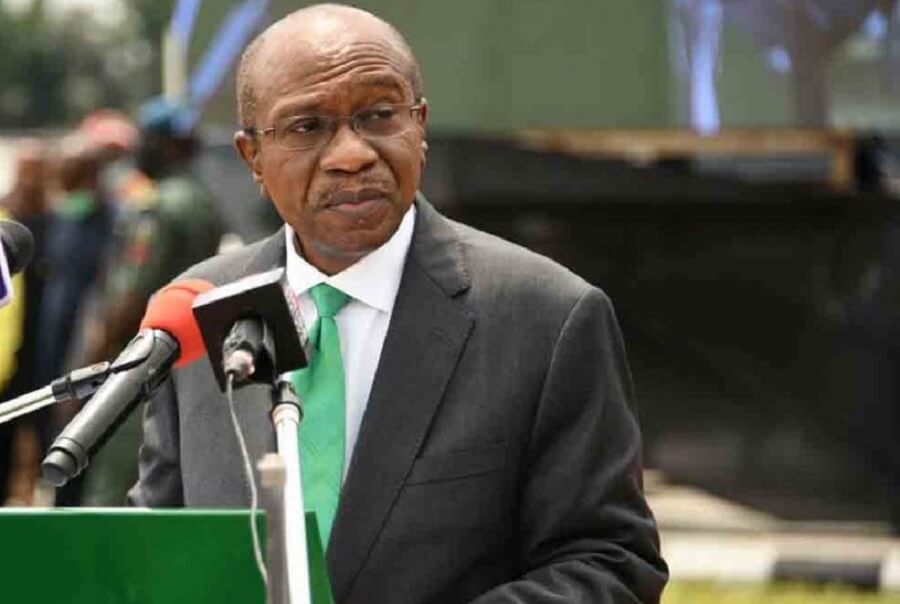

Economic experts in the country have expressed dismay following reports of the $15 billion foreign debts allegedly accumulated by the Central Bank of Nigeria (CBN) during the tenure of the suspended governor, Godwin Emefiele.

The CBN’s first audited financial statements in seven years released on Friday indicated that the apex bank received combined $15 billion cash from JP Morgan and Goldman Sachs in one year.

A former Assistant Director of Research and Planning in CBN, Prof. Jonathan Aremu, said it was scandalous that the bank got itself into such a mess.

The Professor of International Economic Relations at the Covenant University (CU), Ota said he could not readily quantify the economic loss from the CBN action for Nigeria.

He said: “I am aware that the CBN hasn’t published its financial report for years. “This wasn’t the situation in my days at the CBN, because we were always publishing the CBN report year in, year out.

“But things have gone so bad at the CBN. One cannot readily quantify the colossal economic loss to the country because what we are talking about is unheard of.

READ ALSO: CBN releases consolidated financial statements after seven years

“No central bank in the world has had its integrity so impugned like we have seen under Emefiele. This is not good for the country at all. My take is that whoever is involved in bringing the nation to its knees through this debt incurred must not go unpunished.”

The CBN, Aremu said, is not allowed to borrow any money whatsoever from anywhere, because that would be contrary to its core mandate of ensuring the operational efficiency of the micro and macro economy.

The Registrar/CEO, National Institute of Credit Administration (NICA), Prof. Chris Onalo, wondered: “What was the money borrowed for? Was it borrowed for a certain productive sector of the economy?

“Was the CBN in dire financial straits to the extent that it needed to expand its operational efficiency, in terms of monitoring institutions under its regulations?

He said it would be immaterial to conclude on the propriety or otherwise of the CBN decision to borrow until his questions were answered.

A professor of Economics, Sheriffdeen Tella, said: “I am not aware of any CBN Act that allows it to borrow money from Development Finance Institutions on behalf of the federal government.

Tella, who is of Olabisi Onabanjo University, Ago Iwoye, Ogun State, added: “The reason why the CBN isn’t obliged to borrow is because it can easily compromise the external reserves which are domiciled with the World Bank and other DFIs.

“So, if the borrowing was done without recourse to the proper procedures, it is an illegal exercise.”

On his part, Dr. Austin Nweze, a political economist, said it was simply a bad omen. “The federal government has an obligation to service the debts regardless of the paucity of funds,” he said.

READ ALSO: CBN excludes mortgage, micro-finance banks from cash withdrawal limits

However, a former Executive Director, Keystone Bank Plc, Richard Obire, said the CBN debts to the private international financial institutions would seem abnormal to most folks, understandably.

According to him, it does not seem unlawful, however. Were it illegal, the statutory public auditors of the CBN would have said so in its just released audited financial statements.

“What most people are familiar with is the CBN borrowing on behalf of the Central Government through the issuance of long term debt instruments to finance infrastructure.

“The CBN also normally ‘borrows’ by selling short term treasuries to extract excess liquidity from the financial markets to moderate inflation,” he told The Nation yesterday.

He explained that the reported debt was fully secured with securities owned by the CBN which enter the calculation of its foreign reserves.

Health7 days ago

Health7 days ago

Crime1 week ago

Crime1 week ago

Latest1 week ago

Latest1 week ago

Latest6 days ago

Latest6 days ago

Health6 days ago

Health6 days ago

Business1 week ago

Business1 week ago

Football1 week ago

Football1 week ago

Football1 week ago

Football1 week ago