MTN Group Ltd. is close to reaching a $800 million settlement with Nigerian authorities over a claim it illegally transferred $8.1 billion funds out of the country, according to a person familiar with the situation.

“MTN Nigeria continues to engage with the relevant Nigerian authorities to ensure a mutually acceptable resolution of the matter,” a spokesman for Africa’s largest wireless carrier by sales said in an emailed statement on Wednesday. The Nigerian central bank and presidency declined to comment.

The report by Bloomberg said MTN shares jumped to trade 0.4 percent higher at 81.40 rand as of 1:58 p.m. in Johannesburg. The stock has declined more than 25 percent since the allegations were first made in late August.

A decision to transfer $800 million would come just two years after MTN paid $1 billion to Nigerian authorities as a penalty for missing a deadline to disconnect unregistered subscribers. That levy, which was also substantially reduced from the original sum, led to MTN’s first-ever loss in 2016. The company is also accused of non-payment of $2 billion in taxes.

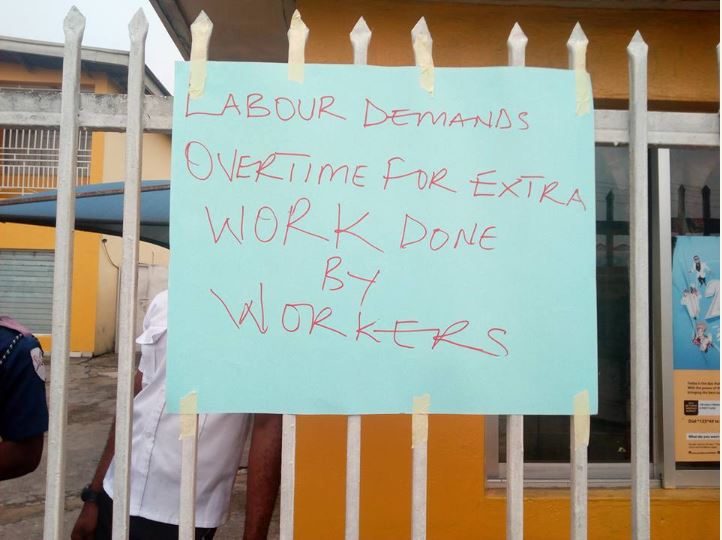

It’s very important the parties reach a quick resolution because the problem gives the wrong signal to willing investors,” Gbenga Adebayo, chairman of the Association of Licensed Telecommunications Operators of Nigeria, said by phone from Lagos. There are many African countries that are investor friendly and are also craving for foreign investment.”

MTN pledged to list its local unit in Lagos as part of a settlement of the earlier penalty from 2015, although those plans are currently in doubt amid the current impasse. MTN The stock is down by more than 50 percent since the start of that first dispute, which also led to an overhaul of management and the arrival of Chief Executive Officer Rob Shuter from Vodafone Group Plc.

MTN has more than 64 million subscribers in Nigeria, making Africa’s most populous country its biggest market.

If the $800 million is a fine, it’s negative because it’s a significant expense for a company that says it’s done nothing wrong,” said Ruhan du Plessis, an analyst at Avior Capital Markets in Cape Town.

Health5 days ago

Health5 days ago

Entertainment1 week ago

Entertainment1 week ago

Crime6 days ago

Crime6 days ago

Education1 week ago

Education1 week ago

Health1 week ago

Health1 week ago

Comments and Issues7 days ago

Comments and Issues7 days ago

Football7 days ago

Football7 days ago

Latest6 days ago

Latest6 days ago