national currency, naira.

READ ALSO: Just in: NNPCL secures $3b emergency loan to strengthen the naira

- The crude repayment loan is not a crude swap or crude for refined products deal but an upfront cash loan against proceeds from a limited amount of future crude oil production.

- The loan is not risky for NNPC Ltd. or the Nigerian Treasury as the exposure for NNPCL is very limited, covering just a fraction of their entitlements. Additionally, there are no sovereign guarantees tied to this loan.

- The loan will assist NNPCL in settling taxes and royalties in advance. It will also equip the Federal Government with the necessary dollar liquidity to stabilize the Naira, with limited risk.

- The funds will be released in stages or tranches based on the specific needs and requirements of the Federal Government.

- With the possibility of enhancing dollar liquidity, which leads to a strengthened naira, the loan initiative will lead to a reduction in fuel costs. This is because if the naira appreciates in value, the cost of fuel will drop and further increases will be halted.

- Subsidy is not coming back as stronger Naira will result in lower prices from the current level, making subsidies unnecessary. The deregulation policy remains unchanged.

- The loan will be repaid against a fraction of proceeds from future crude oil production. It’s a strategic move that ensures a balance between the country’s current economic needs and future production capabilities.

Agribusiness1 week ago

Agribusiness1 week ago

News1 week ago

News1 week ago

News1 week ago

News1 week ago

Football5 days ago

Football5 days ago

Football1 week ago

Football1 week ago

Football1 week ago

Football1 week ago

Entertainment4 days ago

Entertainment4 days ago

Football6 days ago

Football6 days ago