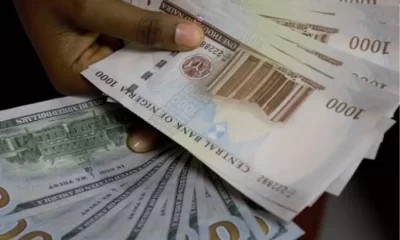

The current Foreign Exchange (FOREX) regime adopted by the Central Bank of Nigeria (CBN) is beginning to generate concerns about the long term effects on Nigeria’s economy.

National Daily reports. Some stakeholders in the polity are beginning to express pessimism that the FOREX regime could only serve short term purpose, arguing that it is not sustainable and may be counter-productive in the long term.

They maintained that the CBN FOREX policy may, in the long run, be creating more crisis for President Muhammadu Buhari and the All Progressives Congress (APC)-Government in managing the economy, essentially, the challenge to end the recession in the country. Their arguments emerged as President Buhari presents the blueprint of his administration for economic recovery and growth this Wednesday.

The stakeholders contend that the rate the CBN is injecting dollars into the foreign exchange market to improve the exchange rate of Naira to the Dollar merely boosts commerce and importation and does not transform the Nigerian economy to promote production. The FOREX regime, they stated, does not promote export, thus, increasing expenditure on consumption of imported goods.

National Daily gathered that the concerns of these stakeholders became germane in the face of the recent global rating that lists Nigeria among the most unfriendly countries in the world to do business. However, the federal government, in response, promised that policies are under the way to make Nigeria a friendly country to do business. This assurance was coming after the federal government had earlier in the year announced processes that will facilitate access to basic documents required by investors to set up businesses in the country.

National Daily market survey indicates that while several people are celebrating that the exchange rate of the naira has appreciated in recent times to N350 per Dollar, this has not reflected on the prices of commodities in the market. Prices of goods are still high as they have been from the beginning of the year, an indication that the assumed appreciation of the Naira is yet to make any impact in the economy.

This is more so, when other economic indices which include the rising unemployment rate, the weakening production capacity of the economy or the dwindling capacity utilization, are yet to make positive changes.

A Major concern expressed by most stakeholders is that should the CBN continue to roll out dollars into the economy without control or corresponding policies to reactivate the production capacity of the economy, the foreign reserves may deplete tremendously thereafter.

Football7 days ago

Football7 days ago

Entertainment6 days ago

Entertainment6 days ago

Football1 week ago

Football1 week ago

Business5 days ago

Business5 days ago

Football1 week ago

Football1 week ago

Football6 days ago

Football6 days ago

Business6 days ago

Business6 days ago

Crime7 days ago

Crime7 days ago