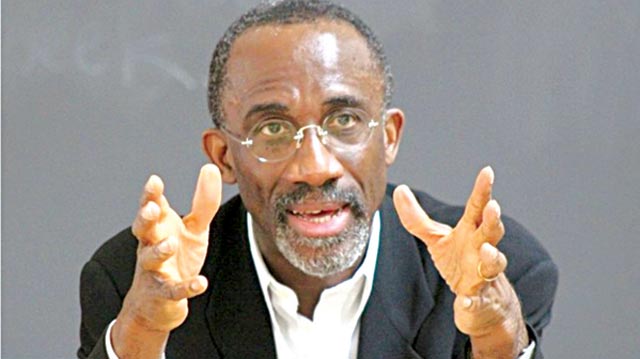

Investigations by National Daily revealed that erstwhile chairman of Etisalat Nigeria Mr. Hakeem Bello-Osagie has launched out in search of investment partners to buy the mega shares in the company.

In May 2013, Emerging Markets Telecommunications Services Limited (EMTS), trading under the name of Etisalat Nigeria, signed a $1.2billion medium-term syndicated loan facility agreement with Zenith Bank Plc, Guaranty Trust Bank Plc, First Bank of Nigeria Limited and 10 other banks.

But, Mr. Osagie who resigned his position on the heat of threats from the banks to take over the Company for failure to pay back the loan plans to regain his position should he get new investors.

A week ago, Hatem Dowidar, the chief executive of Etisalat International, said Etisalat Group would, in the next three weeks, phase out the brand name in Nigeria.

The decision followed Emirates Telecommunications Group (Etisalat Group) withdrawal of further involvement in the ownership of the Nigerian subsidiary.

Until June 15, the United Arab Emirates, UAE, group was a major shareholder in Etisalat Nigeria, along with United Arab Emirates Sovereign Wealth Fund through Mubadala Development Company, Abu Dhabi.

The two affiliates controlled a combined 85 per cent equity in the telecom firm, with Myacinth holding 15 per cent stake through Emerging Markets Telecommunications Services, EMTS Holding BV, owned by former United Bank for Africa, UBA, Mr Bello-Osagie.

Opting to part ways with the company followed the crisis in the wake of the $1.2billion syndicated loan the telecom firm took in 2013 from a consortium of 13 Nigerian banks, an impeccable source revealed to National Daily, Mr. Bello-Osagie has vowed to block moves by an influential ‘money bag’ without technical credentials to take over the company.

ALSO SEE: Etisalat phases out old name, now 9Mobile

According to the Source, “Mr. Bello-Osagie, former chairman’s confidence of pulling a surprise comeback is based on the fact that the 13 banks are supposed to take over the mega shares in Etisalat, but they are not interested. They (the banks) are actually shopping for investors to buy over the shares. Presently, the shares are domicile with UBA Capital.

“So, Mr. Osagie is not giving up on the matter. First, his ‘group’ still maintains 15% stake in Etisalat. Remember, they are the owners of the operating licence too. Secondly, he is not comfortable with an influential business mogul who is making moves to take over Etisalat. The potential investor lacks the technical milieu to manage the Company.

“The man roadblock to him (the money bag) is that he possesses an expired operating license. The Communications Acts 2003 makes it impossible for him to buy over the shares. But he views the present circumstances as a golden opportunity to launch fully into the telecommunications business, especially with the potentials 9Mobile has. He might want to buy the Company through other business ventures. So, EMTS is on red alert”.

The Source also told National Daily that ‘9Mobile’ is merely a transitory name put forward by EMTS to beat the deadline as Etisalat International, has made intentions know to phase out the brand name in Nigeria by month end.

“Remember, at the launch of EMTS in Nigeria in 2008, “0809ja” was adopted, to affirm the “Nigerianness” of its origin. And it worked. The plan now is such that if EMTS succeeds in buying over the banks’ shares then the name 9Mobile, which is a transitory name, shall be dropped almost immediately. Should they fail to get investors of preference to buy the shares, it means EMTS will remain with 15% stake, but the new investors will come out with a new name. As it stands now, it stands 50-50 for Mr. Osagie to come back to his position”, the source said on Sunday night.

Recall, after the interventions of the Central Bank of Nigeria (CBN) and the Nigerian Communications Commission (NCC) in the loan feud between Etisalat Nigeria and a consortium of 13 banks, Mr. Osagie, resigned his appointment as part of restructuring plan for the telecommunications firm.

The new board is headed by Dr. Joseph Nnanna, chairman; Mr. Boye Olusanya who replaced Matther Wilshire as CEO; Mr. Oluseyi Bickersteth, non- executive director; Mr. Ken Igbokwe, non-executive director and Mrs. Funke Ighodaro, Chief Finance Officer.

Health5 days ago

Health5 days ago

Entertainment7 days ago

Entertainment7 days ago

Crime6 days ago

Crime6 days ago

Education1 week ago

Education1 week ago

Health1 week ago

Health1 week ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Football7 days ago

Football7 days ago

Latest6 days ago

Latest6 days ago