The sudden collapse of digital asset trading platform CBEX has left thousands of Nigerian investors reeling from losses estimated at over N2.4 billion, reigniting urgent calls for tighter government regulation and enforcement within the country’s growing but loosely monitored digital investment space.

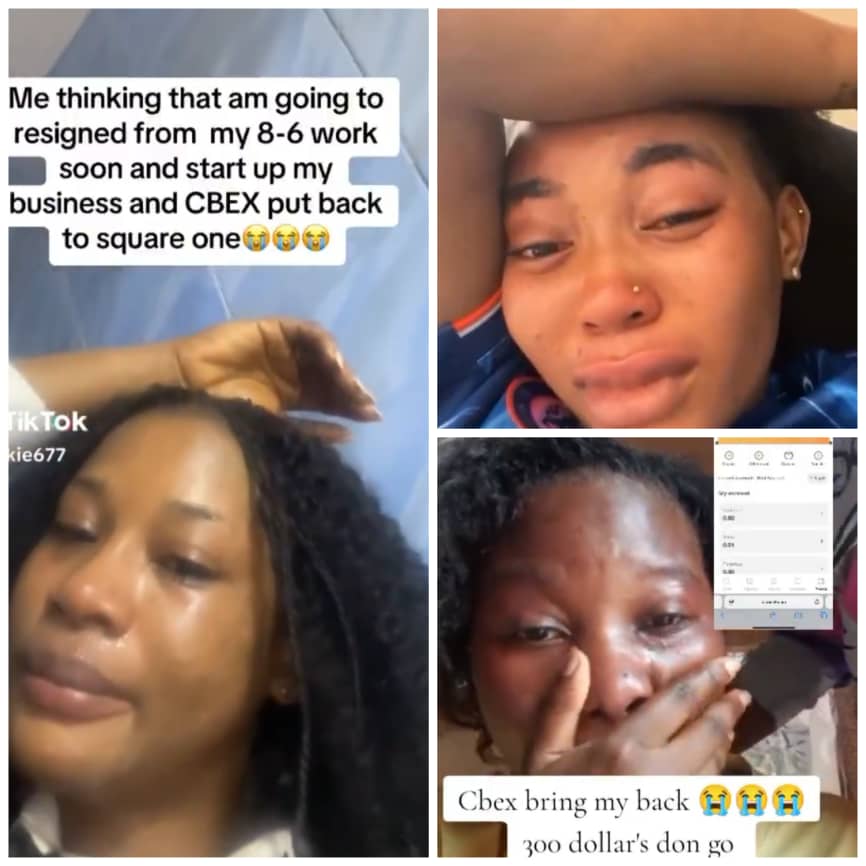

Trouble first surfaced late last week when CBEX users took to social media to report difficulties accessing their funds.

By Monday, the platform had completely shut down, wiping account balances and leaving users locked out without explanation.

Amid the chaos, CBEX administrators allegedly shut down Telegram channels used for customer support and introduced new “verification fees”—demanding $200 for a $2,000 recovery lifeline and $100 for a $1,000 recovery.

The move was widely condemned as a further exploitation of already aggrieved investors.

Despite operating without official social media presence or regulatory approval, CBEX attracted thousands of users with promises of high-yield returns. Its downfall has once again drawn scrutiny to Nigeria’s lack of a robust oversight system for digital finance and cryptocurrency platforms.

During a virtual X (formerly Twitter) Space hosted by Nairametrics, Dr. David Udoh, a medical practitioner and financial literacy advocate, called the CBEX saga a “systemic regulatory failure.”

READ ALSO: Panic as CBEX investment scheme collapses, wipes out over N1trn in investors’ funds

“CBEX was not registered with the Securities and Exchange Commission (SEC). It operated freely, exploiting the regulatory vacuum,” Udoh said.

He linked the popularity of such platforms to Nigeria’s worsening economic hardship, youth unemployment, and low financial literacy, which create a ripe environment for scams masked as investment opportunities.

“When people are desperate and don’t fully understand the risks, they are vulnerable to exploitation. But ultimately, it is the regulators’ failure to act swiftly and proactively that enables these schemes to thrive,” he added.

Udoh joined other experts in calling for preemptive oversight, recommending that regulators monitor platforms in real-time and educate the public on identifying legitimate investment options.

In a separate engagement on Monday, SEC Director General Emomotimi Agama echoed the sentiment, warning Nigerians to avoid platforms not officially registered with the commission.

“If it is not registered, it is illegal,” Agama stated bluntly. “Investors must learn to verify before they commit their money.”

The CBEX collapse has once again brought to the forefront Nigeria’s urgent need to modernize its regulatory approach to digital assets and fintech operations.

Experts argue that early intervention, legal accountability, and nationwide financial education campaigns will be crucial in preventing future investment disasters.

Entertainment6 days ago

Entertainment6 days ago

Entertainment3 days ago

Entertainment3 days ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Business6 days ago

Business6 days ago

Health1 week ago

Health1 week ago

Comments and Issues6 days ago

Comments and Issues6 days ago

Editorial Opinion1 week ago

Editorial Opinion1 week ago

Health5 days ago

Health5 days ago