After defaulting for several years, the Central Bank of Nigeria (CBN) has released the Consolidated Financial Statements for seven years, the first time it will do so since 2015.

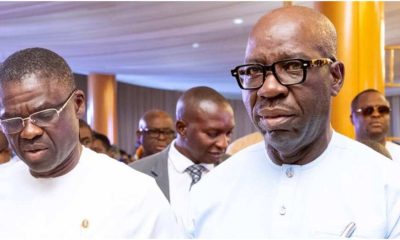

Recall that the suspended CBN governor, Godwin Emefiele had come under attack for not releasing the financial statements to the public.

The Consolidated Financial Statements, which were released by the CBN on its website, are for 2016, 2017, 2018, 2019, 2020, 2021 and 2022 financial periods.

The apex bank also declared a profit after tax of N103.8bn in 2022, up from N75.13bn reported a year earlier.

The bank also revealed that it owes JP Morgan and Goldman Sachs a combined sum of $7.5bn as of the financial year ended December 2022, and another $6.3 billion included as liabilities owned in foreign currency forwards.

The apex bank, however, stated it owes Goldman Sachs $500 million and JP Morgan $7 billion in what it classified as securities lending.

The 2022 financial statement reads, “The Group entered into a securities lending agreement with Goldman Sachs and J. P. Morgan and as part of the agreement, the Group pledged its holdings on foreign securities in return for cash. The cash received from Goldman Sachs is N0.23tn ($500m), 2021: N0.22tn ($500m), and JP Morgan N3.23tn ($7bn), 2021: N3.05tn ($7bn) is recognised in other foreign securities.”

According to the financial statements, securities lending forms part of the CBN’s total external reserves of about N14.3tn or $29bn using the official exchange rate of N494/$1 as of 2022.

The apex bank, however, also owes another N3.15tn ($6.3bn) in foreign currency forward which are forex obligations it needs to make to foreign investors.

According to the CBN Act 2007, the apex bank is expected to publish its report within two months after the end of each financial year.

The financial statements uploaded on the CBN website is an indication that the apex bank, under the leadership of acting Governor Folashodun Shonubi, is ready to open its book to public scrutiny.

Crime2 days ago

Crime2 days ago

Latest1 day ago

Latest1 day ago

Editorial6 days ago

Editorial6 days ago

Agribusiness4 days ago

Agribusiness4 days ago

Business5 days ago

Business5 days ago

Featured5 days ago

Featured5 days ago

Agribusiness5 days ago

Agribusiness5 days ago

Latest5 days ago

Latest5 days ago