Business

The CBN’s renewed push for Nigeria’s non-oil export

Published

3 years agoon

By

Publisher

By Marcel Okeke

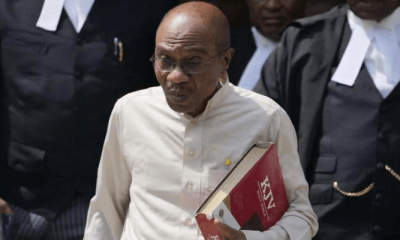

The revelation by no less a person than the Governor of the Central Bank of Nigeria (CBN) late November 2022 regarding the fast-dwindling foreign exchange reserves of Nigeria, left not a few stakeholders and economic agents aghast. Specifically, the Governor, Mr Godwin Emefiele said: “As we all know, for example, the official foreign exchange receipt from crude oil sales into our official reserves has dried up steadily from above US$3.0 billion monthly in 2014 to an absolute zero dollars today.” Emefiele who was speaking at the 57th annual bankers’ dinner organized by the Chartered Institute of Bankers of Nigeria (CIBN) on Friday, November 25, 2022 in Lagos, said “the Nigerian foreign exchange market is in the middle of serious crunch which is straining our reserves and stifling the value of the naira,” adding that “market demand for both goods and invisible transactions has continued to increase under various uses in the face of dwindling supply of foreign exchange.”

From all indications, “absolute zero dollar” inflow into Nigeria’s external reserves from the sale of crude oil (supposed mainstay of the economy) presents a dire scenario and daunting challenge. Apparently, this reality it was that had spurred the apex bank in the past couple of years to adopt a variety of novel non-oil export policies and initiatives. Before now, successive governments (both at the centre and sub-nationals) succeeded only in making non-oil export drive a mantra or a mere singsong—while the ‘petro-dollar’ kept flowing. As they say: ‘there was so much motion without visible movement’. Today, owing to unavoidable local and external vagaries and vulnerabilities confronting virtually all economies across the globe, creativity, commitment and political will must be deployed to keep the Nigerian economy afloat—especially with respect to forex inflow.

Thus, sequel to Emefiele’s lamentation at the 57th annual bankers’ dinner regarding the ‘dried up’ oil forex inflow, the apex bank moved promptly to consolidate its initiatives and raise the momentum on non-oil export drive. This, apparently, gave rise to the theme of the 13th annual Bankers’ Committee retreat (barely two weeks after the CIBN dinner in Lagos) which focused on non-oil exports. On the occasion, Emefiele said that the Bankers’ Committee (composed mainly of top executives of banks) could no longer delay in resolving the structural issues inhibiting non-oil export receipts; hence, the theme of the two-day retreat: “Increasing the Productive Base of the Nigerian Economy: Focus on Boosting Non-Oil Export Revenues”. The CBN boss who is also the Chairman of the Bankers’ Committee, said it was in view of the need to support the fundamentals of the Nigerian economy, diversify from dependence on oil inflows, and minimise the debilitating pressures in the foreign exchange market that the apex bank launched the RT200 programme in February 2022. He said the RT200 initiative, which was designed to stimulate non-oil exports with a US$200 billion foreign exchange income target in three to five years, had been widely accepted and driven by the institutions that constitute the Bankers’ Committee.

The programme (RT200), according to CBN guidelines, is anchored on non-oil export proceeds repatriation rebate scheme—designed to incentivise exporters in the non-oil export sector, to encourage repatriation and sale of export proceeds into the official forex market. In other words, the RT200 was essentially devised to innovatively tackle the fundamental problems associated with the repatriation of non-oil export proceeds. And in the words of Emefiele : “so far, we have recorded and continue to record resounding success with the RT200 programme…inflows through this programme in 2022 rose to about US$1.6 billion and could surpass US$2.5 billion by year-end”. Also, under the rebate scheme of the programme, the CBN has reimbursed a total of N78.4 billion naira, according to available data.

Even before the non-oil export drive momentum being generated by the RT200 programme, the CBN had also rolled out a number of other initiatives to bolster the inflow of foreign exchange into Nigeria in a stable and sustainable manner. One of these, notably, is the Naira-4-Dollar scheme. This initiative reflects the apex bank’s efforts to boost migrant remittances into the Nigeria economy. Under the scheme, all recipients of diaspora remittances through CBN licensed IMTOs are paid five Naira for every USD1 remitted by sender and collected by designated beneficiary. According to CBN’s guidelines, this incentive is to be paid to recipients, whether they choose to collect the USD as cash across the counter in a bank or transfer same into their domiciliary account. At present, CBN’s reports show that the Naira-for-Dollar scheme has been successful in increasing remittance inflows through its registered International Money Transfer Organization (IMTOs).

There is also the “Produce, Add Value and Export (PAVE)” initiative “designed to be the key for fast-tracking a bucket of substitutes to crude oil export which again is expected to encourage backward integration for the local production of select items.” The PAVE, which is shaped after business models of fast-developing economies in Asia, “is expected to make Nigerians consume what they produce, add value to it, and even export the surplus,” according to the CBN Governor. At a recent workshop for finance correspondents in Akure, Ondo State, Nigeria, the CBN boss said the PAVE initiative was akin to South-East Asia’s “much referenced export-led industrialization policy which changed the economic fortunes of countries such as South Korea, Taiwan, Malaysia and Singapore.”

While each of these CBN’s programmes and policies are at various levels of implementation and success, it is appropriate to note that they are some of the most politic and rational efforts in the face of drying forex inflow. The unwholesome circumstances surrounding the production and export of crude oil, especially the burgeoning oil theft and vandalism on oil facilities, seriously curtail Nigeria’s earning power from the commodity. For a fairly long while now, Nigeria has remained the only member of the Organization of Petroleum Exporting Countries (OPEC) that is unable to produce/export up to its allocated quota. It therefore goes without saying that effective diversification of Nigeria’s economy—earning substantial forex sustainably from sources other than oil—is key to any meaningful economic progress. The CBN is therefore taking the right steps in the right direction; it however needs the support, cooperation and goodwill of all stakeholders.

- Mr. Okeke, an economist, sustainability expert and consultant on business strategy, andis a National Daily Columnist. He can be reached at: [email protected]

You may like

CBN Investigator highlights Emefiele’s gross financial offences

Court grants Emefiele bail

Emefiele’s Naira redesign policy responsible for currency’s scarcity–Falana

Debt Management Office To Raise N1.2trn Through Bonds In 3 Months

No plea bargain with Emefiele — AGF

Rumoured arrest of CBN’s Deputy Governor, Aishah Ahmad not true –family

Trending

Entertainment5 days ago

Entertainment5 days agoSimi addresses resurfaced 2012 tweets amid online backlash

Health7 days ago

Health7 days agoSCFN, LUTH introduce bone marrow transplants as curative treatment for sickle cell

Health4 days ago

Health4 days agoDeclassified CIA memo explored concealing mind-control drugs in vaccines

Football1 week ago

Football1 week agoHarry Kane nets brace as Bayern edge Frankfurt 3–2 to go nine points clear

Football1 week ago

Football1 week agoLate Flemming header stuns Chelsea as Burnley snatch 1–1 draw at Stamford Bridge

Crime4 days ago

Crime4 days agoSenior police officers faces retirement after Disu’s appointment as acting IGP

Education6 days ago

Education6 days agoPeter Obi urges JAMB to address registration challenges ahead of exams

Crime1 week ago

Crime1 week agoTwo killed, seven injured in early-morning shooting in Richmond’s Shockoe Bottom