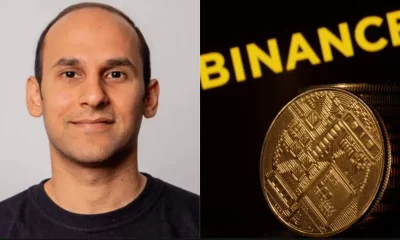

The federal government says it is demanding at least $10 billion as retribution from Binance for profiting from “its illegal transactions” in Nigeria.

Bayo Onanuga, the special adviser on information and strategy to President Bola Tinubu, disclosed this on Friday in an interview with the BBC.

The development comes amid a crackdown on crypto exchange platforms — including Binance — by the federal government.

Nigeria’s government had reportedly detained two top executives of Binance on February 208, 2024, over allegations of price manipulations.

Speaking during the interview, Onanuga said the cryptocurrency platform is causing massive losses for “fixing exchange rates”.

He said the federal government is seeking such retribution from Binance for also fixing foreign exchange rates on its peer-to-peer platform.

READ ALSO: Binance disables the naira feature on its P2P market

“The platform fixes the exchange rate for the country and it is an illegal rate. The CBN is the only authority that can fix the exchange rate for the country,” Onanuga said.

“Binance platform harbours people who fix the exchange rate which quickly affects the Nigerian economy for the time when Nigeria is trying to stabilize the economy. Binance staff cooperated with the government to provide information.”

Prior to the interview, Onanuga had said Binance would destroy Nigeria’s economy if the federal government did not clamp down on the company.

On June 9, 2023, the Securities and Exchange Commission (SEC) said the operations of Binance Nigeria Limited, a subsidiary of Binance, were illegal.

Speaking on the infractions by the crypto exchange platform, Olayemi Cardoso, governor of the Central Bank of Nigeria (CBN), on February 27, 2024, said $26 billion passed through Binance Nigeria from unidentified sources in one year.

Cardoso said the apex bank is collaborating with the SEC to eliminate price manipulations in the FX market.

The CBN, on February 20, announced a partnership with the Office of the National Security Adviser (ONSA) to investigate and penalise those involved in illicit activities within the FX market.

Entertainment1 week ago

Entertainment1 week ago

Business1 week ago

Business1 week ago

Health1 week ago

Health1 week ago

Business1 week ago

Business1 week ago

Latest1 week ago

Latest1 week ago

Entertainment1 week ago

Entertainment1 week ago

Football1 week ago

Football1 week ago

Entertainment5 days ago

Entertainment5 days ago