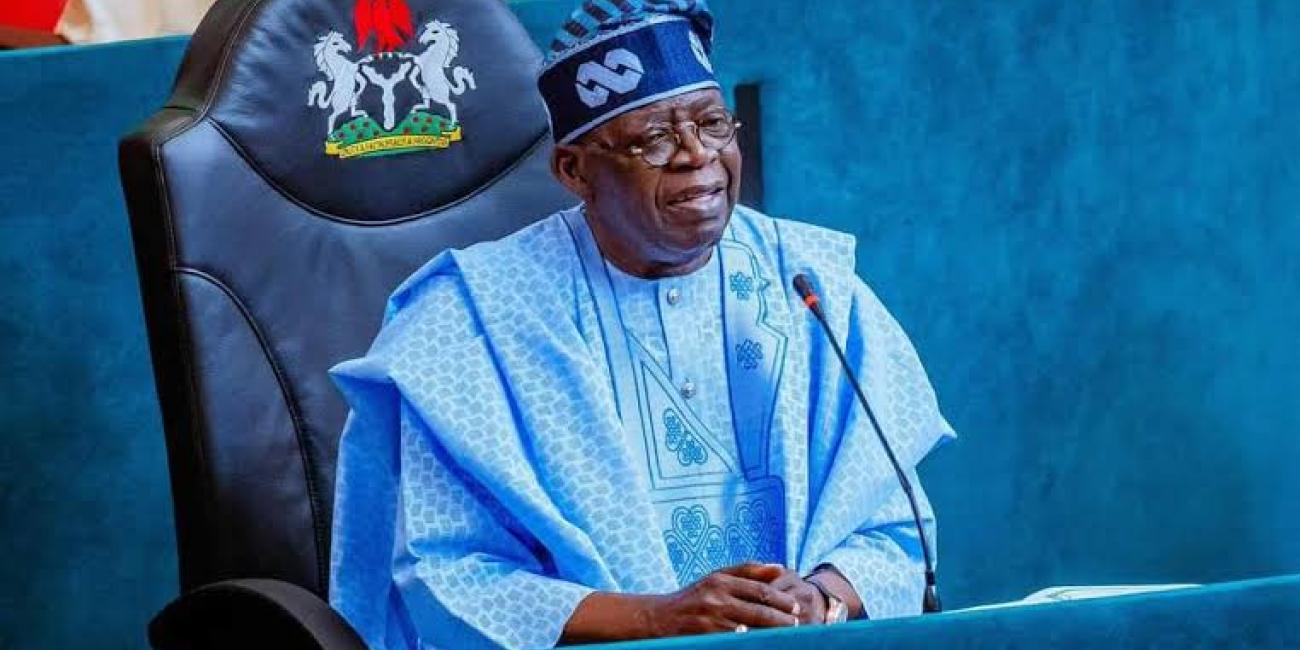

President Bola Tinubu says the tax reform bills will not be withdrawn from the national assembly against the recommended of the National Economic Council (NEC).

During the 144th NEC meeting led by Vice President Kashim Shettima, the council advised that the bills be retracted.

This recommendation followed a meeting in Kaduna where governors from the 19 northern states and key traditional leaders from the region decided to reject the Nigeria Tax Reform Bill, among other issues.

On October 3, President Bola Tinubu, called upon the National Assembly to carefully examine and approve a set of four important tax reform bills.

These proposed bills consist of the Nigeria Tax Bill, the Tax Administration Bill, and a bill aimed at establishing a Joint Revenue Board. Each of these pieces of legislation is designed to improve the tax system in Nigeria and ensure that it meets the needs of the country and its people.

ALSO READ: China opposes U.S. investment restrictions, warns of economic impact

In addition to these proposals, President Tinubu is also advocating for the repeal of the existing law that created the Federal Inland Revenue Service, commonly known as the FIRS. He is proposing that this agency be replaced with a new entity called the Nigeria Revenue Service. This change is intended to enhance the efficiency and effectiveness of tax collection and administration in the country.

On Friday, a statement released by Bayo Onanuga, the special adviser to the president on information and strategy. In this statement, Onanuga confirmed that President Tinubu has received recommendations from the National Economic Council, often referred to as the NEC. However, he made it clear that the president believes the legislative process regarding these tax reforms should continue without interruption. This indicates the government’s commitment to moving forward with necessary changes to the tax system, which is crucial for Nigeria’s economic growth and stability.

Entertainment1 week ago

Entertainment1 week ago

Entertainment4 days ago

Entertainment4 days ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Business1 week ago

Business1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Health6 days ago

Health6 days ago

Football6 days ago

Football6 days ago