Business

How Africa can attain full potential – Zenith Bank GMD, Onyeagwu

Published

5 years agoon

The Group Managing Director/Chief Executive of Zenith Bank, Mr. Ebenezer Onyeagwu, has called for increased impact investing in Africa for the continent to attain its full potential.

He made the call during his keynote address at the Africa Investment Risk & Compliance Summit 2021 organised by the Emerging Business Intelligence & Innovation (EBII) Group which was held at the prestigious University of Oxford, United Kingdom, on Friday, July 30, 2021.

Mr Onyeagwu delivered his keynote address after the special keynote address by His Excellency, Nana Addo Dankwa Akufo-Addo, President of the Republic of Ghana & Commander-in-Chief of the Ghana Armed Forces, who was the Special Guest of Honour. Her Excellency Dr Amani ABOU-ZEID, The African Union Commissioner in charge of Infrastructure and Energy, also delivered a keynote address at the Summit.

READ ALSO: Zenith Bank emerges best commercial bank in Nigeria

Delivering the keynote address with the theme “Leveraging Impact Investment Opportunities for Growth in Africa”, Onyeagwu described impact investing as an investment that yields optimal returns for investors, value for all stakeholders, and guarantees continued sustenance and existence of humanity.

He decried the shallowness of Africa’s financial market as depicted by the fact that no African exchange is among the Morgan Stanley developed markets index, only two African exchanges (Egypt and South Africa) are in the MSCI Emerging Markets Index, and just six African exchanges are in the MSCI Frontier Market Index.

He noted that although the International Finance Corporation (IFC) estimates that the global investors’ appetite for impact investing could total as much as $26 trillion, only approximately 8% of the assets of impact intent funds are focused on Africa.

According to him, this is not significant enough, and Africa appears to be in the room but not on the table, considering that Africa is in dire need of investment and the continent’s 1.3 billion people represent about 17% of the global population of about 7.8 billion.

READ ALSO: World Banks Ranking: Zenith Bank retains top position

Citing the immense opportunities in Africa that represent enormous investment propositions for discerning investors, including the huge population, large market and active labour force, and the rich natural endowment, Onyeagwu described Africa as “the new frontier” for global growth.

He made a case for increased impact investment in Africa, noting that investment opportunities on the continent cut across agriculture, healthcare, housing, infrastructure, electricity, and the creative sectors.

He also called investors’ attention to Africa’s rich natural endowment, which includes 60% of the world’s uncultivated arable land and 9% of the world’s freshwater bodies, noting that Africa holds enormous potential for organic food production. He, therefore, implored investors in the agribusiness value chain to focus attention in Africa for organic food production instead of genetically modified food in other climes.

READ ALSO: Zenith, UBA, others expand loan books by N690bn

Onyeagwu also noted that as a socially responsible organisation, Zenith Bank continues to promote impact investment in Africa. For example, the bank has maintained strong advocacy for investment in Africa through its flagship sponsorship of “Inside Africa” on CNN for 16 consecutive years, which is helping to highlight the immense creativity and talent that abound on the continent and the enormous investment opportunities on the continent of Africa.

He also said that the bank leverages its in-depth knowledge of the African market to guide investors and hedge their exposures. According to him, the bank has been on a steady Environment, Social and Governance (ESG) investment journey, which started with ESG integration as a business strategy as well as being a signatory to the Nigerian Principles for Sustainable Banking and the United Nations Environment Programme Finance Initiative (UNEP FI) Principles for Responsible Banking.

For its efforts, Onyeagwu noted that Zenith Bank received recognition as the “Best Company in Promotion of Gender Equality and Women Empowerment in Africa” at the 2020 Sustainability, Enterprise and Responsibility Awards (SERAS).

READ ALSO: Access, Zenith Bank, others jostle for Union Bank shares

In his call to action, Onyeagwu called for a paradigm shift, noting that Africa is a work in progress, and leaders in the public and private sector should not despair. He encouraged leaders to champion the changes they want to see, pay close attention to responsibility and accountability in leadership.

He also called for the de-risking of Africa through reforms, improved ease of doing business, respect for the rule of law and sanctity of contract, and human capital development. Onyeagwu expressed satisfaction with the several reforms of the Federal Government of Nigeria, including the Road Infrastructure Tax Credit Scheme (RITC), the establishment of the Rural Electrification Agency’s (REA) Rural Electrification Fund (REF), Infraco Plc, and several other development finance initiatives of the Central Bank of Nigeria.

He also noted that several African countries, including Ghana, Kenya and Rwanda, are recording massive improvements in the ease of doing business, leveraging digital technology to simplify government processes and deepen the financial system.

Zenith Bank is Nigeria’s largest and one of Africa’s largest financial institutions by tier-1 capital, with shareholders’ funds in excess of NGN1.1 trillion ($2.64 billion) as at December 31, 2020. The bank is a clear leader in the Nigerian financial space, with several firsts in the deployment of innovative products and solutions that ensure convenience, speed and safety of transactions.

Trending

Health1 week ago

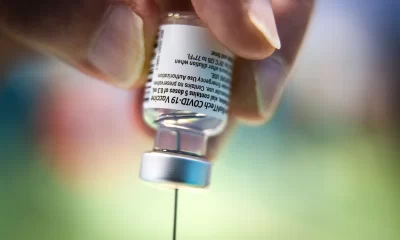

Health1 week agoFOI data show thousands of heart failures reports linked to AstraZeneca COVID-19 vaccine

Latest2 days ago

Latest2 days agoYoruba film industry mourns as popular actress aunty Ajara passes away

Trends3 days ago

Trends3 days agoTonto Dikeh reunites son with Churchill after decade-long split

Crime1 week ago

Crime1 week agoUK Court hears digital, financial evidence in Diezani Alison-Madueke corruption trial

Energy6 days ago

Energy6 days agoNNPC unveils gas master plan to boost Nigeria’s energy sector

Latest1 week ago

Latest1 week agoCourt nullifies PDP National Convention, bars Turaki, others from parading as party officers

Aviation1 week ago

Aviation1 week agoAir Peace dismisses fraud allegations, says Lagos–São Paulo direct flight process ongoing

Latest1 week ago

Latest1 week agoPDP affirms leadership from Ibadan convention after Federal High Court ruling