The ongoing face-off between the federal government of Nigeria and cryptocurrency exchange platform Binance appears to be worsening as the Nigerian government has filed a tax evasion suit against the platform.

The charges were formally lodged at the Federal High Court in Abuja on Monday March 25, 2024 by the Federal Inland Revenue Service (FIRS).

Designated as suit number FHC/ABJ/CR/115/2024, the lawsuit implicates Binance with a four-count tax evasion accusation.

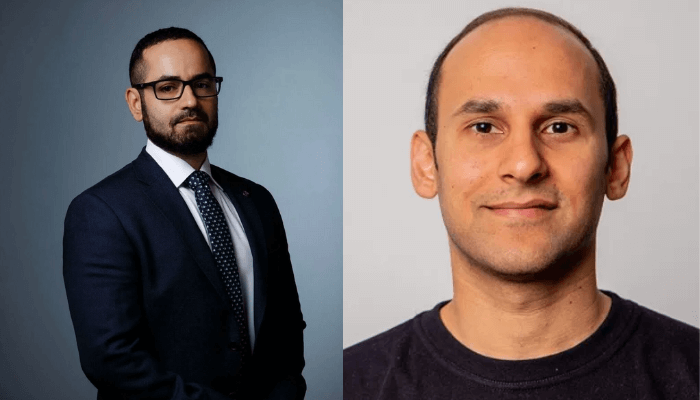

Accompanying the crypto company as second and third defendants in the suit are Tigran Gambaryan and Nadeem Anjarwalla, both senior executives of Binance currently being held in custody by the Economic and Financial Crimes Commission (EFCC).

The charges leveled against Binance include allegations of non-payment of Value-Added Tax (VAT), Company Income Tax (CIT), failure to file tax returns, and complicity in aiding customers to evade taxes through its platform.

Furthermore, the Federal Government accuses Binance of neglecting to register with FIRS for tax purposes and contravening existing tax regulations within the country.

One of the counts in the lawsuit pertains to Binance’s purported failure to collect and remit various categories of taxes to the federation, as stipulated by Section 40 of the FIRS Establishment Act 2007 as amended.

This section explicitly addresses the non-deduction and non-remittance of taxes, prescribing penalties and potential imprisonment for defaulting entities.

READ ALSO: Arrested Binance executive escape from custody

The charges outline specific instances where Binance allegedly violated tax laws, such as the failure to issue invoices for VAT purposes, thereby impeding the determination and payment of taxes by subscribers.

“Any company that conducts business exceeding N25 million annually is deemed, by the Finance Act, to be present in Nigeria,” the FIRS noted in a statement.

“According to this rule, Binance falls into that category. So, it is obligated to pay taxes like Company Income Tax (CIT) and also collect and remit Value Added Tax (VAT). However, Binance did not adhere to these requirements, thus violating Nigerian laws and potentially facing investigation and legal action for this infraction.”

The Federal Government says it remains steadfast in its commitment to ensuring compliance with tax regulations and combating financial impropriety within the cryptocurrency sector.

Meanwhile, one of the detained Binance executive, Nadeem Anjarwall is said to have escaped from the guest house where he was being detained.

According to a report by Premium Times on Monday, the Binance executive escaped on March 22, from the Abuja guest house where he and his colleague were detained.

Anjarwalla was said to have escaped after guards on duty led him to a nearby mosque for prayers in the spirit of the ongoing Ramadan fast.

He is believed to have flown out of Abuja using a Middle Eastern airliner — but how he got on an international flight despite his British passport, is unknown.

On February 28, two of Binance’s top executives – Anjarwalla, a 37-year-old British-Kenyan and Binance’s regional manager for Africa; and Tigran Gambaryan, a 39-year-old US citizen and Binance’s head of financial crime compliance, were detained by the Nigerian authorities for weeks.

The Nigerian government alleges that over $21.6 billion in transactions on Binance involved individuals whose identities were shielded, pointing to potential illicit activities such as money laundering, terrorist financing, and market manipulation.

Health & Fitness3 days ago

Health & Fitness3 days ago

Featured1 week ago

Featured1 week ago

Aviation5 days ago

Aviation5 days ago

Business1 week ago

Business1 week ago

Aviation4 days ago

Aviation4 days ago

Aviation4 days ago

Aviation4 days ago

News7 days ago

News7 days ago

Business1 week ago

Business1 week ago