The federal government is contemplating tapping into domestic dollar savings to improve liquidity in the foreign exchange market to stabilise the naira through liquidity.

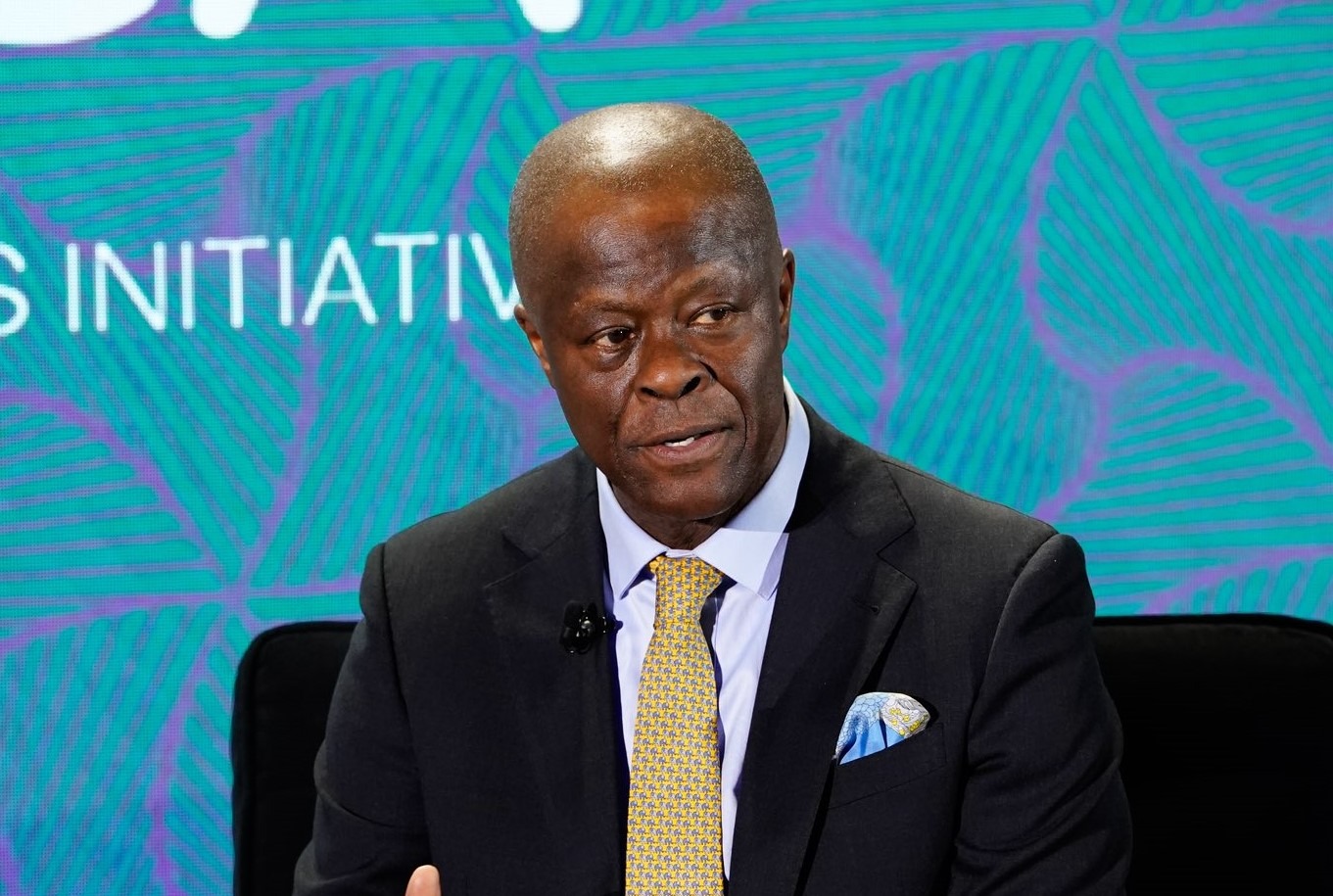

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun stated this in an interview with Bloomberg Tv on the sidelines of the World Economic Forum (WEF) in Davos, Switzerland.

The Minister noted that the government’s priority is to stabilise the naira through liquidity. He mentioned that receipts from crude oil sales remain the main source while also looking at domestic dollar savings with and outside the official market.

According to him, “The priority is to stabilize the naira that means getting in the additional liquidity – number one from oil revenue,”

READ ALSO: Naira drops to N878.57/$1 at official market, hits N330/$1 at black market

“We’re also looking to make sure we tap Nigerian savings, in particular domestic dollar savings both inside and outside the formal market. There’s a lot of cash in the Nigerian economy.”

Furthermore, he noted that the priority of the CBN still remains clearing the FX backlog which he estimates at $5bn.

“There is actually liquidity within the banking system and there should be a way of getting the banks to actually help with that backlog, either on a spot or a forward-rate basis,”

“We believe that if we corral the dollars that are available, we can pay down that backlog almost in one fell swoop.”

The Minister also hinted that Nigeria is contemplating issuing Eurobonds later in the year if the rates are considerably lower, stating that major issuers have informed the country of the possibility this year.

The Naira on Wednesday fell to a record low of N1,320 per dollar following strong demand on the parallel market, also known as the black market.

This represents 3.03 per cent or N40.00 weaker than N1,280 recorded at the close of trading on Tuesday.

This depreciation marks the lowest the Naira has come to since October 26, 2023, when it reached N1,300 against the dollar on the parallel market.

The domestic currency depreciated 4.72 per cent to close at N878.57 to a dollar at the close of business, based on data from NAFEM where forex is officially traded.

This represents an N39.62 loss or a 4.72 per cent decrease in the local currency compared to the N838.95 closed the previous day.

The intraday high recorded was N1299.50/$1, while the intraday low was N720.50/$1, representing a wide spread of N579/$1.

Health & Fitness6 days ago

Health & Fitness6 days ago

Aviation1 week ago

Aviation1 week ago

Aviation7 days ago

Aviation7 days ago

Aviation7 days ago

Aviation7 days ago

Aviation7 days ago

Aviation7 days ago

Aviation6 days ago

Aviation6 days ago

Featured4 days ago

Featured4 days ago

Crime4 days ago

Crime4 days ago