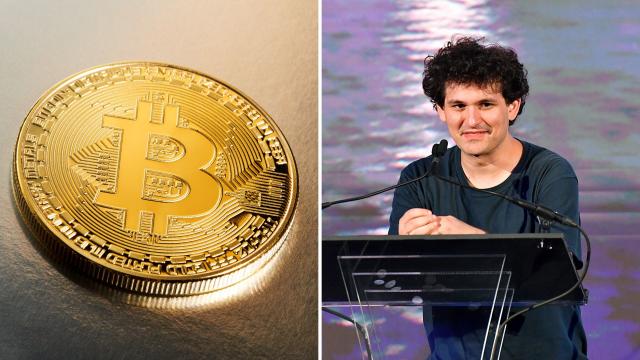

Bitcoin, the world’s largest cryptocurrency by market capitalisation, has dropped to about $16,300— its lowest level since November 2020.

The cryptocurrency price traded 7.5 percent lower on Thursday afternoon, dropping to $16,385 by 11:51 am, according to data from coinmarketcap.com.

Ethereum, the second-largest cryptocurrency by market cap, also dropped by 0.39 percent to $1,180.

The total value of the cryptocurrency market is down 4.8 percent to $824 billion.

The entire cryptocurrency industry is experiencing a crisis due to the financial turmoil of FTX, one of the fastest-growing crypto exchanges in the world.

Binance, world’s largest cryptocurrency exchange platform by volume, announced on Tuesday that it would acquire FTX, but it later backed out of the deal.

Binance said that it was abandoning the deal after a due diligence examination of the company as well as recent reports of mishandled customer funds and alleged US agency investigations of FTX.

READ ALSO: Bitcoin transactions soar among Nigerians despite CBN

“As a result of corporate due diligence, as well as the latest news reports regarding mishandled customer funds and alleged US agency investigations, we have decided that we will not pursue the potential acquisition of http://FTX.com,” Binance said in a statement.

“Every time a major player in an industry fails, retail consumers will suffer. We have seen over the last several years that the crypto ecosystem is becoming more resilient and we believe in time that outliers that misuse user funds will be weeded out by the free market.”

The development has caused fear and uncertainty among investors in the volatile crypto market.

“What is complicating today’s mood on Wall Street is that the liquidity crisis for FTX is spilling over into other cryptos,” Edward Moya, Oanda’s senior markets analyst, said in a note on Wednesday afternoon.

Advertisement“FTX was viewed as one of the so-called safe crypto players, and their demise is raising concerns that other key crypto companies could be vulnerable here.”

Latest7 days ago

Latest7 days ago

Business1 day ago

Business1 day ago

News6 days ago

News6 days ago

Politics1 day ago

Politics1 day ago

Latest5 days ago

Latest5 days ago

Covid-191 week ago

Covid-191 week ago

Business5 days ago

Business5 days ago

Crime1 week ago

Crime1 week ago