What started as a social media campaign in Kenya soon morphed into a week-long violent protest that has led to fatalities and the torching of government buildings.

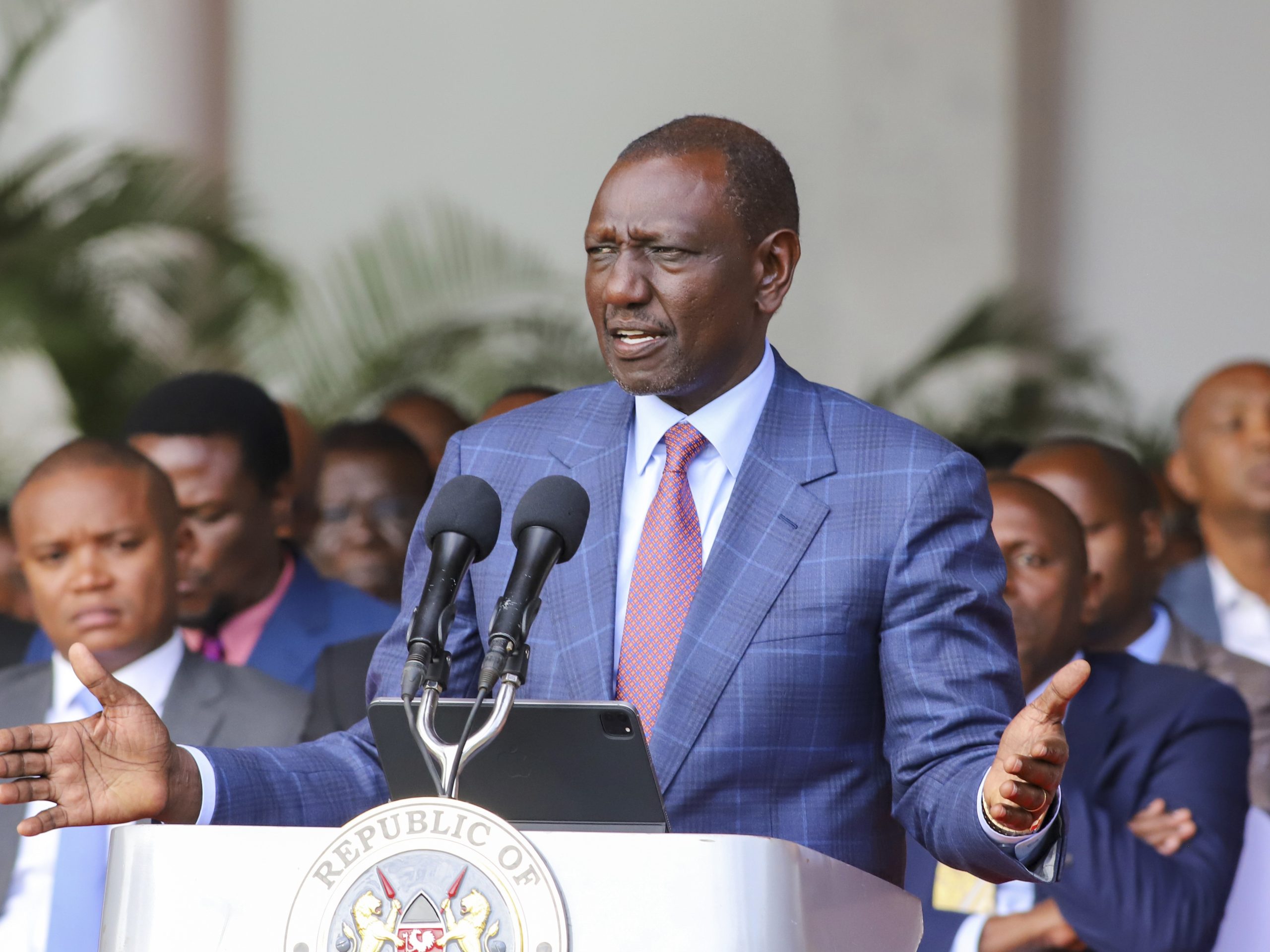

Protesters have vowed not to back down even after Kenya President William Ruto withdrew his assent to a controversial finance bill on Wednesday.

The bone of contention has been a bill to raise taxes across board — otherwise called the Finance Bill 2024.

In Kenya, a finance bill is usually presented to parliament before the start of a financial year that runs from July to June, laying out the government’s fiscal plans.

The bill aims to generate an additional $2.7 billion in taxes. The government says the bill is meant to plug Kenya’s ballooning budget deficit and reduce reliance on borrowing.

Currently, Kenya’s public debt stands at 68 percent of GDP, significantly higher than the 55 percent recommended by the World Bank and the International Monetary Fund (IMF).

The situation is so dire that the country has turned to the IMF for help, which has made raising revenue a pre-condition for further assistance.

READ ALSO: Kenya in turmoil: 13 Killed in tax protest violence

But Kenyans are worried. They fear the tax hikes in the proposed bill could cripple an already weakened economy and worsen the hardship for over 7.8 million Kenyans living in extreme poverty.

While finance bills in Kenya have faced opposition before, the intensity and scale of the current protests are unprecedented.

The government has dropped some of the contentious proposals but protestors want the entire bill scrapped.

Part of the initial proposals sought to introduce a 16 percent sales tax on bread and a 25 percent duty on cooking oil.

There was also a planned increase in the tax on financial transactions as well as a new annual tax on vehicle ownership amounting to 2.5 percent of the value of the vehicle. These were among the sections dropped by MPs.

Another key provision of the bill is a charge on products dubbed the ‘eco levy’. The tax targets most manufactured goods, including sanitary towels and diapers, that contribute to waste and harm the environment.

After an outcry, the government said the levy would only apply to imported products.

The eco levy was also aimed at digital products, including mobile phones, cameras, and recording equipment. This was also met with stiff resistance as citizens pointed out their reliance on these products for their livelihoods.

READ ALSO: Two Nigerians arrested for allegedly killing and dismembering a 20-yr-old girl in Kenya

The finance bill introduces a 16 percent tax on goods and services for direct and exclusive use in the construction and equipping of specialised hospitals with a minimum bed capacity of 50.

Kenyans worry that this could mean higher healthcare costs.

The bill also proposes an increase in import taxes from 2.5 percent to 3 percent of the value of the item, to be paid by the importer.

The rise comes just a year after the rate was reduced from 3.5 percent to 2.5 percent.

The discontent runs beyond the bill — this is more about a simmering frustration that has boiled over.

Kenyans are fuming over a government they feel has been ignoring their plight for decades.

Ruto’s attempt to justify the tax hikes by comparing them to what obtains in other African countries has fallen on deaf ears.

Last year, a finance law that introduced several unpopular taxes also sparked protests.

Ruto has also offered to engage leaders of the youth-led protests without saying when.

Entertainment1 week ago

Entertainment1 week ago

Entertainment5 days ago

Entertainment5 days ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Comments and Issues1 week ago

Health7 days ago

Health7 days ago

Health3 days ago

Health3 days ago

Football7 days ago

Football7 days ago